This article is also available in Spanish.

Solana continues to prove that it is one of the best blockchains in this cycle. After surging 35% over the past 60 days, the popular Layer 1 blockchain is back in the news with more on-chain activity.

According to the latest data, Solana’s DeFi Total Value Locked, or TVL, grew to $5.7 billion in the third quarter, a 26% improvement over the previous quarter.

Crypto lending company Kamino leads the pack with $1.5 billion in TVL and an impressive 7% quarter-over-quarter growth thanks to the additions of jupSOL and PYUSD. The latest data also suggests that Solana’s market cap is now $3.8 billion, a 23% improvement, boosted by PayPal’s PYUSD integration.

DeFI continues to fuel Solana’s growth

Solana DeFi leads the network’s activity with $5.7 billion in total value locked. SOL’s latest data reflects a solid 26% quarter-on-quarter growth, making the blockchain the third largest in this metric, overtaking Tron.

In Messari’s report, Solana’s TVL increased as a result of increased activity for Kamino, which accounted for $1.5 billion of total blocked contracts. Kamino’s latest quarterly numbers represent growth of 57% thanks to the recent integration of jupSOL and PYUSD.

In addition to Kamino Finance, Solana’s blockchain included $1.1 billion worth of locked assets in Raydium and $749 million in Jupiter. Kamino Finance’s impressive performance is linked to the launch of Kamino Lend V2, which offers a treasury and permissionless marketplace layer.

Analysts expect Kamino Finance to maintain its dominance by adding up-to-date projects such as Spot Leverage and Lending Orderbook.

Solana DEX shows signs of slowing down

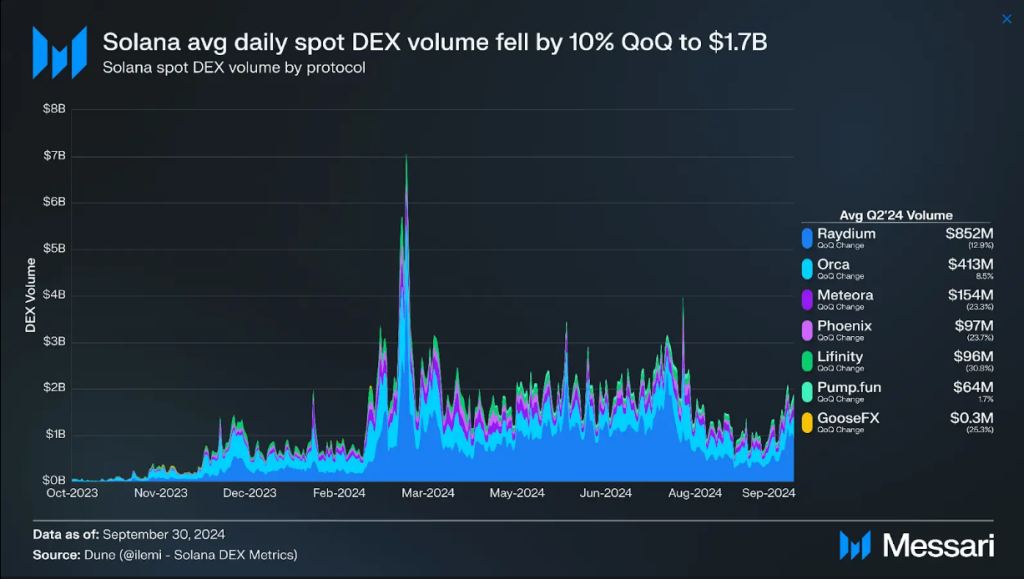

Solana’s DEX activity was down 10% quarter-over-quarter, but had recovered slightly through October. The average daily volume on the blockchain exchange reached $1.7 billion, mainly due to the decline in meme coin prices.

Raydium maintains its dominance on Solana’s DEX, with 51% market share, although its average daily volume dropped 13% to $852 million. Volume increased by $350 million with the release of Moonshot, a mobile cryptocurrency trading app.

Jupiter also remained on top, capturing 43% of total spot volume. The platform has been helped by recent developments including the release of Jupiter Mobile and the integration of Google Pay and Apple Pay.

SOL stablecoins get facilitate from PYUSD

In the same report by Messari, PayPal’s PYUSD lifts the SOL stablecoin market. The PYUSD index was launched in May at Solana, which largely contributed to the boost in the company’s market capitalization, which currently stands at $3.8 billion. With stimulating features like programmable transfers and transfer hooks, PayPal’s PYUSD became instantly popular.

In addition to PYUSD, USDC also contributes to the Solana stablecoin market. Circle’s Web 3.0 services integration for SOL provides enterprise features such as fee sponsorship and programmable wallets, enabling developers to quickly integrate multi-chain solutions.

Featured image from StormGain, chart from TradingView