Image source: Getty Images

Nvidia (Nasdaq: NVDA) It took some bruises in January, falling 13%at some point. However, it jumped and is now 3.4% higher in 2025. In five years there is no reliable 1 817%!

King Ai Chip is to spend earnings in the quarter of 2025 on February 26. Here I will take a look at the latest forecasts entering the results report.

Incredible growth

Because Chatgpt was published at the end of 2022, the quarterly results of Nvidia blew up Wall Street estimates.

The table below shows data on revenues and profits per share (EPS), as well as a surprise exceeding EPS expectations.

| Quarter* | Income | Surprise of revenues | EPS | EPS surprise |

|---|---|---|---|---|

| Q1 24 | USD 7.2 billion | 10.1% | $ 0.11 | 18% |

| Q2 24 | USD 13.5 billion | 20.7% | 0.27 USD | 29.7% |

| Q3 24 | USD 18.1 billion | 11.2% | USD 0.40 | 18.5% |

| Q4 24 | USD 22.1 billion | 8.4% | 0.52 USD | 12.3% |

| Q1 25 | USD 26 billion | 5.8% | USD 0.61 | 9.2% |

| Q2 25 | USD 30 billion | 4.4% | USD 0.68 | 5.4% |

| Q3 25 | USD 35.1 billion | 5.8% | USD 0.81 | 8.3% |

As we can see, Nvidia crushed estimates twice with numbers about a year ago. However, as the AI revolution has matured, and analysts have a better hug on the demand of tokens, surprises, which is understandable, fell into individual numbers.

Of course, this is still impressive and means that Nvidia beat estimates on both the upper and lower line every one quarter from the beginning of 2023 and during this period he added an amazing 2.8-TRNE market capitalization!

In the fourth quarter, Wall Street expects revenues of USD 38 billion and EPS in the amount of USD 0.84. This would constitute a unique augment of 72% and 64%.

These are the main numbers that investors should watch out for. Although the thing that will probably decide later the direction of the share price is guidelines for Q1 26. Investors will want to know that the demand for AI Chip will remain sturdy this year.

Currently, analysts forecast revenues of USD 41.7 billion and EPS 0.91 USD for the current quarter (Q1). If the company changes it up, the actions can jump higher and vice versa.

Target price

Broker’s share prices should always be taken a pinch of salt, especially when it comes to unstable stocks, such as NVIDIA. To say this, they can provide valuable insight into potential market differences.

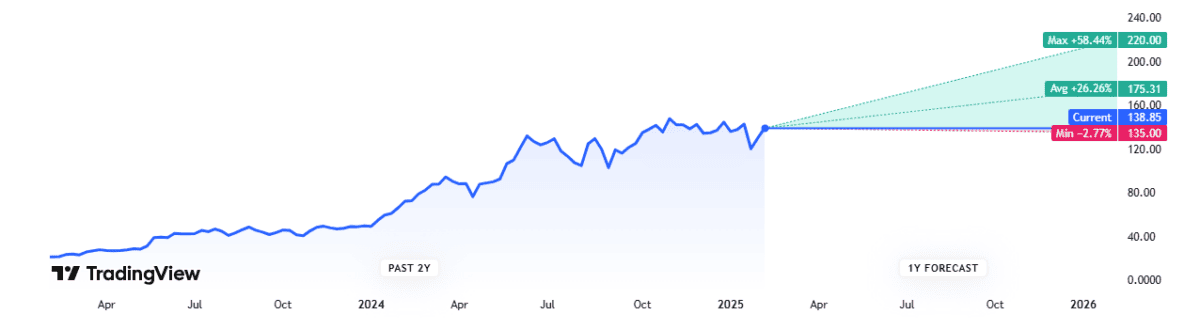

So what is the latest front for Nvidia? On the basis of 52 analysts covering the average 12-month-old target price is USD 175. This is about 26% higher than the current price of PLN 138.

Quotation

Finally we have a quote. Based on current FY26 estimates, the shares are approximately 31 times 31 times profit. This does not look too demanding, considering the rapid development of the company.

Combining this with a price of USD 175, a convincing matter can be considered that this is an augment in the purchase.

What could go wrong?

However, as IT specialist Stanford Roy Amara once said: “We usually overestimate the effect of technology in a short period and underestimate the impact in the long run. ”

In other words, transformational novel technologies rarely avoided early speculative bubbles throughout the history. The Internet was the most renowned example, although they were different.

In addition, about 36% of NVIDIA sales came from only three customers in the last quarter. If these clients reduce expenses for AI infrastructure after initial buildings, the chip manufacturer can immediately leisurely down the augment in revenues.

Considering this medium -term uncertainty, I do not intend to buy shares at today’s price.