Image source: Getty Images

I think that these actions in Great Britain are a great choice for investors to consider whether they are looking for a sturdy second income. Here’s why.

Platinum Play

Golden supplies are not the only game in the city for investors who want to operate rising metal prices. Plainum Group Metal (PGM) shares are another potential game to look at, because the prices here will also start.

Gold prices have increased by 45% over the past year. Meanwhile, platinum increased by 47% during this period. And this may be due to further significant profits as metal supplies fall.

According to World Platinum Investment Council, the total platinum delivery will fall to five -year minima in 2025. As the demand for jewelry and investment interest increases, the organization expects the market that the market will record a deficit of 850,000 ounces this year.

Purchase of platinum stocks such as Sylvania Platinum (LSE: SLP) can be a more profitable way to operate metal prices than physical metal or metal tracking fund. Over the past year, the enhance in stock price in South African Górnik has illustrated this theory over the past year.

Miners enjoy the effect of “lever”, in which revenues grow next to the prices of goods, while their costs remain largely stable. This can lead to an enhance in profits, as indicated by an 118% enhance in EBITDA from year to Sylvania in the last budget year (until June 2025).

It should be remembered that the “lever” factor may also mean that earnings may fail if the metal prices are inverted. But now I think that this phenomena should continue working in favor of the company.

City analysts share my optimism and expect that earnings are almost double in finance 2026. Forecasts are also increased by the company’s plans to enhance all-year platinum, palladium, ROD and gold-like-so-called group 4E-to 83,000 to 86,000 ounces from a record of 81 002 last year.

It also means that brokers expect that the annual dividend will enhance to about 4 pence per share this year from 2.75 pence last year. This leaves Sylvania Platinum with a vigorous capacity of 5.2% dividend.

Favorite FTSE 100

BAE systems (LSE: BA.) It does not offer this type of high dividend performance in the near future. In 2025 and 2026, they correspond to 1.8% and 2%, respectively.

However, the prospect of a greater dividend growth still makes it make it make it make it FTSE 100 Share a worthy of sedate attention.

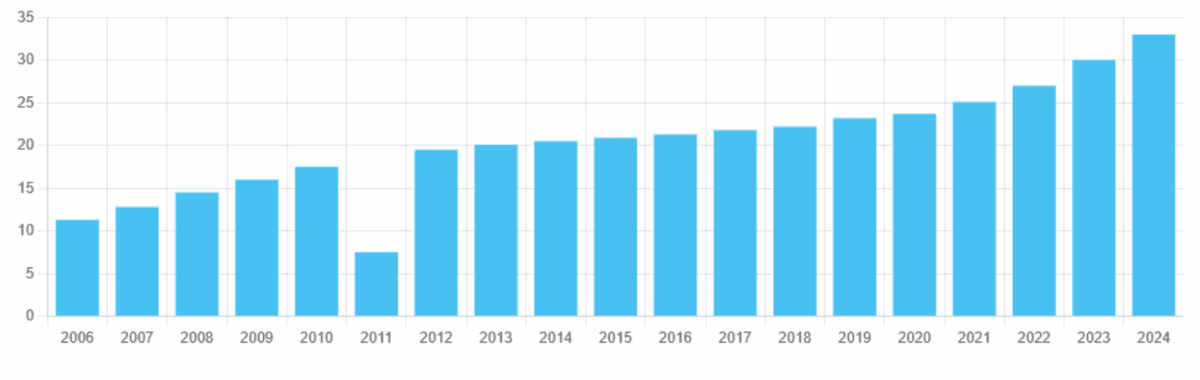

Payments of shareholders have been growing every year since 2012, which caused last year’s dividend 33 pens per share. And city brokers expect that they will raise another:

- 8% in 2025, up to 35.7 pence.

- 10% in 2026, to 39.4p.

To look at all this from a perspective, the enhance in dividend in a wider indicator of Great Britain’s action was an average of 3% -4% in this century.

This does not cause that BAE systems are not a problem to buy. As the main supplier of the Defense Department, its profitability is exposed to any withdrawal of the US military activities on the global scene.

However, this is not a formality, because the geopolitical landscape is still developing. In addition, the company may expect that sales for other key customers, such as Great Britain, Australian and Saudi Arabia, will grow. Strong expenses from NATO countries and partner countries led to the sale of the group by 11% higher in the first half.

This, in turn, encouraged Bae to raise momentary dividend by 9% year on year. From the western attachment to the continuation, I expect dividends to be marshals.