Image source: Getty Images

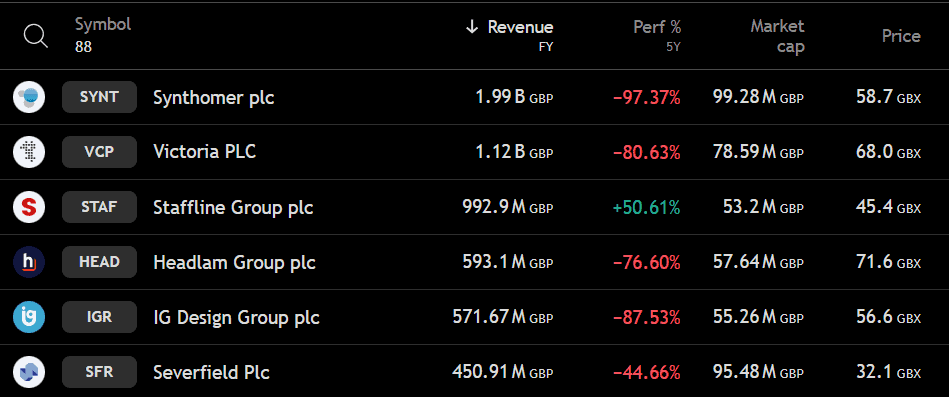

It is not unusual seeing a herd of penny who suffered weighty losses, but few have fallen as far as Cythhomer (LSE: Synt). Over the past five years, by 97.37%, the main supplier of water polymers has become one of the worst stocks of a penny in Great Britain.

And yet the company still brought almost 2 billion pounds of revenues last year – more than any other penny shares on the market. Once an ingredient FTSE 250Synthomer fell on the territory of Penny Stock last month after its market capitalization fell below 100 million GBP.

In the results of the full year in 2024, the group reported a net income loss of 72.6 million GBP -Gwałtów from a profit of 208 million GBP in 2021. The last six months of results for 2025 were worsened, with a loss of profit per share (EPS) of -26 pens, compared to profit forecasts.

So what went wrong – and can he get back?

Boom and years of bust

Synthomer’s story is one of the cycles. In 2018, the company enjoyed a rapid boost in the demand for nitrile gum butadiene (nbr), a key ingredient in disposable medical gloves. Earnings increased, and the acquisitions helped in positioning the group as a global specialist player of chemicals, giving investors confidence in the history of growth.

Until 2019, this rush disappeared. Higher costs of raw materials and weaker demand in Europe and Asia caused a profit contract. Then he came 2020 and Pandemia. Once again, the demand for gloves increased, causing another rally.

But the boom was low -lived. The takeover of Omnov’s solutions in 2020 was desied with a huge debt company. Synthomer was left with growing costs, falling profits and a balance under pressure.

Actions, currently trading around 58 pence, have fallen by 98.5% from the highest level of 2021 above 4,000 pens. Investors who bought at the top noticed the extraordinary value that was removed.

Expansion and finance

In October 2021, Synthomer bought the Eastman Chemical glue business for USD 1 billion, which included a factory in the Netherlands producing about 80 different synthetic resins. While the contract extended the product base, she added debt to the stack.

Even the balance is not without merit. The group has 2.45 billion GBP in assets and 996.6 million GBP of capital in relation to 960 million GBP of debt. Last year, he also generated 15.7 million GBP for operating cash flows.

The management now focuses on delevant, and the covenant relief has agreed with the lenders’ previous by 2026, giving some breath. In addition, free cash flows improved last year, and the net debt was almost half of the previous levels.

Can it recover it?

Recovery depends on reducing the net debt to EBITDA to a safer level. This may include the sale of unrelated assets, refinancing on better conditions or waiting for interest rates easier. Any signs of stabilization of profits or debt reduction may result in the re -results of the Synthomer share price.

Personally, I think that it is worth considering this herd of penny only for investors with a powerful risk appetite. It can be a classic high-risk story, a high-nutrition.

But for me a weighty lever, continuous losses and uncertain macroeconomic environment make it look too speculative for now.