Technical analysis of amzz Elliott Wave

Function: Tendency.

Mode: Impulsive.

Structure: Theme.

Position: Wave (V) {i}.

Direction: Plus in (V).

Details: It seems that the market fills the five -oxide sequence in Wave {i}, and Wave (V) is currently developing. Wave (III) previously extended, supporting the continuous growth potential in the wave (V).

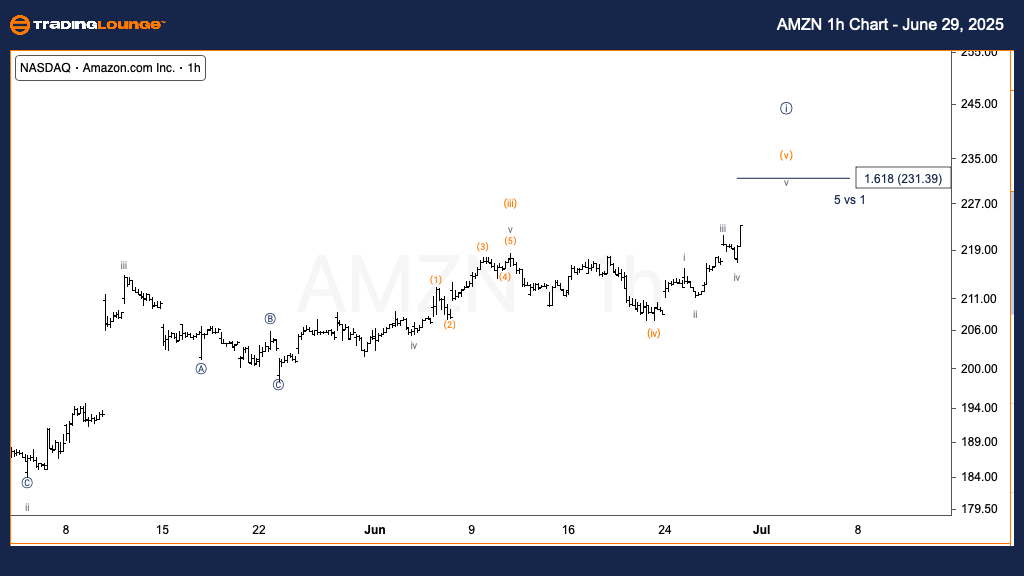

Technical analysis of amzz Elliott Wave

Function: Tendency.

Mode: Impulsive.

Structure: Theme.

Position: Wave (V) {i}.

Direction: Plus in (V).

Details: With wave III and wave I (V) showing similar lengths, the V wave can stretch. This extension can lead to a price campaign at the top of a smaller group 1, focused on 230 USD.

This analysis for Amazon.com Inc. (Amzz) It covers both daily and 1-hour charts, using Wave Elliott theory To forecast the market direction.

Daily chart review:

Amzn passes through the wave (V) {i}, which indicates the final phase of the five -time pattern from the low April. With a previously extended wave (III), the wave (V) can reach a similar length or cut. Repair wave {ii} may occur after completing.

Hourly chart review:

The wave (V) develops with a clear structure. The similarity of the length between waves III I and (V) confirms the likelihood of extension in the v. The price can reach the peak of a smaller group 1, about USD 230, which is in line with Fibonacci projections in typical formations of motive waves.