Image source: Getty Images

Difficult market conditions mean this Legal and general (LSE: LGGU) Actions have brought a disappointing return since April 2015.

At 249.8 pens per share, FTSE 100 The company has dropped by 5.7% of the value over the last decade of 265.10 pence. This means that shares worth 10,000 pounds purchased ten years ago is now worth £ 9,430.

This is not a kind of results of long -term legal and general owners that they would count on. However, the constant flow of dividends taking blue-chip means that the overall return is not as faint as the price of the action suggests.

From the end of April 2015, the financial services giant paid dividends in the amount of 167.17 PA. As a result, someone who has invested 10,000 pounds at the time would achieve a total return of 12,860 GBP, or 28.6%.

This is much below the average FTSE 100 of approximately 84.2%. Can legal and general shares provide profits from the index in the future? And should investors consider buying a company today?

Prices will rise?

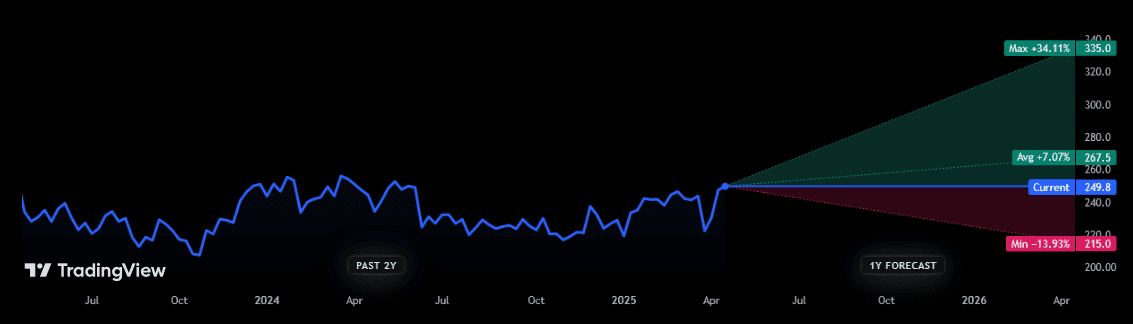

Unfortunately, urban analysts do not provide price forecasts for the next 10 years. However, estimates are available for the next 12 months and provide space for optimism.

15 analysts with rankings of legal and general shares believe that they will appreciate to the diameter of percentages over the following year. However, analysts are not united in their assessment, as the chart shows.

However, despite the fact that brokers tilt more dividends on the market, I think there is a good chance for a solid return in the compact -term period. Dividends are above 9% for each of the next three years.

In the years 2025–2027 legal and general return plans for about 40% of market capitalization (5 billion pounds) to shareholders by combining dividends and purchase of shares. Thanks to the sturdy balance – its Solvence II capital indicator ended 2024 at 232% – the company looks in great shape to hit this purpose.

Should investors buy legal and general shares?

To say, I am more sure of the Legal & General dividend perspective than the price of shares. Specializing in discretionary financial products (think about managing assets, life insurance and retirement products), he is at risk of stagnation or even falling as global economic struggles for adhesion.

The introduction of Trump’s “tariffs” and mutual actions of American trading partners threatens to upload growth. It also means that inflationary pressure can augment by exerting further pressure on consumer expenses.

But as a long -term investor, I think legal and general is a great participation to consider (I keep it in my own portfolio). I believe that earnings will augment strongly over the next decade and later, driven by rapid aging of the population on its markets and the growing importance of financial planning. Maybe this is a turbo demand for services in which he specializes.

In the meantime, investors can comfort with dividends by 9%, even if the price of Legal & General shares achieve weaker results. To sum up, I think that the company could prove that one of the outstanding purchases of FTSE 100 in a long -term perspective.