Image source: Getty Images

According to the latest data from Bank of Americafund managers looking to stand out from the crowd in 2026 are eyeing UK shares. But should everyday investors do the same?

Making above-average profits in the stock market requires you to do something different. And that may mean looking for undervalued opportunities in FTSE100 and FTSE250.

It is ahead of the stock market

Overcomes difficulties in the stock market even for the best investors. But those who simply buy index-tracking funds give themselves zero chance of doing so.

There is nothing wrong with earning an average return. Historically, stocks and shares have generated better long-term returns than cash and bonds, and this is no coincidence.

However, this is not a good solution for professional fund managers. They must find ways to perform better than average to justify charging customers fees to manage their money.

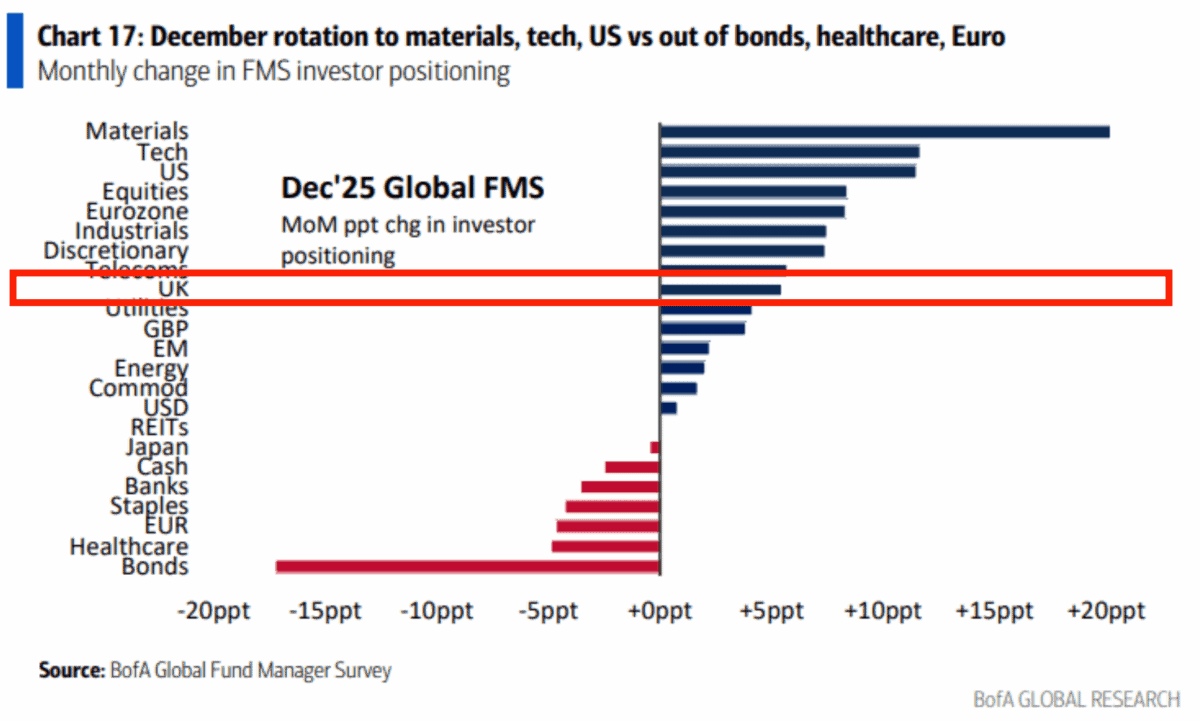

The Bank of America Fund Manager Survey is published monthly. It gives investors an intriguing insight into what the astute money is thinking and doing.

Follow the money…

According to the latest data, the most popular shares of fund managers in the perspective of 2026 are shares of companies from the technology, materials and American equities industries. However, few are interested in UK shares.

In other words, UK stocks are far from the consensus pick, but a handful of investors are taking a chance on a potential opportunity. And I think it’s worth paying attention to.

Fund managers typically have to report their performance to their clients every year. Therefore, it is natural to think in a 12-month (or potentially even shorter) perspective.

When investing, I look further into the future. But even in this context, there may be opportunities to buy UK shares now that may not emerge at the end of next year.

Value in the UK

On the subject of conflicting views, JD Wetherspoon‘s (LSE:JDW) is a UK stock that I plan to own for the long term. It’s been a tough year for the hospitality industry, but the company’s shares are up 23%.

Unlike many investors, I believe that one of the reasons may be the arduous environment Why the company is doing well. As competitors closed locations, the company saw an boost in comparable sales.

This is an unconventional view, but I think the biggest risk is the government trying to lend a hand the hospitality industry. My feeling is that this would lend a hand JD Wetherspoon’s competitors rather than its interests.

The company’s cost advantage results from its scale and assets, which reduce leasing liabilities. And I’m willing to bet it will be something that will last for a long time.

Doing things differently

Whether it’s the next 12 months or 12 years, investors can only outperform by doing something different. But it doesn’t have to be anything drastic.

It may be as straightforward as thinking that UK shares are a better value than most investors think. And that seems to be the current view of some fund managers.

JD Wetherspoon shares have outperformed in 2025 and I think they can do the same in the longer term – and even faster.