Image source: Getty Images

During the first 30 minutes of trade today (July 30), Aston Martin Lagonda (LSE: AML) The price of the shares was almost 3% lower. Investors reacted to the results of the sports producer in six months ended on June 30, 2025.

When issuing the results of the first quarter in April, the group said that its key financial goals were “Positive corrected EBIT (profit before interest and tax) for a full year and free cash flows (FCF) in H2“.

The announcement this morning confirms that the group should have a positive FCF over the next six months. However, EBIT will be “Improvement in the direction of Breeeven“.

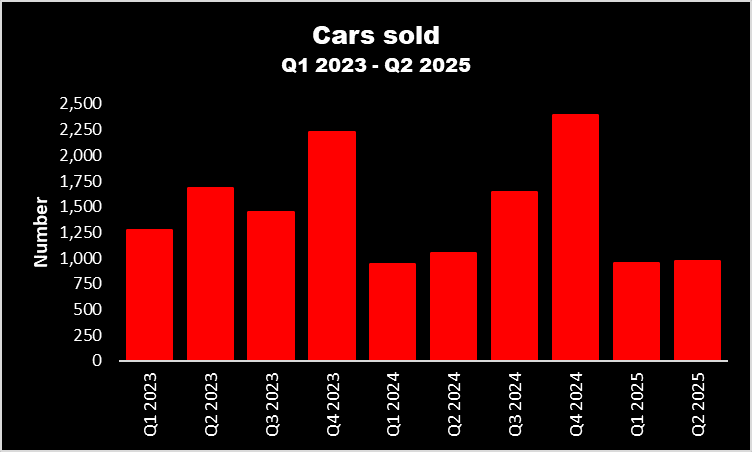

Compared to the same period in 2024, sales were essentially flat, and the company sold less “less” “Special‘

Looking to the future, the group hopes to strengthen their balance by selling their participation in the F1 team, which has its name.

And its medium -term targets of 400 million GBP EBIT and the percentage of the gross margin in “Forty means“Stay unchanged.

Restless story

Although there is little proof that he said that, Albert Einstein often attributed one of the most celebrated quotes of all time: “The definition of madness does the same over and over and expects various results“.

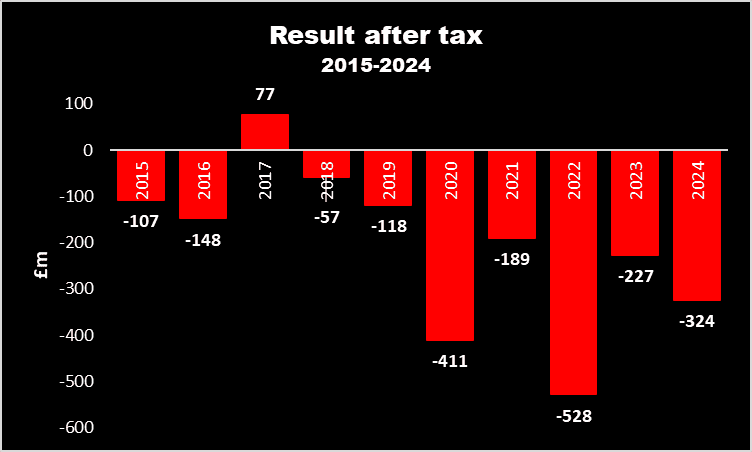

Whenever I look at the numbers of Aston Martin, the expression often comes to my mind. For years (no, decades), the iconic brand has been trying to balance cars on a eternal basis. Instead, it still becomes losses, even though it sells one of the most attractive vehicles. According to the BBC, it was gnawed seven times since the foundation in 1913.

Over the past 10 years he has been profitable – a year before the debut on the stock market. In this decade, a cumulative loss of 2.03 billion GBP was recorded. And after today’s announcement, it seems that 2025 will not be different.

It does not require genius …

I am not a physicist, but even I know that if there is no way to profitability, there is really no real investment case. To get to black, Aston Martin must either sell more to cover his fixed general costs, reduce costs or raise prices. In an ideal world it would do all three.

But when the product sells nearly 200,000 pounds, only a diminutive number of customers is available.

Inflation means that the costs are always growing and if no more cars have been sold, the group is unlikely that it will have the power to buy to secure further discounts against mass purchase. I am sure that the overall costs can be cut a bit, but not very much.

When it comes to raising sales prices, President Trump’s tariffs have already done this for American customers of the group, but the frustrating Aston Martin has no revenues.

Regardless of how it turns, there is no straightforward solution.

Not for me

I am really sorrowful because of the situation in which the group is. Aston Martin is a cult brand that has won many awards for being nippy. This does stunning cars that receive enthusiastic reviews from the automotive press.

However, today’s announcement of the results shows that he is still facing great challenges.

I wish the group well, really. But unfortunately I can’t find sufficient reasons to justify me with the investment.