Image source: Getty Images

I am not interested only in the high profitability of dividends when I buy shares for passive income. I want dividends that can provide a balanced and growing dividend over time.

As this table shows, Greencat UK (LSE: UKW) It is expected to impress both numbers in the next few years:

| Year | Dividend for action (forecast) | Dividend performance |

|---|---|---|

| 2025 | 10.38p | 8.6% |

| 2026 | 10.70p | 8.8% |

| 2027 | 11.01p | 9.1% |

It is very critical to remember that dividends are never guaranteed. What’s more, the city’s forecasts (on which these profits are based) can shoot both below and above.

However, I am sure that this dividend star will provide a long -term second income for investors. If the forecasts are right, the 10,000 pounds of the lump sum will be dividends in the amount of 2653 GBP today from now to 2027.

This is why I am considering FTSE 250 A company for my own portfolio.

Good and bad

Maintaining renewable energy can be sometimes problematic. When the sun does not shine or the wind does not blow, profits may fall as a decrease in energy production, potentially affecting dividends.

This is a constant threat to Greencat UK, whose assets are in Great Britain, as its name suggests. However, this stronger geographical trace also has its advantages.

The United Kingdom is famed for its excellent wind speeds and long coasts, and the powers at sea at sea often exceed 50%, which makes it one of the leading turbine construction sites in the world. Capacity in future wind farms also increased by up to 65%, as technology increases.

The United Kingdom also becomes one of the most supportive environments in the world for green energy. Last Friday (July 4), the government announced up-to-date plans to combat the wind industry on land through steps, such as simplifying the planning process and increasing supply chains.

In this way, the government wants almost double wind ability on land, up to 27 GW-29GW until 2030.

Dividend hero that I consider

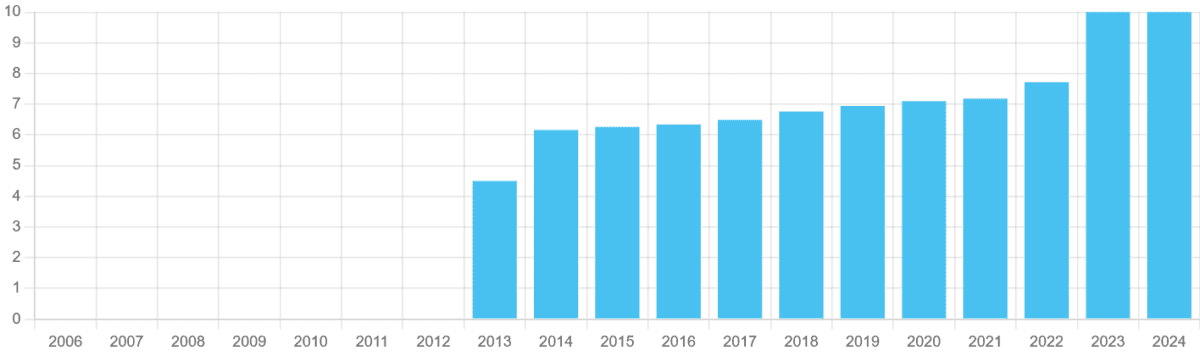

This ensures a significant range for Greencat UK, which is currently the owner of 49 wind farms to maintain his progressive payment policy. As you can see, the annual dividends here have grown consistently since it was mentioned London Stock Exchange Over a decade ago.

The only exception was in 2024, when the company reduced long -term energy production forecasts by 2.4%, which leads to a decrease in the value of assets. But along with the changes introduced, urban analysts expect dividends will start to raise again from 2025.

The graphics also emphasize another attractive function of such renewable energy resources. The demand for electricity remains generally stable in all economic conditions, even during high inflation and slowdown related to pandemic. So, although these companies can produce energy, revenues and cash flows are constantly combining.

Although this is not without risk, I am considering adding Greencat UK to my own portfolio for long -term income.