Image source: Getty Images

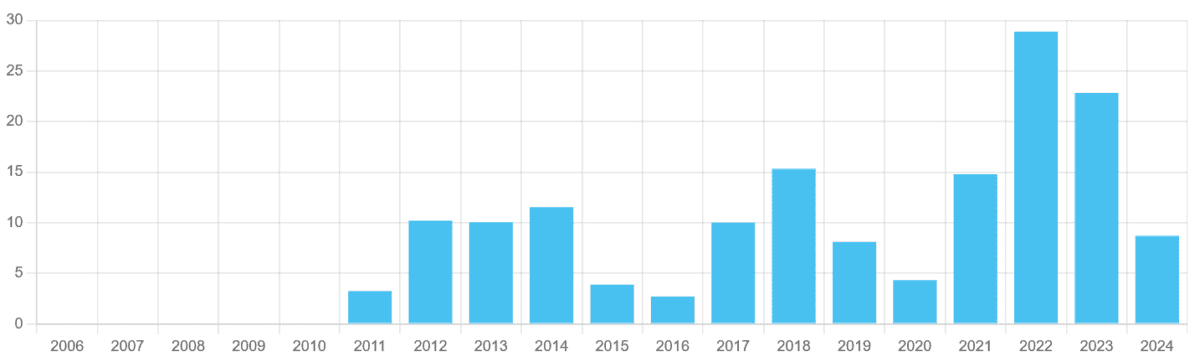

Mining shares are among the most cyclical. Annual profits may sway wildly depending on the economic conditions, as is the dividends of shareholders. This was the case with Glencore (LSE: Glen) is divided for over a decade.

From the list on London Stock Exchange In 2011, the payments of shareholders were raised and and down, like entertainment. Recently, they sank as the economy of China and higher global interest rates achieved the demand of goods. In previous years, they increased because recovery after postpandemic propelled metals and energy values.

Interestingly, urban analysts tilt Glencore actions so that they have a sturdy reflection in the next few years.

9.6% dividend performance

| Year | Dividend for action | Dividend augment | Dividend performance |

|---|---|---|---|

| 2025 | 14 cents in the USA | 40% | 3.8% |

| 2026 | 22 cents in the USA | 57% | 6.2% |

| 2027 | 34 cents in the USA | 55% | 9.6% |

Perhaps you will not be surprised that this stunning dividend growth coincides with the expectations, that profits break off.

Currently, the number of Crunchers expect glencore:

- To deviate from losses to the share of 13 American cents last year to profits of 20 cents in 2025.

- To register earnings of 33 American cents in 2026, moreover by 65% year on year.

- To print earnings of 44 American cents the following year, an augment of 33%.

Such an augment significantly exceeds the expected augment in dividend by 1.5-2% for wider FTSE 100 In the near future. It also means that the dividend profitability of Glencore shares shoot next to the long -term average FTSE of 3% to 4%.

Shaky cover

But dividends are never guaranteed. So I have to think about how realistic these forecasts are.

A plus, a solid Glencore balance can leave it in a better form to pay dividends during a up-to-date economic situation than many other miners. From December 2024, its Net-Debt-Ebitda indicator (profit before interest, tax, depreciation) was modest 0.78.

But as we have seen once, it is probably not enough to stop the fall of cash prizes if the profits fell. Glencore already looks exposed on this front, with expected dividends covering from 1.3 to 1.5 times through the expected earnings to 2027.

These numbers are far below the security reference point twice.

Should investors buy Glencore shares?

The prediction of Glencore dividends in 2027 remains a hard question, taking into account the current macroeconomic uncertainty.

Encouraging that the US-China trade agreement announced today (May 12) bodes well for the company’s profits, as well as a constant decline in global inflation. However, there is a significant risk for the global economy (and what is the extension) of the prices of goods, including the potential of fresh vacuuming between the USA and other main trading partners.

It is therefore helpful to consider phrases that Glencore shares can provide in the long run, not just the next few years. And from this perspective, I am much more positive when it comes to the assessment of dividend and the potential of share prices.

As a producer of goods, as well as a trader, FTSE has significant possibilities to apply the next “freight supercyc”. I think that earnings and dividends can augment as topics such as the growing digital economy, brisk urbanization and decarbonization initiatives drive the demand for metals.

I buy shares based on their investment potential for at least a decade. At this time, I think Glencore is worth consideration.