Bitcoin’s ongoing correction is drawing vast holders back to centralized platforms, with CryptoQuant data showing a surge in cryptocurrency inflows into whale-dominated Binance. At the same time, derivatives positioning continues to decline, reinforcing the picture of risk mitigation in the market for both spot and futures contracts.

Bitcoin Whale’s share of inflows is growing rapidly on Binance

CryptoQuant Darkfost Contributor (@Darkfost_Coc) he said Binance is seeing a noticeable escalate in whale activity as withdrawals put pressure on participants “from retail participants to whales and even institutions.” He focused on the “whale inflow rate,” a metric that compares BTC inflows from the top 10 transactions to total exchange inflows, smoothed using a weekly average to reduce the impact of one-off transfers.

“According to the whale inflow indicator, we are seeing a clear increase in whale activity on Binance, reflecting specific market dynamics,” Darkfost wrote. “This ratio is calculated by comparing BTC inflows from the 10 largest trades to total inflows. Using a weekly average helps reveal a clearer trend by filtering out noise from isolated, unique trades.”

Between February 2 and February 15, Darkfost reported that the ratio increased from 0.4 to 0.62, suggesting that a larger portion of Binance’s incoming BTC is now coming from a diminutive set of vast transfers. While this indicator does not prove it is intentional, higher concentrations of whale inflows are often interpreted as an escalate in potential sell-side supply on the exchange’s order books, especially during risk-free periods.

“However, it is worth noting that this reflects an increase in their share in inflows, which can be interpreted as increasing selling pressure on the market,” he added.

Darkfost also signaled that some of the activities may be associated with a specific entity. “Some of these inflows can be attributed to a well-known whale, likely Garrett Jin. Nicknamed 19D5 or the ‘Hyperunit Whale,’ this whale has been particularly active on Binance recently, moving close to 10,000 BTC onto the platform.”

He described the broader context as a story about liquidity and venue selection rather than a single-wallet anomaly, arguing that many whales were sending “significant amounts of BTC” to Binance, helped by its depth, and uncertainty was pushing investors to reassess exposure.

Unwinding derivatives adds pressure

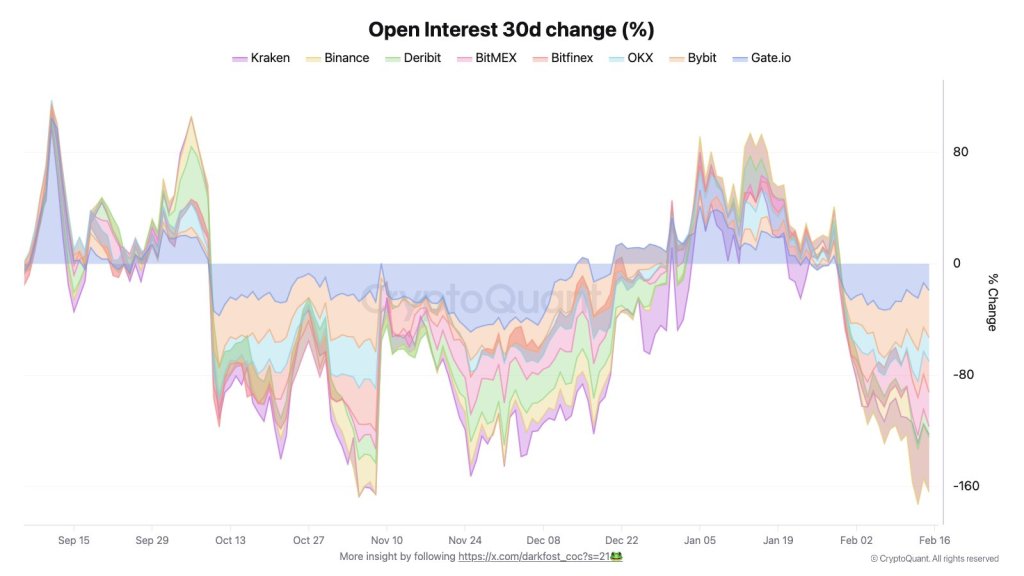

In a separate post, Darkfost argued that the post-cycle peak contraction in the derivatives market remains a major feature of the current tape. “An analysis of open interest in Bitcoin across exchanges shows how severely the derivatives market has contracted since the recent all-time high and the October 10 sell-off,” he wrote, adding that speculation had “reached unprecedented levels.”

He pointed to previous peaks in BTC-denominated open interest on Binance: 94,300 BTC after the November 2021 peak compared to 120,000 BTC at the market peak in October 2025, and stated that total open interest across all exchanges increased from 221,000 BTC in April 2024 to 381,000 BTC at the cycle peak.

Since that peak, he said, the number of open offers has declined almost every month, including a pointed period from October 6 to October. On December 11, interest in open cryptocurrencies Binance fell by 20.8%, while Bybit and Gate.io saw declines of 37% each. According to Darkfost, the decline continues, with Binance down another 39.3%, Bybit down 33%, and BitMEX down 24%.

His conclusion is that the market is still in a de-risking phase, whether voluntary or forced by liquidations in the face of volatility. “Overall, this environment indicates that investors are actively limiting exposure, mitigating risk, or being pushed to exit through liquidation due to continued volatility,” he wrote. “Under these conditions, it is difficult to imagine Bitcoin stabilizing permanently and rekindling the bullish trend in the short term.”

At the time of publication, the BTC price was $67,823.

Featured image created with DALL.E, chart from TradingView.com