Dr. Reddy Laboratories Elliott Wave Technical Analysis

Function: Stubborn trend.

Mode: Impulsive.

Structure: Orange wave 3.

Position: Navy wave 1.

Next direction lower level: Orange wave 4.

Details: Orange Wave 2 seems complete; Orange Wave 3 is now progressive.

Wave cancel the level of annulment: 1018.

Daily Elliott Wave Analysis for Dr. Reddy Laboratories emphasizes the stubborn trend with the current market operation in the impulsive phase. Orange Wave 3 is developing in a wider navy blue wave construction. This configuration signals a forceful upward trend because Orange Wave 3 usually represents a energetic Elliott sequence.

After the end of the orange wave 2, orange wave 3, which indicates the renovated purchase force. Then the corrective withdrawal in Orange Wave 4 is expected, but for now the rush up is intact. The key level of annulment is set to 1018. If the prices fall below this point, the current wave structure will require change.

To sum up, the market prospects remain positive. Traders should follow the continuation of Orange Wave 3, maintaining the awareness of the annulment point. The impulsive nature of the current movement suggests the potential of additional profits before the revival of the correction wave 4.

Daily chart

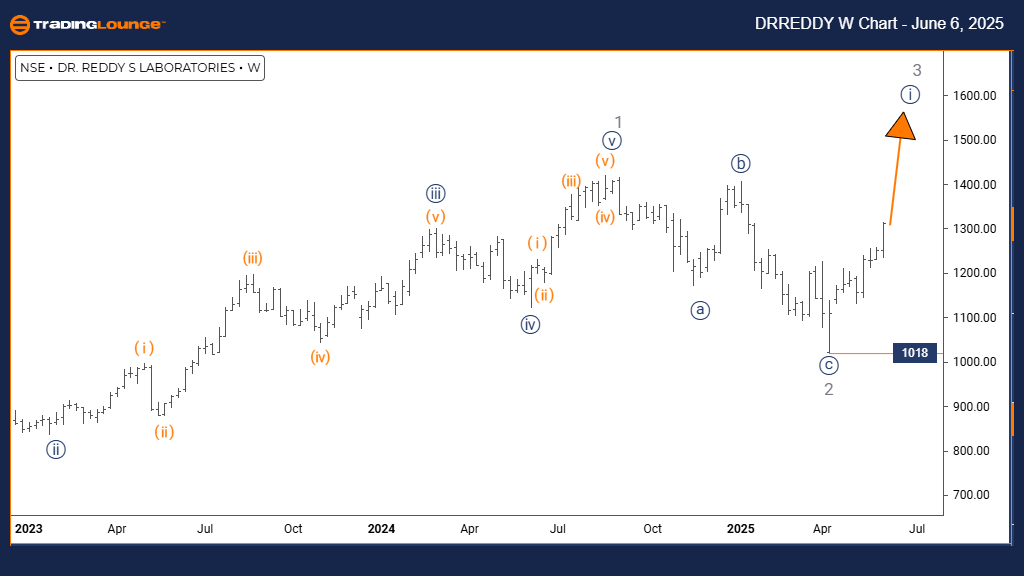

Dr. Reddy Laboratories Elliott Wave Technical Analysis

Function: Stubborn trend.

Mode: Impulsive.

Structure: Navy wave 1.

Position: Gray wave 3.

Direction The next higher degree: Navy wave 1 (launched).

Details: Gray Wave 2 seems complete; The navy blue wave 1 gray wave 3 is now dynamic.

Wave cancel the level of annulment: 1018.

On the weekly chart of Dr. Redda Laboratories continues the stubborn impulsive wave. The market is currently changing in a navy blue wave 1, which is part of a wider wave of gray 3. This compensation suggests the beginning of long -term upward movement.

Gray Wave 2 has ended and the navy blue wave 1 progresses, which indicates a fresh Copides shoots. The next wave for monitoring is also a navy blue wave 1, simply initiating in the gray wave 3. If the price drops below 1018, the number of waves would be annulled.

This configuration means constant upward movement. As long as prices remain above 1018, stubborn perspectives. Traders and investors should carefully observe the market to confirm the continuous impulsive behavior.