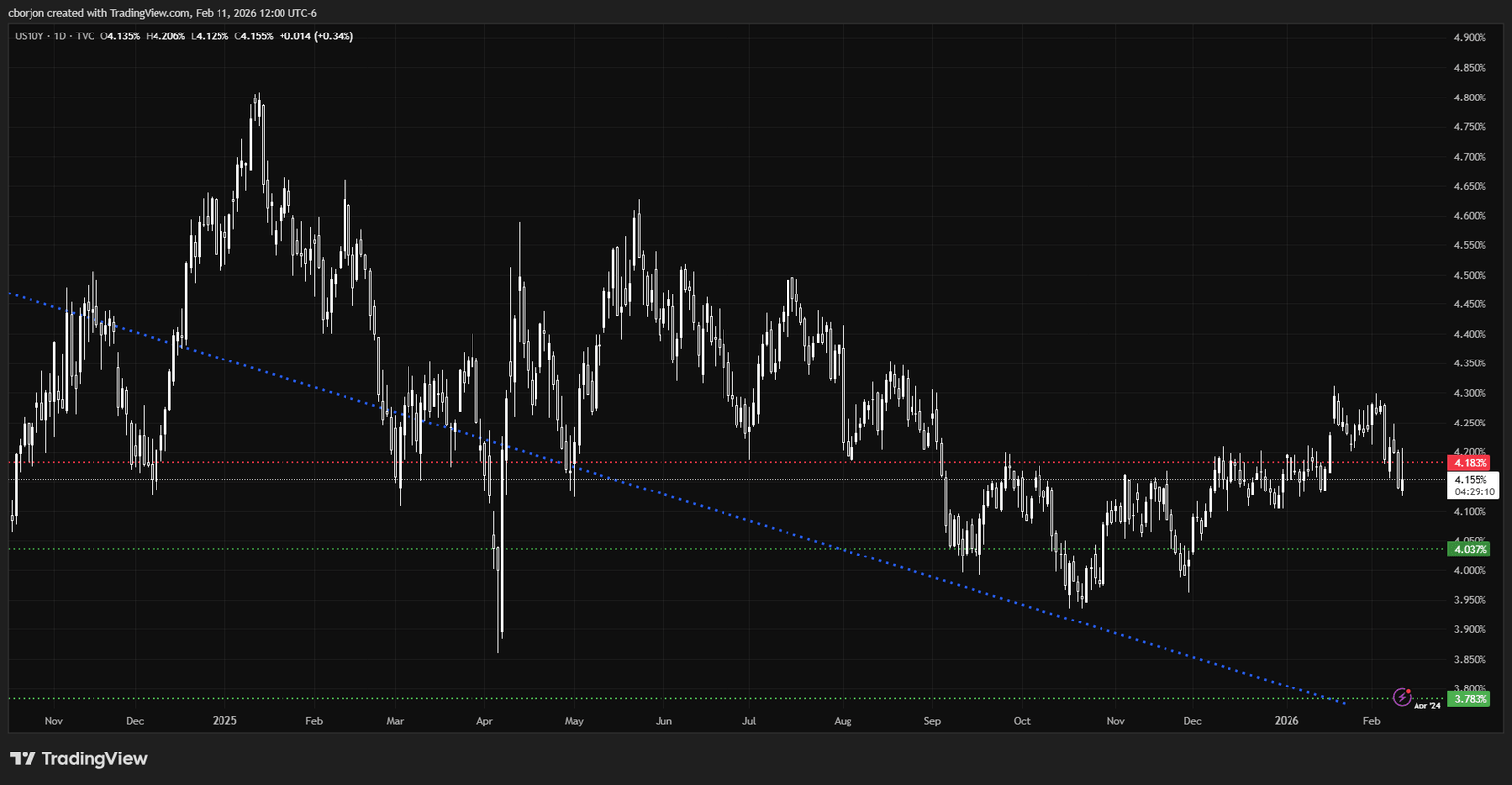

U.S. Treasury yields are rising across the curve, with the U.S. 10-year Treasury bond rising nearly one and a half basis points to 4.155% after the release of a sturdy U.S. jobs report that lowered investor expectations for further monetary easing by the Federal Reserve.

Treasury yields rise slightly after solid jobs data and hawkish Fed rhetoric frosty expectations for aggressive monetary easing

The 10-year U.S. Treasury yield rebounded to around 4.125% after the U.S. Bureau of Labor Statistics (BLS) revealed the economy added 130,000 workers to its workforce. people, compared to economists’ estimates of 70,000, according to the latest Nonfarm Payrolls report.

Looking at the data, the unemployment rate dropped from 4.4% to 4.3%, below the Fed’s estimate of 4.5% for the full year.

Expectations that the Fed would cut in March faded as money markets priced in a 27-basis-point rate easing in July 2026. Investors seem confident that the U.S. central bank will cut rates twice throughout the year, with the first cut occurring in July.

Hawkish comments from the president of the Kansas City Fed, Jeffrey Schmid, restricted the decline in yields in the US. He said that “interest rate cuts could allow inflation to remain higher for longer” and that policy must remain restrictive if inflation approaches 3%.

The US Dollar Index (DXY), which measures the dollar’s performance against six currencies, fell 0.14% to 96.75, representing a positive tailwind for gold prices.

Meanwhile, U.S. financial markets’ five-year inflation expectations are 2.47%, up from 2.5% a day earlier, in line with the 5-year breakeven inflation rate. Over the decade, the 10-year bond yield has fallen from 2.35% to 2.32%, indicating that markets expect inflation to decline toward the Fed’s 2% target over the medium term.

Investors are focusing on US Consumer Price Index data

Initial unemployment claims and Fed speeches are scheduled for Thursday. On Friday, attention will focus on the January CPI report, where headline and core inflation are expected to decline from 2.7% and 2.6% y/y to 2.5%, respectively.

Yield on 10-year US treasury bonds