Image source: Getty Images

How useful would a second income of £500 a week be to you? This would make my life much more comfortable, which is why I invest any free cash I have in the stock market.

Why wouldn’t I? The UK is renowned for its powerful dividend culture, underpinned by a huge selection of mature, market-leading and financially sound companies. AJ Bell expects FTSE100 companies alone will pay a staggering £80.7 billion in dividends for 2025.

But how much would you need to invest in UK shares to earn a passive income of £500 a week? Let’s take a look.

Aiming for a second income

Please remember that dividends are never, ever guaranteed. With this in mind, investors can take steps to enhance their chances of a powerful and lasting second income over time.

One of the most powerful tools for maximizing dividends is building a diversified portfolio of stocks. We’re talking about companies spread across different sectors and regions, which protects investors’ profits from individual shocks and ensures a polished (and hopefully growing) stream of dividends.

But how huge would someone’s wallet have to be to generate hundreds of pounds of income a week? This depends on the size of the dividend yield, which shows how much dividend income someone earns from their investment.

Let’s assume an investor wants to earn an income of £500 on a 6% dividend stock. At this level they would need a portfolio of just over £433,000.

Is this achievable?

Most people don’t keep that amount of money at the bottom of a drawer. But given the time, it’s a sum that, as history shows, is a very achievable goal.

The stock market has significant wealth creation power. The long-term return on global stock investing ranges from 8% to 10%. Add to this the power of compounding, where investment returns enhance over time, and you have a powerful combination that can multiply your returns over the long term.

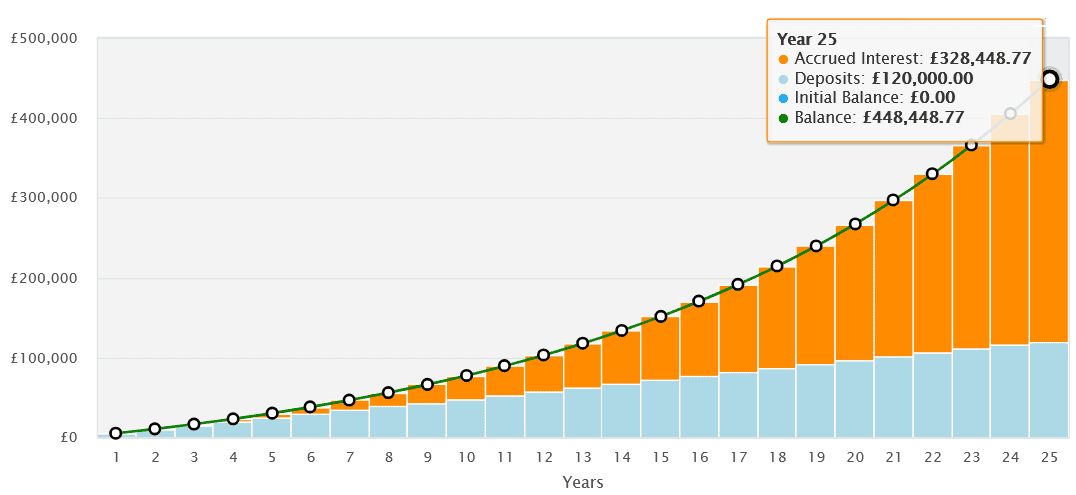

For a £433,000 portfolio, someone could invest £400 a month for less than 25 years and have a real chance of achieving this goal. They are assumed to achieve an average annual return of 9%.

FTSE 100 Dividend Star

Legal and general information (LSE:LGEN) is just one great dividend stock that investors should consider today. Simply put, it is an ATM. It also shows a great appetite for returning the generated capital surplus to shareholders.

With the exception of the pandemic-affected year 2020, dividends have increased every year since 2011. City analysts expect this proud record to continue, resulting in massive dividend yields of 8.4% and 8.6% for 2026 and 2027, respectively.

But can Legal & General continue to pay such huge dividends on its shares? Past performance is not always a reliable indicator of future returns. If hard economic conditions and competitive threats take a toll on profits, payouts could be impacted from that point forward.

It’s possible, but overall, I’m sure these will still be the highest-grossing stocks. The Solvency II capital ratio of 217% provides an excellent buffer against any earnings volatility. That’s more than twice what regulators require.

Looking longer term, I expect profits to continue to grow as the financial services market grows. Given Legal & General’s powerful commitment to dividends, this would likely provide investors with a more attractive yield