This article is also available in Spanish.

Less than a day before polls closed in the United States, cryptocurrency analysts continued to put in their two cents on the future of Bitcoin and cryptocurrencies.

For example, many Wall Street analysts say that BTC’s wild market prices will continue after the election. Other analysts and observers have shared their price predictions based on who will win next Tuesday.

It is designed by Gautam Chhugani of Berstein Group Bitcoin it could augment to $80,000 or even $90,000 if Republican Donald Trump wins the election. If Kamala Harris wins the polls, Chhugani expects the BTC price to drop to $50,000.

But Bernstein didn’t stop predicting Bitcoin immediately after choice; the group remains bullish on Bitcoin in the brief term and expects the digital asset to reach $200,000 by 2025.

According to Bernstein analysts, other key factors influencing Bitcoin’s price are growing demand for spot BTC ETFs and rising US debt.

Bernstein adjusts BTC price forecasts: 50 thousand dollars for Harris, 80-90 thousand. dollars for Trump

Bernstein analysts have revised their Bitcoin price estimates based on the potential results of the upcoming US elections. If Harris wins, they predict Bitcoin will drop to around $50,000 while… pic.twitter.com/Z1zJ21aJ48

— Wolf of all streets (@scottmelker) November 4, 2024

Bernstein’s Bullish Outlook for Bitcoin Next Year

Analysts at Bernstein are betting on Bitcoin and expect its price to reach $200,000 by the end of next year, regardless of the election results. Gautam Chhugani made this bold prediction a few days before the Americans’ election visit and added that the results would not affect the long-term prospects for this asset.

The analyst’s bullish project on Bitcoin is based on several factors. He even compared the stock to a “genie in the bottle” and said it was challenging to stop its price trajectory.

Chhugani identified several factors that could impact the asset price, including increased interest rates on BTC ETFs and higher government debt. Last month, Bernstein’s chief analyst targeted $100,000 worth of Bitcoin. dollars, but soon revised its forecasts to reflect changes in market trends.

Irregular BTC price action ahead of elections

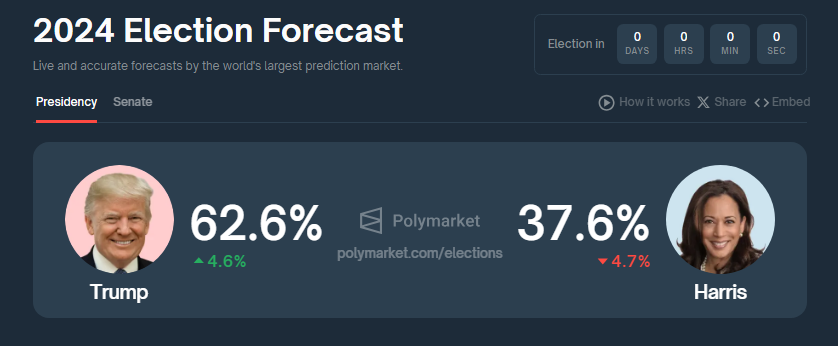

This year’s election battle between Trump and Harris is one of the most discussed and anticipated. In addition to established polls, data from betting markets such as Polymarket have also gained fame.

For example at Polymarket Trump remains the favoritebeating 63% of all bets, with Harris winning 38%. Bernstein analysts say that regardless of performance, the asset will experience short-term price movements.

However, they expect BTC to benefit more from Trump’s victory. The same Bernstein analysis shows that Bitcoin could surge to $90,000 if the Republican wins.

Currently, the price of Bitcoin has dropped from 69,000. dollars to 68 thousand dollars due to profit-taking. Analysts also noted delicate inflows into ETF funds this week. Most analysts agree that Bitcoin is still poised for growth at the end of the year.

US election results may impact other digital properties

The US elections affect other digital assets apart from Bitcoin. For example, under Harris’ presidency, Ether stands to benefit from tighter regulations that could limit the performance of competitors like Solana.

However, Chhuhani has a different view, arguing that if the SEC adopts moderate policies, it could fuel Bitcoin and other assets.

This year’s election cycle puts cryptocurrencies and blockchain at the center of debates. Both candidates shared their thoughts on cryptocurrencies, and Trump offered more cryptocurrency-friendly solutions.

Harris, a Democrat, was initially reluctant to offer policy proposals, but as the campaign progressed she changed her tone.

Featured image from Invezz, chart from TradingView