ASX: Westpac Banking Corporation – WBC Elliott Wave Technical Analysis Tradingglnge.

Regards,

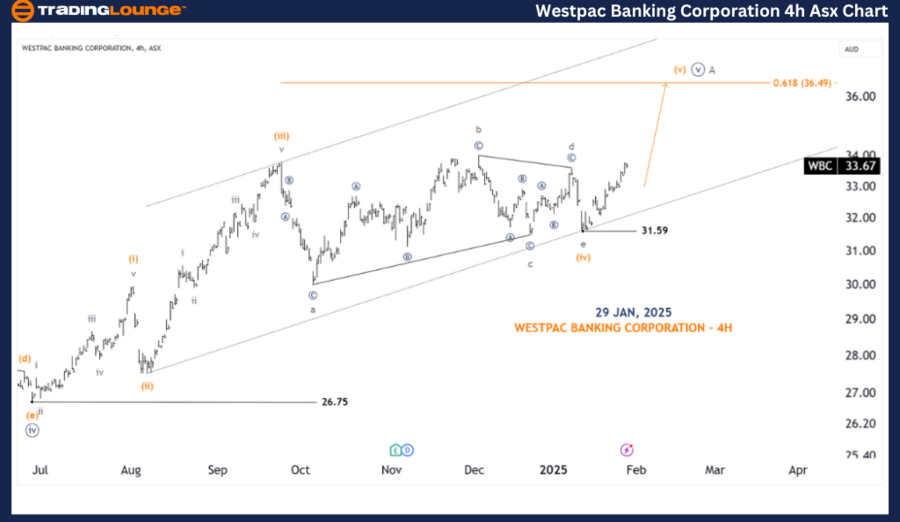

Today’s analysis of Elliott Wave provides an updated perspective of the Australian Securities Exchange (ASX) focusing on Westpac Banking Corporation (WBC).

Our analysis indicates that ASX: WBC could finish the triangle pattern by suggesting upward movement. This assessment also emphasizes the key price levels that facilitate traders determine whether this scenario remains essential when it is annulled, and when the tendency of stubborn confirmation occurs.

WBC (chart 1D, semiconductor scale)

-

Function: Main trend (Diploma Minut, Navy).

-

Mode: Theme.

-

Structure: Impulse.

-

Position: Wave (V) – orange wave ((V)) – Navy.

Details:

Our analysis identifies the triangle pattern, and the fourth wave has recently ended at a low level of 31.59. This configuration follows the wave (V) – orange, which began in the direction of up. It is expected that the target price will reach about 36.49 or as high as the upper edge of the channel.

For this scenario to remain valid, the price must remain above 31.59.

WBC (4-hour chart)

-

Function: The main trend (compact, gray).

-

Mode: Theme.

-

Structure: Impulse.

-

Position: Wave (V) – orange.

Details:

It seems that creating a triangle has ended and the price exceeds the end of the wave D – Gray. In the compact period, the price is expected to go towards the nearest goal with a ratio of 0.618 Fibonacci Wave (V) to the wave (I).

Application:

Our Wave Elliott analysis for ASX: Westpac Banking Corporation – WBC provides key information on current market trends, helping traders make conscious decisions. By identifying critical price levels that confirm or annul our number of waves, we enhance confidence in our forecast.

By integrating these technical factors, we provide a professional and objective prospect of market trends, equipping traders with useful insight into effective decision making.

Technical analyst:

Hua (Shane) CUONG, CEWA-M (Master’s designation).