Bitcoin’s recent weakness is being portrayed less as a technical failure than a liquidity problem, with Ki Young Ju arguing that key factors that have sustained the rally in fresh capital inflows have stalled. In this setup, in his opinion, a full capitulation like -70% is required, based on one variable: whether the strategy will turn from a buyer to a significant seller.

Will Bitcoin experience another -70% bear market?

On February 1st postKi said: “Bitcoin is falling as selling pressure continues and there is a lack of fresh capital inflows.” He pointed to the flat realized value as evidence that additional money was no longer flowing into the market, and linked it directly to market structure. The “realized limit” has flattened, which means a lack of fresh capital. When market capitalization falls in these conditions, it is not a bull market.”

From his reading, it appears that the profit taking had been going on for some time and was simply absorbed. He wrote that early holders were “sitting on large unrealized gains from ETF and MSTR purchases” and “have been taking profits since the beginning of last year, but strong inflows have kept Bitcoin near 100,000.” The change now, in his view, is that the most significant offer has expired: “Now that influence has dried up.”

This is where the failure math changes. Ki identified Strategy (MSTR) as the “primary driver of this growth,” but argued that the reflective decline seen in previous cycles was unlikely without a decisive shift away from the company’s balance sheet strategy. “Unless Saylor significantly reduces its stack, we will not see the 70% decline seen in previous cycles,” he wrote, making an explicit condition rather than presenting the payout as inevitable.

Still, he didn’t say the market had found a bottom. “The selling pressure is still there, so the bottom is not clear yet,” Ki said, adding that the more likely path is time rather than plain liquidation. Its basic case is “broad sideways consolidation” – a system in which volatility can persist but it is more hard to maintain direction without up-to-date marginal buyers.

Stablecoin liquidity is drying up

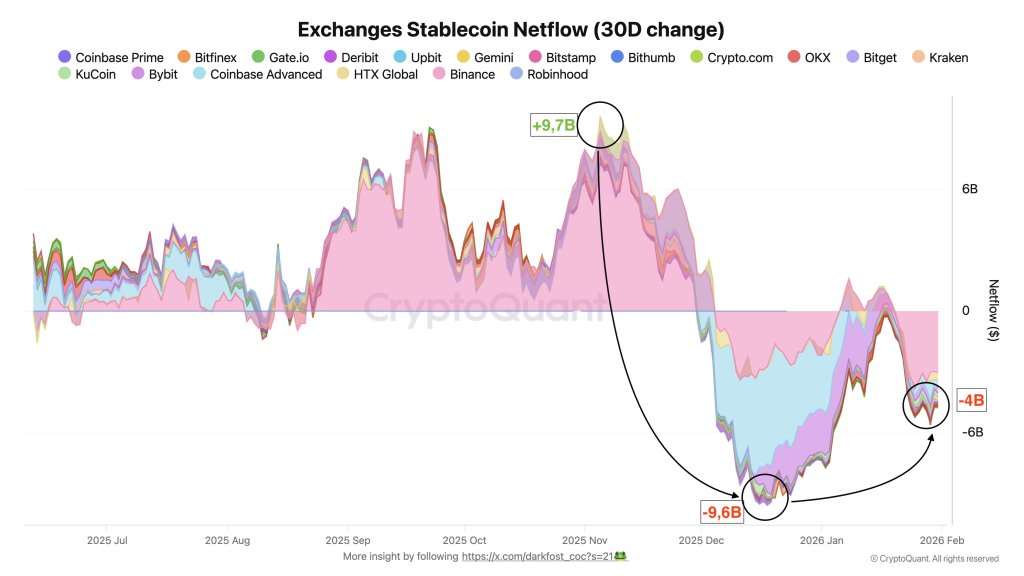

Co-creator of CryptoQuant, Darkfost in addition color what “lack of fresh capital” looks like in plumbing. He argued that stablecoin activity, often treated as a short-term proxy for deployable cryptocurrency liquidity, has surged as uncertainty remains elevated.

“The cryptocurrency market is currently going through a delicate phase characterized by structural illiquidity in a context of persistently high uncertainty,” he wrote, calling it a “risk-averse” environment, especially for assets such as precious metals and equities that are still drawing flows.

Darkfost said the stablecoin market has grown by more than $140 billion since 2023, but the overall stablecoin market capitalization began to decline in December, “putting an end to this sustained growth trend.” He argued that the signal that could be used is exchange flows: “Strong inflows typically indicate a desire to gain exposure to the market, while outflows instead suggest capital preservation and risk reduction.”

He highlighted October as the last month of markedly high liquidity, with “average monthly net stablecoin flows exceeding $9.7 billion,” with nearly $8.8 billion concentrated in Binance alone – conditions that “supported Bitcoin’s rally towards a new all-time high.” He said that since November, these inflows have been “largely eliminated” – an initial decline of $9.6 billion, then a brief stabilization, followed by renewed net outflows of more than $4 billion, including $3.1 billion from Binance.

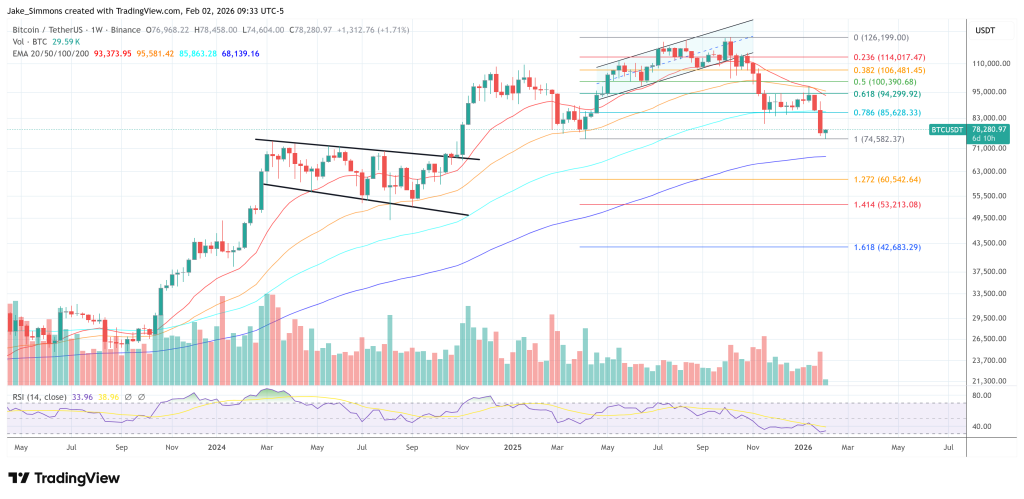

At the time of publication, the price of BTC was $78,280.

Featured image created with DALL.E, chart from TradingView.com