What’s worth knowing:

- Corporate Bitcoin proxies and strategic bets saw 60% losses due to premium decline during the recent market correction.

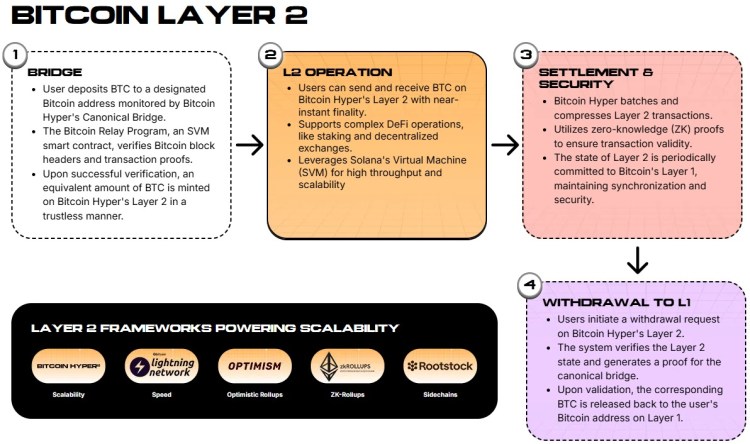

- Capital is shifting from passive holding vehicles to dynamic infrastructure protocols that address the fundamental limitations of blockchain.

- Bitcoin Hyper ($HYPER) uses the Solana Virtual Machine (SVM) to provide swift shrewd contracts and sub-second finality on the Bitcoin network.

- Whale activity remains forceful despite the market crash, with more than $31 million raised in January and a significant accumulation of enormous purses.

The recent market correction was particularly severe for proxy bettors.

While the underlying asset was withdrawn, leverage and falling premiums left Strategy investors, particularly those exposed to MicroStrategy and related public pension funds, facing withdrawals exceeding 60%.

This volatility exposes the inherent risk of holding Bitcoin through corporate vehicles that trade at huge premiums to their net asset value (NAV). High-beta proxies don’t just catch a frigid when the market sneezes; they get pneumonia.

But is cryptocurrency dead? Hardly.

The doom and gloom narrative categorically denies chain flows. Capital does not leave the ecosystem; it rotates. We are seeing a huge shift from high quality passive proxies to dynamic infrastructure layers.

While holders of legacy instruments lose due to leverage, growth-oriented protocols attract significant liquidity. This rotation suggests that shrewd money is prioritizing utility over mere speculation as a store of value this quarter.

This charge is leading Bitcoin Hyper ($HYPER)a project that completely defied the broader market crisis. By solving the main bottleneck of the Bitcoin network, scalability, Bitcoin Hyper has attracted the attention of developers and institutional whales alike.

While public market players lick their wounds, this emerging Layer 2 protocol secures millions in funds, signaling a shift toward building decentralized applications directly on top of Bitcoin’s security layer.

Bitcoin Hyper Integrates SVM to Solve the Scalability Crisis

The basic thesis driving capital Bitcoin Hyper ($HYPER) is technical, not speculative. Bitcoin’s base layer (L1) is secure but notoriously snail-paced. 10-minute block times and confined programmability stifle DeFi innovations before they even launch.

Previous attempts to scale Bitcoin have often relied on snail-paced sidechains or complicated networks of channels like Lightning, which (let’s be straightforward) lack the full capabilities of shrewd contracts.

Bitcoin Hyper fundamentally changes this architecture by integrating the Solana Virtual Machine (SVM) as the Layer 2 execution environment.

Why does this matter? Because it combines the settlement guarantee of Bitcoin with the high execution efficiency of Solana. The protocol ensures sub-second finality and negligible transaction costs. This effectively unlocks high-frequency trading and complicated DeFi applications that were previously impossible on the Bitcoin network.

From a developer’s perspective, it’s a 0 to 1 moment. Offering full compatibility with Rust-based shrewd contracts, Bitcoin Hyper enables Solana’s huge developer ecosystem to deploy dApps that settle on Bitcoin without rewriting code.

The architecture uses Canonical’s decentralized bridge for seamless $BTC transfers and a modular design where L1 handles settlement while SVM L2 handles execution. This technical breakthrough likely explains why sentiment around $HYPER remains bullish despite the bleak macroeconomic situation.

Whales raise $31 million as shrewd money flows into L2 infrastructure

While retail traders are selling in panic in response to MSTR volatility, sophisticated actors are aggressively accumulating positions in infrastructure plays. The discrepancy is greatest in pre-sale data Bitcoin Hyper ($HYPER).

According to the official pre-sale page, the project has raised an impressive $31.2 million and counting, a figure that contrasts sharply with the loss of liquidity from centralized exchanges.

The order flow suggests buying with high confidence rather than random speculation. On-chain data from Etherscan shows only one whale wallet pumping 500 thousand dollars in recent transactions.

This type of accumulation during a downtrend usually signals that institutional players view the current price of $0.0136751 as a significant discount to the long-term utility value of the project.

Tokenomics further enhances this holding behavior. With a high APR staking protocol available immediately after TGE and a modest 7-day vesting period for pre-sale players, the project combines long-term incentives with network security.

As the strategic bet becomes unclear for those relying on corporate proxies, HYPER’s $ raise shows that the market still has a huge appetite for real technological advancements in the Bitcoin ecosystem.

Check out the $HYPER pre-sale.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments, including pre-sales and leveraged products, carry inherent risks. You should always conduct due diligence before making investment decisions.