Image source: Getty Images

One action that I have in my actions as well as ISA and SIPP portfolio actions Ferrari (Nyse: Race). While the iconic Italian sports company probably does not require a presentation, it is far from any venerable cars.

No, Ferrari is valued as an ultra-luxury brand. That is why the actions are often among peers Hermès International AND LVMH (Moet hennessy louis vuitton) instead of muddy car manufacturers Stellantis AND Ferry.

While the shares raced 185% higher in five years, it fell by 16% in just over a month. This withdrawal caused analysts in both Barclays and Kepler Cheuvreux to update Ferrari shares to buy from Hold.

Barclays said that the company maintains a relative “Safe-Haven“Status compared to other European car manufacturers affected by US tariffs. From April 2, Ferrari will escalate prices by up to 10% in some models in the US. This shows the company’s price force.

Meanwhile, Kepler said: “This is PIT Stop, which we have been waiting for a long time to become more positive. “

But should I buy more shares about DIP?

Safe marina

To start with, I agree that Ferrari stocks are a slightly unthreatening marinade. 25% of President Trump’s tariffs for car imports aim to encourage the production of cars in the USA. But Ferrari only produces its supercars in Maranello in northern Italy and this will not change.

Customers value the fact that cars are largely manually mounted in the same historical factory in Italy. This craft and heritage are an critical part of the brand’s attractiveness.

Meanwhile, the company limits production to maintain exclusiveness. As a result, the arrears in the order extend to the beginning of 2027 due to incredible demand.

In other words, you can’t just go out and buy a novel Ferrari, even if you have money. And existing owners have a much more chance to secure a circumscribed editing models than novices.

The result is the extraordinary visibility of earnings, which investors value highly. As long as the order book extends two years for the future, I think that the actions will have a significant bonus to the wider market.

Of course, we can complain about how gigantic this bonus should be, but the fact that the company deserves no doubt on it. At the moment, the price ratio to profit is 43, which is lower than a few months ago (just over 50).

Margin margin pressure

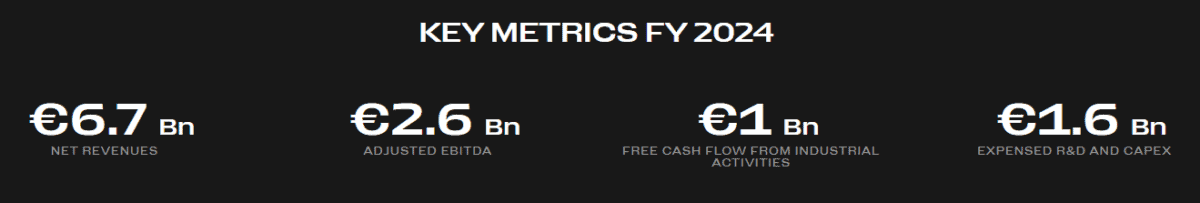

Last year, revenues increased by 11.8% to EUR 6.7 billion. Disports amounted to 13,752 pieces, which is only 1%, but net profit increased by 21% to just over EUR 1.5 billion.

The main risk I see is some kind of damage to the brand. Ferrari cares about his reputation, but no brand is completely resistant.

It is also worth noting that the management sees a potential hit of 50 base points on the margins this year due to tariffs. On the other hand, Ferrari’s operational margin was 28.3% last year, so it has a lot of flexibility.

My movement

Regardless of whether we feel comfortable with it or not, the prosperous become richer around the world. And this is undoubtedly a very supportive trend for ultra-luxury brands such as Ferrari.

I already have a slightly enormous position in the entire ISA and SIPP. 16% decrease is not enormous enough to justify it is even greater.

But for investors who want to invest in a growing global wealth motif, I think Ferrari shares are still worth considering as a long -term farm.