Image source: Getty Images

In April, investors of the stock market were treated in white. It was a month characterized by moments of fear, euphoria, wild variability and huge fluctuations in stock prices thanks to the Trump mountain queue. As a consequence, both FTSE 100 AND S&P 500 So far they are red for 2025.

But one resource of “Safe Harm” confirms its enthusiasm among huge stock market turbulence. The price of gold has recently reached a recent record level above USD 3,200 per ounce. Many analysts believe that the bullion can still grow in the coming months and years.

Vaneck Junior Gold Miners Ucits ETF (LSE: GDXJ) is a rotational fund (ETF), which offers exposure to the gold mining sector. This is why you should consider in today’s tough investment environment.

Unique form of exposure to gold

Investing in gold extraction shares is different possibilities and risk than buying neat goods. Of course, there is a sturdy correlation between the gold price and the prices of the precious metal companies.

But gold miners can sometimes outweigh or worse price movements in physical gold. Due to its operational efficiency, production costs and exploit of gold, mining companies have clear dynamics so that investors can remember.

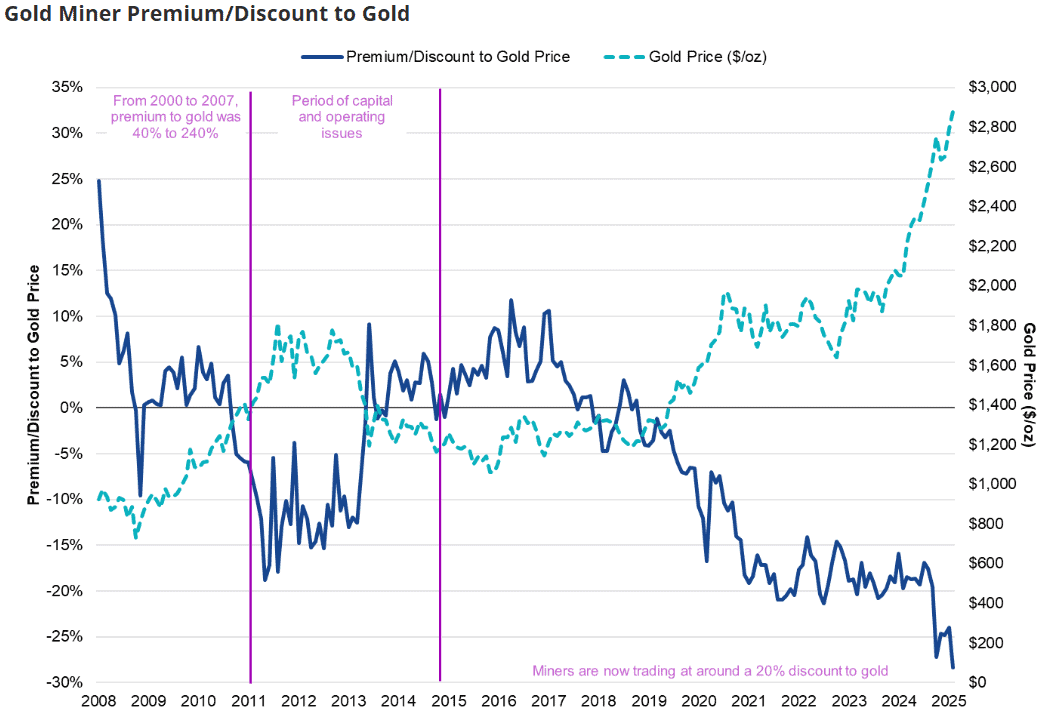

In recent years there has been a significant discount between gold miners and yellow metal. This suggests that the possibility of potential investment value in Górnik Gold Actions may exist. The bay may start narrowing.

Investing in miners at an early stage

ETF Vaneck Junior Gold Miners is the only fund of this kind available in Europe. Offers exposure to smaller mining shares, “Some of them are at an early stage of exploration“.

Slightly less than 59% of 84 companies in the ETF stock portfolio is defined as actions with average capitalization worth from USD 3 billion to USD 20 billion. Some known examples from the FTSE 100 index include Mining Endeavour AND Fresnillo. Other shares of the campaign have market limits below USD 3 billion.

Investing in companies at the early stages of their growth cycles can be attractive, because larger manufacturers have the potential of acquisitions. Often, shareholders can exploit such movements. Topping goals can experience share price jumps during negotiations, although this is not always the case.

However, such companies also have a higher variability of share prices than more mature miners. They also have a greater risk of failure to perform the commitment and may be less competitive.

Shelter from a storm on the stock exchange?

Gold extraction actions often experience fluctuations in prices independent of wide market cycles. In times of uncertainty, these companies can take advantage of the fear of investors. As we have seen this year, capital can quickly flow from other market areas to protected marina assets.

To say that, ETF Vanecka is not resistant to current difficulties. Almost 48% of the portfolio focuses on Canadian mining companies. These companies are based on the US as the main place of export.

Trump’s decision to apply 25% tariffs to Canadian imports can make gold from the country very costly for American refineators and jewelers.

Nevertheless, I think this ETF can be a useful addition to the wallet to consider. I would not like to be too exposed to gold miners, but they can offer useful diversification to investors concerned about the protection of wealth on today’s agitated stock exchange.