Image source: Getty Images.

Nvidia (NASDAQ:NVDA) shares are not far from record highs. However, there was a slight recovery on Tuesday, November 4, after the market became a bit concerned about valuations in the technology sector.

Some of this worry can probably be attributed to Palantirresults. They were exceptional, but apparently not enough to satisfy the market, which valued the data software company at 300 times forward earnings. These results and the resulting price action likely sent shockwaves through the market.

Another reason for Nvidia’s withdrawal was the news that Michael Burry had sold shares through a put option. Simply put, Burry — best known for predicting the 2028 subprime mortgage crisis — is betting that Nvidia and its peers, particularly Palantir, will see their stock prices decline.

Burry’s put options on Nvidia are for 1 million shares. That’s a huge number, worth $186 million. Admittedly, his bet on Palantir is six times larger.

A move worth making?

I think many investors would understand or agree to compact Palantir, but Nvidia is a completely different story. While Palantir is trading at 117 times forward price to sales, Nvidia is trading at 45 times earnings.

To expand on this comparison, Nvidia’s price-to-earnings-to-growth (PEG) ratio is 1.27, while Palantir’s is 8.1. This tells us that Nvidia is significantly cheaper using customary metrics.

This is where I’m skeptical of Burry’s move. Personally, I think there are plenty of reasons to believe that Nvidia stock is still undervalued.

First, the stock’s PEG ratio – a measure of growth-adjusted earnings – is 29.5% below the average in the information technology sector. Yes, equipment manufacturers traditionally offer discounts. But Nvidia is much more than just a hardware company. It is central to the artificial intelligence revolution and has a huge software ecosystem.

It has consistently beaten earnings expectations in recent years. While recent increases are not enormous, they do tell us that forecasts may underestimate the company’s growth potential.

This is really critical because, as mentioned above, it is already trading at a 29.5% discount to the sector average.

There’s more to it than that

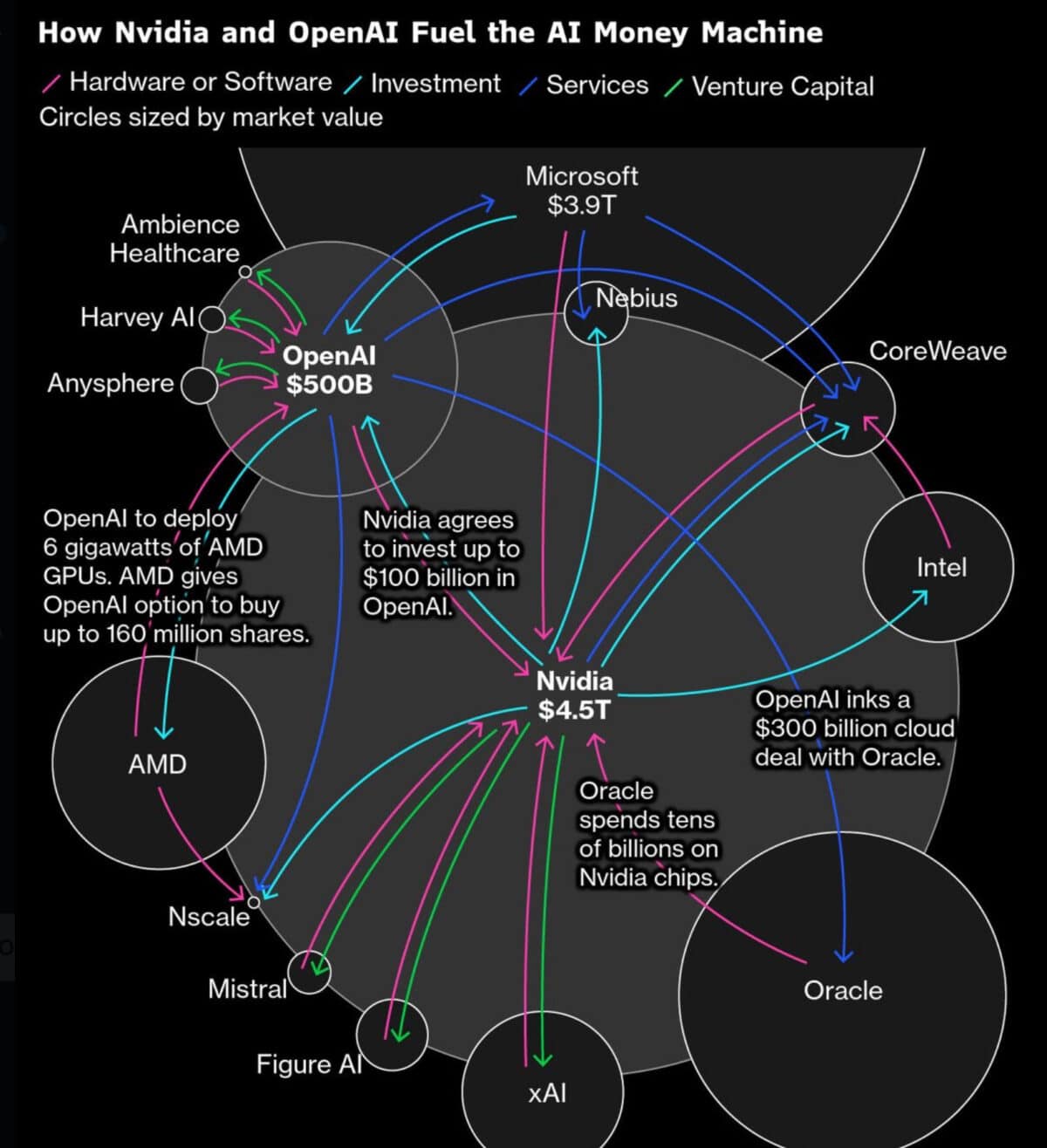

However, I appreciate that Burry is probably not interested in valuation, but in the AI sector bubble. He had already referred to the notable graphic showing how money flows in a circle in a sector.

What does this graphic show us? It shows us that Nvidia is a major player in capital flows in the sector. For example, we can see Nvidia investing in OpenAI, with which it will then sign a deal worth $300 billion Oraclewhich buys Nvidia chips itself.

I understand how worrisome that would be, but it’s funded primarily by free cash flow, not debt. This is an critical distinction.

Personally, I think some valuations are of great concern in the market, but Nvidia is not one of them. I still think this is a stock that investors should consider.