Image source: Getty Images

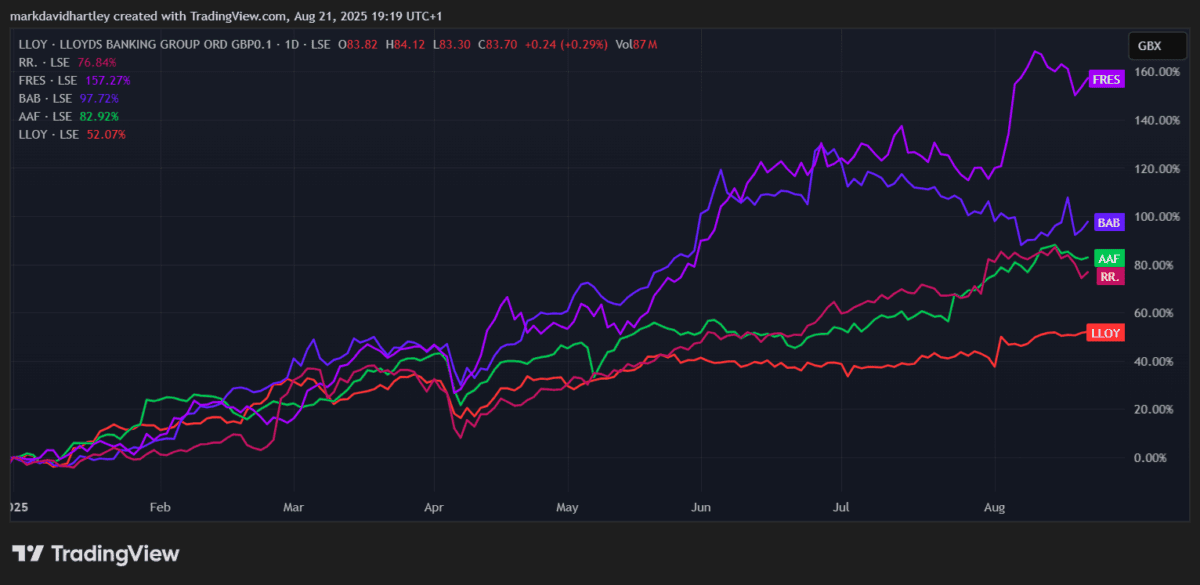

Lloyds“(Lse: Lloy) shares continued their seemingly endless climbing this week, increasing their total annual profits to the amazing 54%.

Just a handful FTSE 100 Stocks are doing better, including FresnilloIN GrandmotherIN Airtel Africa and always popular Rolls-Royce. He runs a package among Lloyds banks. Nestwest AND Barclays increased by about 40%, a Standard charter increased by 37% and HSBC 24%.

This is quite a return for a bank, which was not so long perceived as a serial worse.

Rushing train?

RBC Capital Markets recently compared European banks to “Rushing train“In the research note. This sounds stimulating, but the analysts also emphasized how the sensitive sector remains for geopolitical shock German bank AND OSB group.

Goldman Sachs He also adopted a more stubborn position, raising the target price of Lloyds shares to 99 pens from 87 pence at the beginning of this month. On average, 18 analysts now see shares up to 90.7 pence in the following year – about 8% higher than today. Eleven analysts even have a sturdy purchase grade, and eight sticks to hold.

It seems that confidence comes back in a substantial way.

Paypoint partnership

Another promising development is the news of Lloyds’s partnership from Paypoint. By BanKLocal The service, group customers will soon be able to make cash deposits in over 30,000 locations in Great Britain.

This means uncomplicated and convenient access to payment for 300 pounds a day in notes and coins, and the money displayed on the accounts within a few minutes. Importantly, Lloyds will be the first of the main banks that have fully adopted the program.

In the era in which bank branches close at a record pace, it looks like a wise move that can support maintain customer loyalty.

Reliable income … for now

Income remains an critical reason why many investors buy Lloyds shares. However, the last rally for the first time in almost three years reduced dividend performance below 4%.

Despite this, dividends grow. Forecasts suggest that payments can reach 4.7 pens per share by 2027 – an augment of 48% compared to today’s 3.17 pence. Not bad, although history shows caution. When Covid hit, Lloyds lowered the dividend in half. If he repeated a similar shock, shareholders may meet the same disappointment.

Interest rates and inflation also remain risk factors. A fierce change or can strongly achieve bank profitability.

Still good value?

All this growth has not become unnoticed. The price ratio to Lloyds (P/E) is currently 11, which is higher than Natwest, HSBC and Barclays. Its debt for equity is also much higher than most peers.

This suggests that Lloyds may not be an opportunity once. But although the best profits can be in the bag, I would not expect that the history of growth will disappear overnight.

In the case of investors of long -term income, Lloyds remains an attractive choice of FTSE 100 to be considered. The valuation is no longer budget-friendly, but with dividends that are to grow, and novel services, such as Paypoint Partnerships, augment value, there is still a sturdy case of having this British bank giant.