This article is also available in Spanish.

The 2024 US presidential elections have been decided. Donald Trump will win a second term by defeating Kamala Harris. In the middle of election night, the price of Bitcoin on Binance surged to a fresh record high of $75,407.

The euphoria is fueled by Trump’s gigantic campaign promises. He wants to establish Bitcoin as a national strategic stock, fire Securities and Exchange Commission (SEC) Chairman Gary Gensler, and generally enforce cryptocurrency-friendly policies. While most experts believe that a Harris victory would mean a short-term setback for Bitcoin, most experts’ forecasts are extremely bullish thanks to a Trump victory.

However, renowned economist Henrik Zeberg offers a cautious perspective. Zeberg warns that Trump’s proposed economic policies could accelerate a recession in the US, leading to a “bust out” scenario for Bitcoin and the broader cryptocurrency market. Central to his argument is Trump’s plan to replace some taxes with tariffs to spur domestic economic growth.

Is Bitcoin’s best-case scenario coming?

Drawing parallels to historical events, Zeberg suggests that Trump’s tariff strategy may reflect the economic mistakes of the 1920s and 1930s. In a post on X, he shared a link to a Wikipedia page containing information about the Smoot-Hawley Tariff Act of 1930. he stated: “Now everything is prepared for history to repeat itself. US tariffs introduced during recession – worsening economic downturn and bursting the largest bubble in history.”

The Smoot-Hawley Tariff Act is widely considered to be the catalyst that deepened the Great Depression. This act, by significantly increasing U.S. tariffs on imported goods, triggered retaliatory tariffs imposed by other countries, leading to severe restrictions on international trade. This spiral of protectionism has exacerbated global economic decline, causing increased unemployment and prolonged hardship around the world.

Amid these economic concerns, Zeberg predicted a significant, though potentially short-lived, boost in Bitcoin’s price. “Let’s make it simple! Target BTC 115-123 thousand.” – he assured via X a few days ago. His analysis is based on Fibonacci extension levels, a technical analysis tool used to predict future price movements based on historical price patterns.

According to Zeberg’s analysis, the critical level to monitor is the Fibonacci extension at 1.618, calculated at $114,916.16. He suggests that this level is “most likely the highest,” indicating that Bitcoin could reach this price level before a significant reversal occurs.

The analysis also noted other key Fibonacci levels that could serve as resistance points during Bitcoin’s rally. The 0.382 level at $77,437.88 represents significant initial resistance after breaking the previous all-time high.

The 0.618 level at $85,205.47 could provide minor resistance as the price rises. Additionally, the 1.0 level at $107,435.71 represents a key psychological and technical threshold, while the 1.27 level at $123,148.19 indicates a possible breach of the initial target zone.

The annotation on Zeberg’s chart asks the question: “58% in less than 3 months at the top?” This suggests that he expects prices to rise rapidly over a relatively brief period of time, in line with historical patterns.

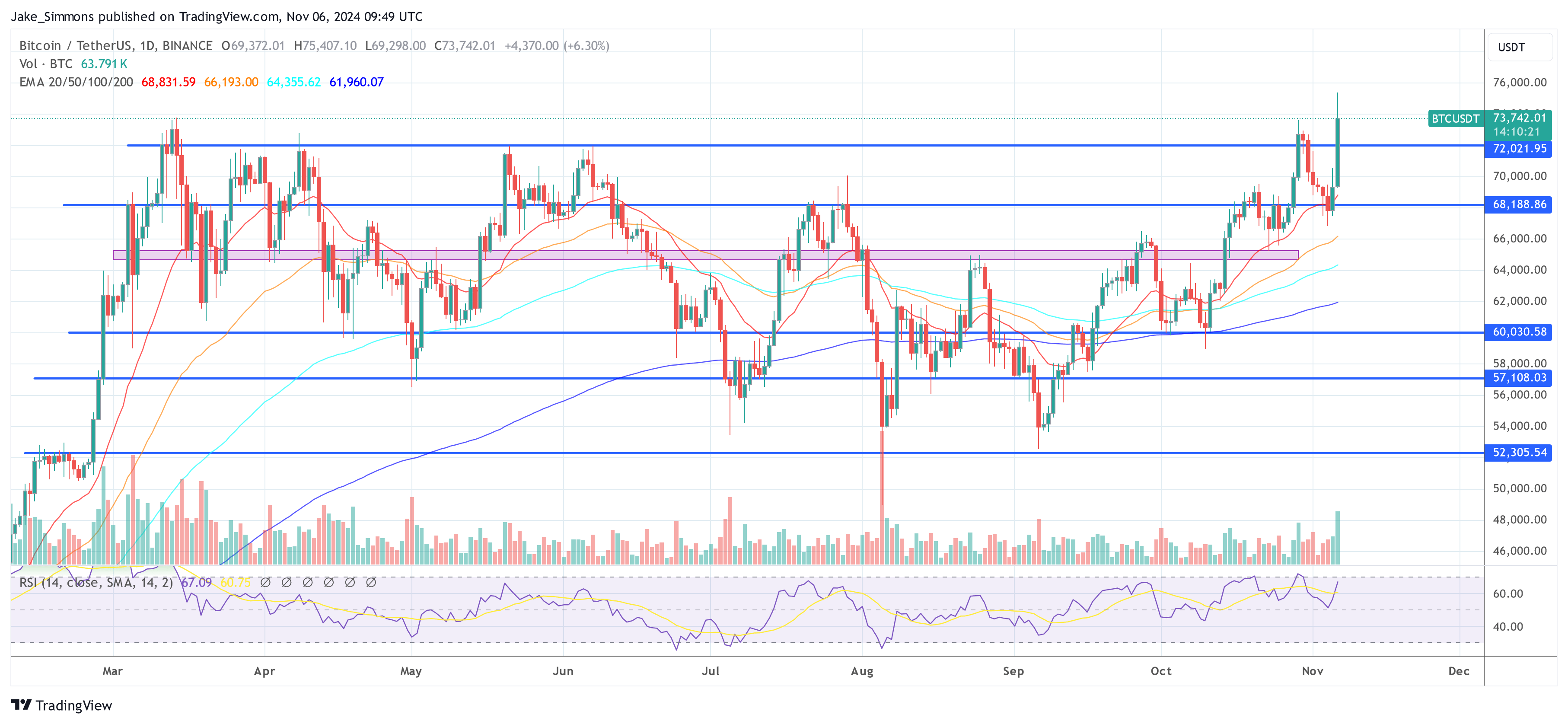

At the time of publication, the BTC price was $73,742.

Featured image created with DALL.E, chart from TradingView.com