Image source: Games Workshop PLC

For most of the last two years, growth supplies have taken a place. High inflation, growing interest rates and nervous ones investors led to shift towards values and defense sectors. But are inflation now alleviate and the rates are probably close to their peak, or do height in Great Britain eventually issue a return?

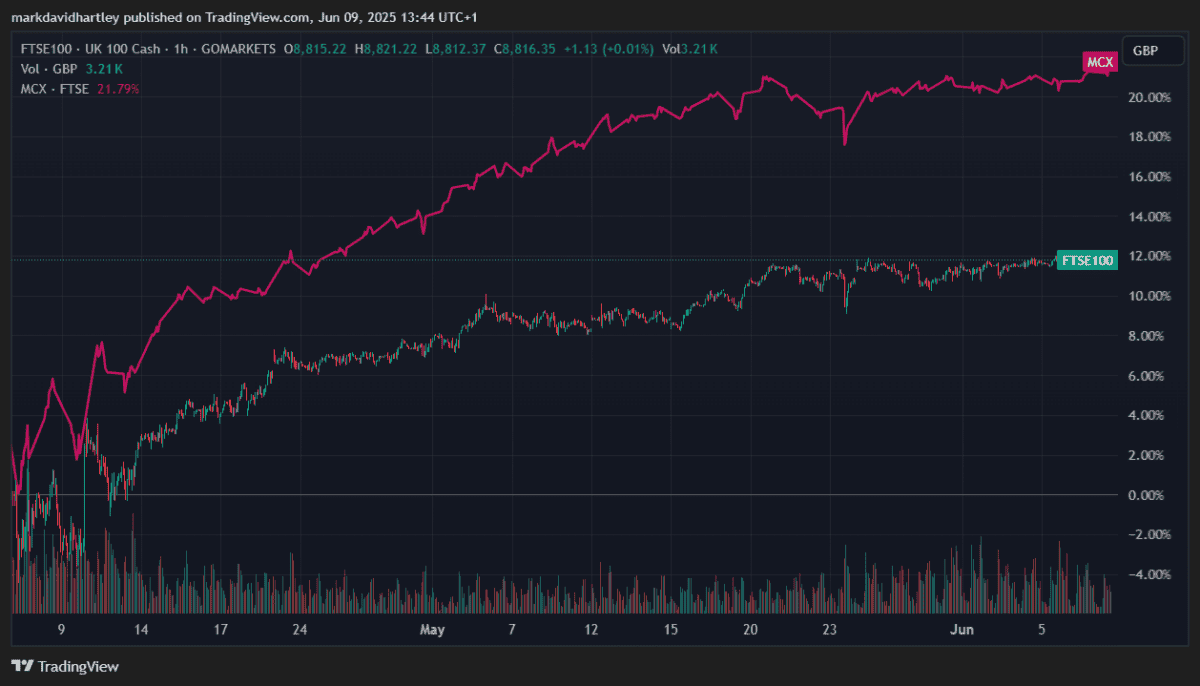

There are still early days, but the characters are encouraging. . FTSE 250House for many of the best names of Great Britain, began to surpass FTSE 100 In recent months. This is usually a sign that investors are starting to favor more risky, faster growing companies.

Why growth resources fought

Growth actions often promise powerful future earnings, but a significant part of this value was associated with forecasts. When interest rates grow, future profits are more discounted, thanks to which growth shares look less attractive compared to constant alternatives paying dividends. This is a key reason why discretionary companies of technologies and consumers achieved worse results in 2022 and 2023.

But now the inflation of Great Britain has dropped to below 3%, and the Bank of England expected further reduction of rates this year. If the borrowing becomes cheaper, growth companies can be easier to raise capital, invest and implement these long -term forecasts.

Recovery signs

The last results of several highly developing British companies were solid. For example, an extremely popular FTSE 250 company Games Workshop (LSE: GAW) reported record revenues and profit in its latest update, and international expansion still increases the shoot. His shares have increased by over 20% of the year so far.

With full control over intellectual property, product development and licensing more and more popular Warhammer Franchise, her future looks promising.

Revenue are constantly grown, supported by a devoted fans base, modern released products and expanding retail and internet channels. Recent results showed a two -digit boost in profits, and the income of license fees from media transactions is added by a lucrative revenue stream. Despite the niche market, international demand is still growing.

However, there is a risk. Shares trade in price to profit (p/e) of 30, leaving little space for development. If the results do not impress, this can lead to brief -term losses. Growth is also associated with consumers’ expenses that may change in a decline.

Despite this, with a balance and growing global appeal with a ready -made, actions should be considered a long -term growth.

The next FTSE 250 shares, which have recently been recorded, is the High Street Tech seller Currys. Actions increased by 30% this year after good results conducted by the sale of laptops integrated by artificial intelligence (AI). Last month, the company raised its profit forecast for the third time this year after reaching the stock price the highest level. And with a P/E ratio of only 7.5, it seems that it still has a lot of space for growth.

POSSIBILITY

The wave can turn to growth actions in Great Britain. Falling inflation and a possible change in monetary policy created more favorable conditions for the long -term recognition of capital. But selectivity remains crucial.

While FTSE 100 tends to favor income and stability, there are still many stimulating possibilities of growth in FTSE 250 I OBJECTIVE markets. For investors willing to make up for lessons – and a bit of variability – it may be the right time to re -introduce a growth exposure to a balanced portfolio.