Businessmen work with stock market investments using smartphones for commercial data analysis. Smartphone with a stock exchange chart on the screen. Financial stock market.

Are you looking for risk management ways, but still go to gigantic profits? Here are three investment funds with FTSE 250 I think they deserve a closer look.

Useful Murray

As the name suggests Murray Income Trust (LSE: MUT) is a real hero for investors looking for huge and growing passive income. And today you can pick it up at very low costs.

At 854 pens, a 9.6% discount to the net assets (NAV) for the action:

Dividends at Murray Income have increased over the following 51 years. But unlike some British dividend growth confidants, profitability here are far from disappointing. This year it is 4.8%, far before FTSE 100Average 3.4%.

He is able to do this thanks to focusing on a series of payment of Blue Chip income shares. Outstanding resources include UnileverIN RelxIN Astrasenec AND National grid.

This inter -sectoral exhibition provides additional strength, although remember that its focus on British actions creates a regional risk. Murray Income provided an average annual return of 4.9% from 2015.

Take him to the bank

By 116.4 pens per share, Bankers Investment Trust (LSE: BNKR) trades with a 9.5% discount to the estimated NAV per share. I think that for investors trying to effectively diversify their resources.

In total, investment trust has shares in 101 different companies covering the Globe. As you can see below, it is quite well differentiated by the sector and geography, although the huge weight of American technological stocks ensures enormous growth potential when digital economic explodes:

According to the Bankers Investment Trust website, “To achieve an increase in capital exceeding the global FTSE indicator and a dividend increase greater than … consumer price indicator in Great Britain. “It did a pretty good job, and dividends grow for 58 years on spin.

Total annual phrases here amounted to an average of 7.9% from 2015, although the economic slowdown can affect its technological resources, I think it is still a great trust in consideration, and especially at today’s prices.

Rock Solid

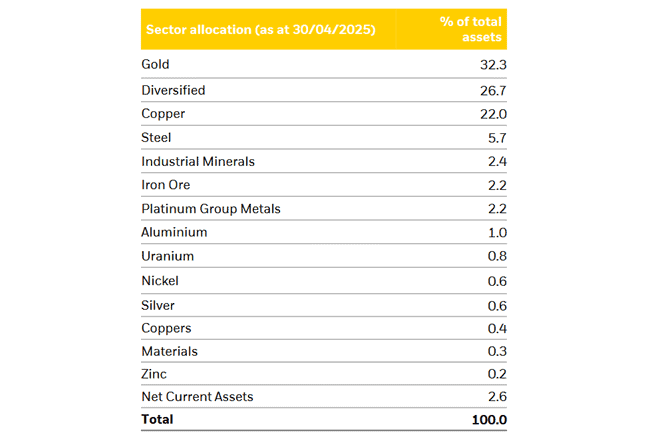

Investing in Blackrock World Mining Trust (LSE: BRWM) Today has a greater risk. As the name suggests, 100% of his shares operates in the cyclical world of goods production.

Not only this, but the industry on which it focuses is susceptible to significant unpredictability. Disappointments may be common at the stages of searching, construction and production of the mine, which means that sales and costs can change significantly.

But with farms in over 60 different mining companies – including diverse weighty weights Red RiverIN OSH AND Glencore – Effectively spreading is a risk. Its wide wing range also provides protection against located problems on specific freight markets and countries (almost 60% of its shares operate all over the world):

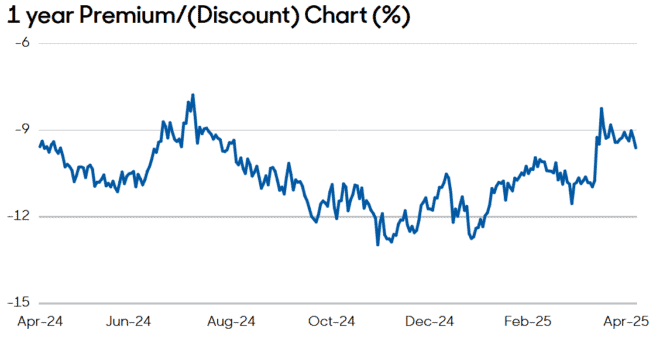

On 517 Pens to Blackrock World Mining Trust trades with a 6.5% discount on his action. By providing an average annual refund of 9.8% from 2015, I think that today it is worth a earnest look.