Image source: Getty Images

Investing in a mix of US and Great Britain shares with long -term perspectives can be a way to a luxurious pension. Sticking on the plan and devoting a immense amount of income each month, it is possible to attract significant returns – and achieve generational wealth.

I know that this is an abused sentence, but it’s worth repeating: the sooner it starts, the better. The miracle of sophisticated phrases means that there may be a huge difference between 20 and 30 years. The snowball effect means that the returns are growing exponently, and each additional year causes even faster growth.

This does not mean, however, that it is basic – or guaranteed. There are a lot of different geopolitical factors that should be taken into account, which can send global global or refueling markets. Sometimes it can be an annoying experience that requires patience and dedication-but the prize can be worth risk.

Let’s make several calculations.

Road to wealth

. S&P 500 He returned an average of 12% over the past decade, with dividends. . FTSE 100 He returned only 6.3%. This suggests that investors should focus only on American actions, but the mixture of both is a good way to protect the portfolio against the market slowdown in one region.

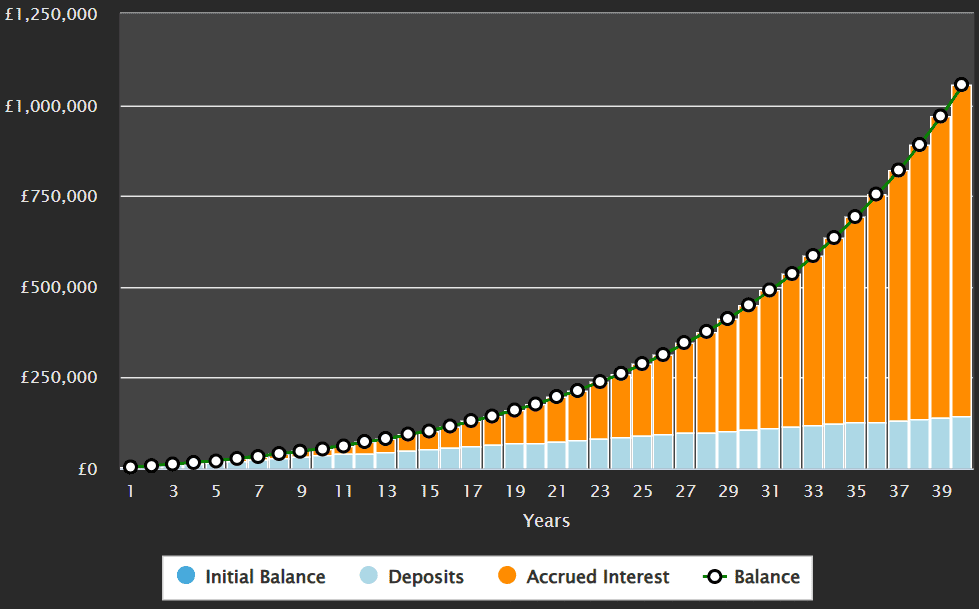

This realistic establishment of a well -balanced action portfolio in Great Britain and the US can return an average of 8%. A monthly investment in the amount of 300 pounds in an 8% portfolio may augment to 177 884 GBP over 20 years. Go further for the next 20 years, and the sophisticated returns would bring a sum to 1 054 284 GBP.

This is a lot of time, but if a devoted investor began at the age of 30, he could reach him shortly after retiring. Even the overdue starter at the age of 40 can reach almost half a million over 30 years.

The best actions of the growth of Great Britain

In recent years, S&P 500 has been hosted in recent years, but FTSE 100 should not be ignored. Stocks like Games Workshop AND Alpha group In recent years, they have enjoyed spectacular growth.

However, I am more biased towards well -established companies with documented achievements with long -term growth potential. I believe that British investors should consider it, it is Group 3i (LSE: III), International Investment Company focusing primarily on private equity and infrastructure.

Its portfolio includes stable companies generating cash that support consistent dividend payments. His flagship holding, Action, is a European discount seller who has provided a unique growth.

The actions increased constantly from 460p to action to 3874 pence. This is an augment of 742%, which is an annual augment of 11.2% per year.

The dividend augment is even more impressive, increasing the sophisticated annual foot by 32% in the last 15 years. This shows a forceful dedication of the value for shareholders.

However, there are disadvantages to be considered. As Private Equity, 3i earnings can be unstable and closely related to economic cycles. Charges for the results and valuations of assets change with market moods that can affect dividend stability. In addition, its dependence on several key assets, such as action, introduces the risk of concentration.

Despite this, the company consistently provided good results, reflected in its growing net assets (NAV) and growing dividends. His investment in infrastructure, especially, provides reliable income over time, which makes it attractive to passive people applying for income.