This article is also available in Spanish.

Bitcoin (BTC) whales appear to be offloading some of their holdings ahead of the hotly contested 2024 US presidential election.

2% drop in BTC stored at whale addresses

In post at

According to the analyst, there was a 2% decline in the number of wallet addresses containing 1,000 or more BTC.

It is worth noting that since May, the number of Bitcoin whales was at its highest in mid-October, when Republican presidential candidate Donald Trump was the clear favorite to win.

At the time of writing, decentralized forecast markets platform Polymarket gives Trump has a 62.7% chance of winning, while Democratic candidate Kamala Harris has a 37.4% chance of becoming the next US president.

Bitcoin whales selling some of their BTC holdings as Americans prepare to vote could indicate a cautious approach, perhaps to mitigate potential election-related price volatility.

Bitcoin whales expect price volatility?

The sell-off may suggest that Bitcoin whales anticipate a tighter regulatory environment for digital assets after the election. These concerns cannot be unfounded, as the Biden administration has faced accusations of adopting a hostile stance towards the digital assets industry.

On the contrary, Trump repeatedly promised during his election campaign that he would make the US the “crypto capital of the world.”

In addition to the whale selloff, long-term BTC holders appear to be dumping their holdings. According to recent analysisover the last seven days, long-term holders have sold over 177,000 BTC.

Another scenario worth considering is that any further decline in whale addresses’ BTC holdings without a corresponding drop in price could indicate that retail investors are increasing their desire to purchase the digital asset.

It is worth noting that the demand for Bitcoin among retail investors has shown a steady upward trend since September 2024. According to a recent study reportretail demand for BTC increased by 13% last month, reflecting a shift in market risk appetite from risk-off to risk-on.

Martinez also turned his attention to BTC sequential TD on the 12-hour chart and how the buy signal flashes.

For the uninitiated, TD sequential is a technical analysis indicator used to identify potential price exhaustion points and trend reversals in financial markets.

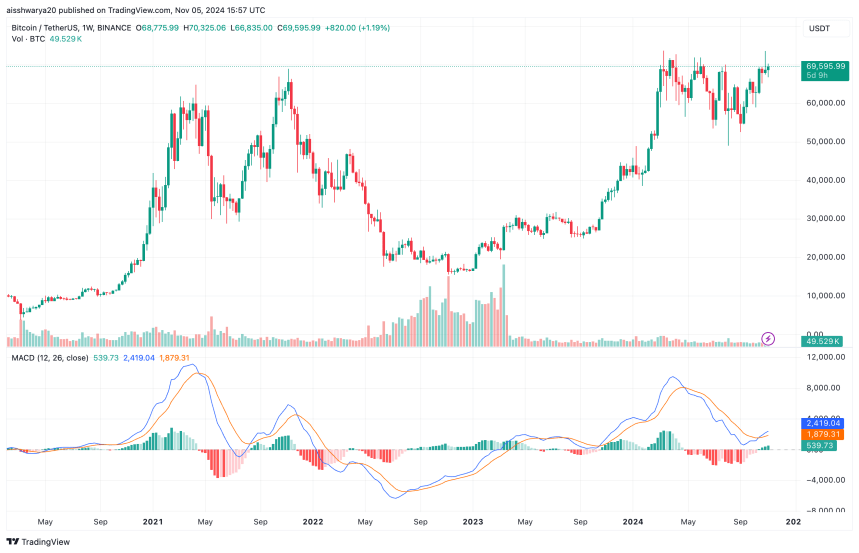

That said, a Trump victory may not be the cure for Bitcoin’s falling price as it is critical for the largest digital asset to maintain its support level of $68,000 to avoid a drop to $63,000. At press time, BTC is trading at $69,595, up 1.3% over the last 24 hours.

Featured image from Unsplash, Charts from X and Tradingview.com