This article is also available in Spanish.

Cryptocurrency analyst Tony Severino said this Bitcoin price is approaching the strongest part of the bull run. Based on his analysis, Tony provided insight into how high the flagship cryptocurrency could go when it reaches its peak this market cycle.

Bitcoin price target for the strongest part of this bull run

Tony revealed in post X that Bitcoin’s price could reach a market high of $133,000 in this bull market. He explained that 2-month BTC Relative Strength Index (RSI) is approaching 70, which has ushered in the strongest part of any previous bull run. In 2012, this led to a price augment of 11,000%. Meanwhile, this led to price increases of 2,700% and 437% in the 2016 and 2020 bull markets, respectively.

The analyst noted that each peak in the next bull run was roughly about 20% of the peak of the previous cycle. Therefore, 20% of the 437% rally recorded in Running of the Bulls in 2021 will set the price of Bitcoin at a target price of $133,000. A potential augment in this target would give BTC buyers a return of approximately 87% at current price levels.

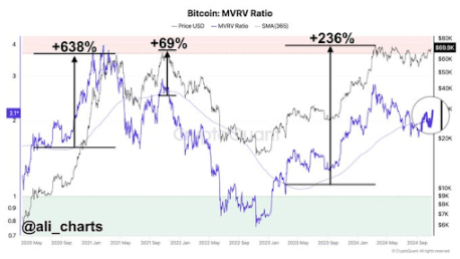

Cryptocurrency analyst Ali Martinez also suggested buying the Bitcoin price as this level may not be a delayed entry. In a post on X, he explained that the market-to-realized value (MVRV) ratio had breached the 365-SMA (elementary moving average), which often signals gigantic bull gains. He added that it was golden cross it just happened again.

The attached analyst chart showed that Bitcoin’s price increased by 236% last time. This therefore means that despite the recent surge above $73,000, there is still plenty of upside for the flagship cryptocurrency in this market cycle.

BTC could rise to $462,000

Ali Martinez provided a more bullish outlook on Bitcoin’s price than Tony did in terms of how high the flagship cryptocurrency could go this running of the bulls. In the post, X noted that BTC had peaked between the Fibonacci retracement levels of 1.618 and 2.272 in previous bull cycles.

If Bitcoin’s price were to follow a similar pattern, Martinez noted that BTC’s next high could be between $174,000 and $462,000. Predictions for what a peak could mean for Bitcoin this market cycle continue to differ, although the consensus remains that the flagship cryptocurrency grow above $100,000.

Experts such as Standard Chartered have even predicted that Bitcoin’s price could surge above its $100,000 target this year if Donald Trump wins the US presidential election.

At the time of writing, Bitcoin is trading at around $72,300, up almost 2% in the last 24 hours, according to data from CoinMarketCap.

Featured image created with Dall.E, chart from Tradingview.com