Today we have significant news about the potential reduction of tariffs in China. President Trump suggested that “80% tariff on China seems appropriate” before the upcoming commercial conversations with Chinese officials. This would cause a significant decrease in relation to the current tariffs, which reached up to 145%.

What is particularly compelling – and a story – a summer reaction to the stock exchange to this message.

Despite what was usually considered positive for the economy (lower tariffs), the stock exchange did not answer with enthusiasm. At the time of writing, the supplies are slightly reduced, which suggests one of two things (or both):

1. The market does not believe that these tariff reductions will significantly improve economic perspectives, or

2. The market is prepared for a decline based on technical factors and sentiments, overwhelming what would normally be positive news.

This reaction is consistent with what I talked in recent alerts – markets do not always react to messages directly, especially when technical conditions and market positioning already indicate in a specific direction.

Skeptical bond market in the field of trade growth

The reaction of the bond market to this message provides an additional context. Treasury Renches did not record significant movement, which suggests that investors with a constant income remain skeptical about the long -term impact of these potential tariff adaptations.

From the point of view of technical analysis, today’s price results confirm what charts tell us: the market is probably positioned for a significant decline, regardless of the flow of messages. When markets do not collect positive messages, it is often a sign that sales pressure remains dominant. In other words, although the stock movement was miniature, the message is raucous: wrestling wants to fall here.

This is deep, because the performance of the action together with one of the USD indexes ensure a key background for many markets, including goods (such as copper) and precious metals.

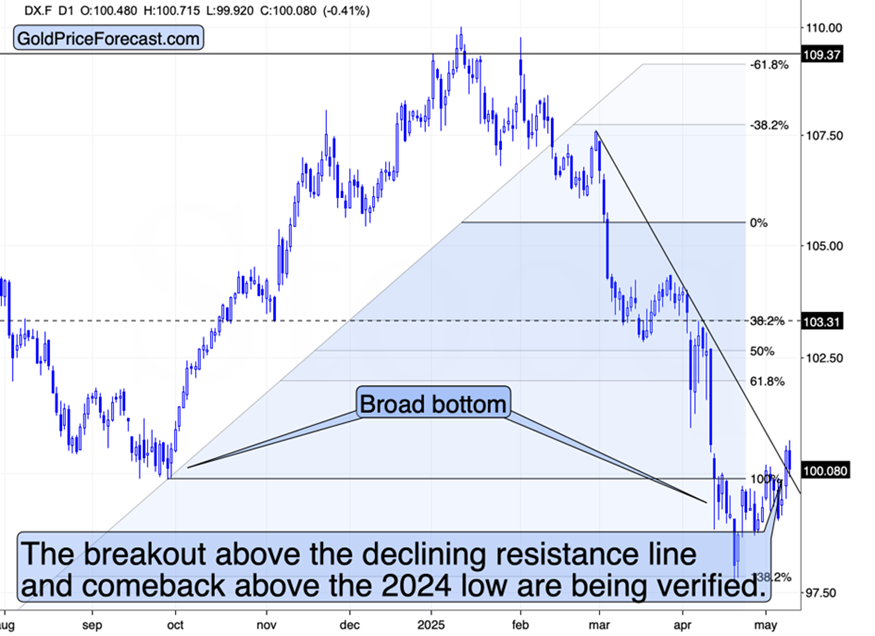

And the latter also did something really unusual (and in accordance with what I have been writing about for many days). Namely, it increased by a low level of 2024 and a decreasing resistance line.

Yesterday, before the rally, as follows I commented on the above chart:

“In the brief period, we see that USDX is on the verge of breaking above its steep, decreasing resistance line. At the same time, the rally above this line will also regain USD over minimis last year, thus annuling the failure.

This is the most likely, and when this happens, for many market participants it has become clear that the trend reversed.

Then the declines on the precious metal market will become much larger. “

Indeed, USDX increased and the gold refused. Today, the USD index corrects this rally, while gold improves its fall.

Given the breakthrough of USD, it is completely normal, and since the decreasing resistance line – has been verified as support. This is a stubborn configuration of the USD index.

Verification of a breakthrough above the brief -term resistance line, as well as the cancellation of traffic below the low level 2024, confirms the very stubborn perspective. This is especially the case because so many investors are still bears for the American currency. (Reverse the Asian financial crisis, someone?)

Therefore, today’s higher movement in gold has miniature consequences. The same applies to silver and mining stocks.

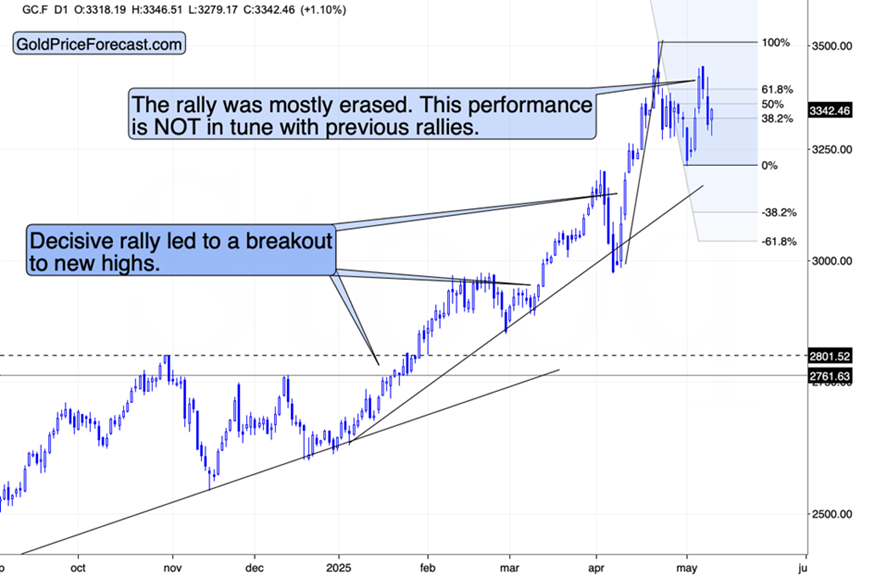

Shoot bear is built in gold

The consistency is that the last Gold price results are clearly different from what we saw at the beginning of this year, when Gold was approaching previous maximas. The rally was fleeting, as I warned.

Gold moved to previous ups in a indefinite way, and then breaks over them. There used to be a miniature break after a breakthrough, but before the breakthrough there were no corrections, let alone significant.

The fact that we saw a significant decrease in Gold this week and a return below 38.2% of Fibonacci (yesterday’s closing) clearly proves that the previous stubborn pattern was broken.

Now that USDX verifies his breakthrough, the chances of falling gold in the following days/weeks are constantly growing. This translates into the same perspectives of silver and mining stocks.

And if the reserves are falling – and they probably do it – a decrease in silver and miners will probably be enlarged.

In addition, because the tariffs are now disappearing, the appeal based on tariffs and uncertainty Gold will fall. At the same time, the tariffs will probably remain high enough to continue to cause economic damage to the global economy, supporting declines in stock markets and freight prices. Of course, there are ways to benefit in this situation.

Do you want free subsequent activities in the above article and details not available for 99%+ investors? Sign up today to our free newsletter!