Image source: Getty Images

Passive investing has become the tool of choice for most investors today. It’s effortless to see why. In the depths of the global financial crisis in early 2009 S&P500 reached 750 points. Since then, the index has entered the phase of the largest bull market in its history and is currently over 6,000 points. An escalate of over 700% means that an investment made then of £10,000 would be worth £70,000 today.

The effective market hypothesis

Passive investing has its roots in the 1960s in an academic theory known as the effective market hypothesis. The idea behind this theory is that so many knowledgeable, lively managers perform fundamental analysis and valuation that stocks are always valued at their fair market value. This fact makes it complex for lively managers to consistently beat the market.

Initially confined to gigantic pension funds, passive investment strategies began to enter the mainstream in the behind schedule 1990s. Today, index funds and the newer innovation of ETFs are touted as a low-cost and diversified approach to investing.

S&P 500 bubble

Passive investing is a great strategy when the stock market is rising. However, the inexorable rise in the value of the US stock market over the last 15 years is, in my opinion, creating complacency.

One area that has been bothering me for some time is the stock market focus. If I invest in an S&P 500 tracker, I’m supposedly buying a broad basket of stocks from a variety of sectors. But this is no longer the case, given that the top 10 holdings operate mainly in the technology space and account for 34% of the total share.

Just because a passive investing strategy has worked so well in the past doesn’t mean it will continue to do so. The complete unknown today is that this type of investment instruments has never been tested in a real bear market. After all, the decline in 2020 lasted only a few weeks, and the decline in 2022 lasted only 9 months.

I’m still collecting stocks

A petite percentage of my stocks and shares ISA portfolio is allocated to the S&P 500 tracker. But for me it’s not the time to sleep, so I mainly choose my own shares.

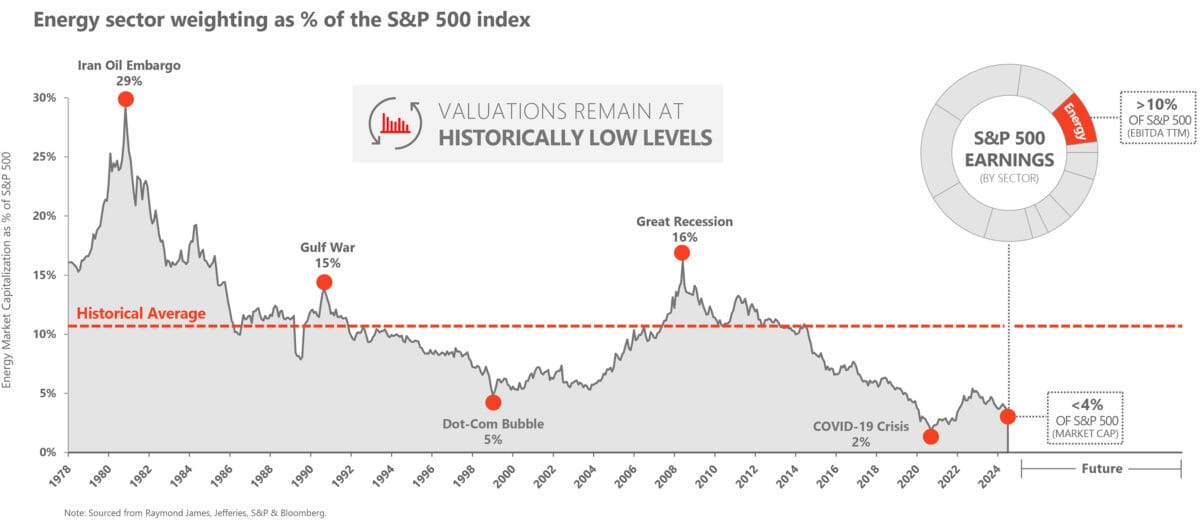

One sector where I remain bullish on the long term is energy. The chart below from Devon energyhighlights how distorted the market has become. Total weighting of the three largest shares, Apple, NvidiaAND Microsoft that’s five times the size of the entire energy market. This means opportunity for me.

Source: Devon Energy

I believe we are entering a phase where energy demand will escalate rapidly. Onshoring of production capacity in the US is progressing rapidly. The acceleration of the green revolution will, ironically, result in a pointed escalate in energy demand from highly energy-intensive metal mining operations.

But the biggest impact on energy will come from technology companies themselves. The development of data centers to manage generative AI capabilities will result in an explosion in energy demand like we have never witnessed before.

I especially like it BP AND Shell due to their extremely low valuations compared to their US counterparts. The price of neither of them reflects what I see as the coming tsunami that will be in demand over the next decade and beyond.