Image source: Getty Images

When it comes to dividends, the difference between buying shares when they are low-cost and when they are steep, it can be dramatic. And this is something that passive income investors, which they must pay attention to.

At the moment, there are many inventory on which analysts have positive views. But the couple distinguishes me as particularly intriguing opportunities to consider.

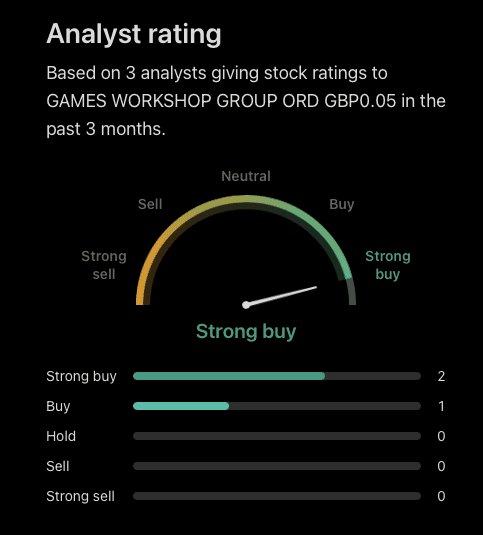

Games Workshop

Games Workshop (LSE: GAW) is a favorite by analysts covering actions in Great Britain. And regardless of whether it is an boost or dividends, actions were an overdue investment for shareholders.

In terms of boost, profit per share has more than twice in the last five years. And although this happened, the company paid almost 80% of the net income as dividends.

It can be risky. If the demand ranges, because household budgets are tightened and discretionary expenses are under pressure, there is a real chance that dividend may not be balanced.

In a sense, however, the high payment rate is a sign of the Games workshop strength. Its main asset is intellectual property, and this does not require a huge amount of investment.

For most companies, paying dividends means compromise in terms of returns. Cash returned to shareholders cannot be used to open recent stores, recruit more employees or acquire other companies.

However, thanks to the Games workshop, the situation is different. That is why it increased as the largest investment in my ISA actions and actions and why I think it is worth considering in July.

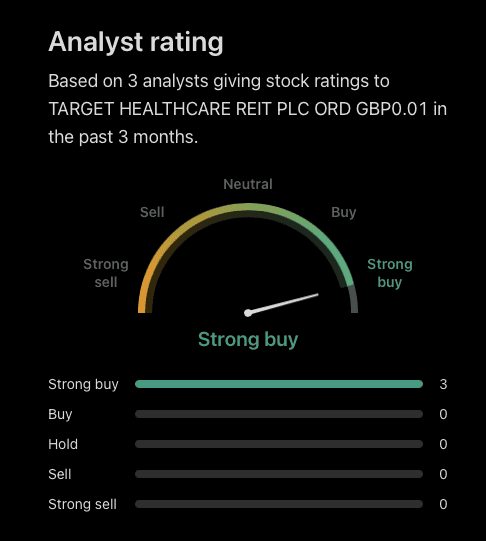

Target Healthcare Reit

There are not many analysts that he pays attention to Target Healthcare Reit (LSE: Thrl), but those that think it’s worth considering. And it’s uncomplicated to understand why.

The company has a portfolio of 94 nursing homes, which it rents to operators in Great Britain. Like other real estate investment funds (REIT), it returns 90% of this shareholders as dividends.

The levels of occupancy are currently about 85%, which is at a low level. This reflects the continuous risk of inflation of the company’s tenants that have restricted ability to boost prices.

However, I think that the overall trend of longer life expectancy should become a great demand over time. And there is much more to like in actions from an investment perspective.

It should be remembered that tax treatment depends on the individual circumstances of each client and may change in the future. The content in this article is provided only for information purposes. It is not to be, nor does it constitute any form of tax advice.

Target has a mighty balance, which is not automatic when it comes to reit. His lease was also left, on average 25 years, providing good long -term stability for the company.

Taking all this into account, I think that 5.6% of dividend performance is relatively attractive. So I understand why analysts think this is one of the investors – and it is certainly one that I have an eye on now.

Finding shares for purchase

I am often quite skeptical about the assessment of analysts – especially positive. When it comes to investing my own money, I’m more careful.

However, with Games Workshop and Target Healthcare Reit, the sight of consensus looks likely to me. I think there is a lot to like in actions, and dividend investors should take a look.