Bitcoin is marching higher, exceeding $70,000 and $72,000 in the last two days, triggering a wave of demand. Although prices are moving in a narrow spot price range, the upward trend remains. While there are areas of weakness, at least seen earlier today, candlestick patterns on the daily and weekly charts indicate strength.

Is Bitcoin getting ready to jump sixfold to $462,000?

In the post on X, one of the analysts thinks Not only will Bitcoin break its all-time high of $74,000, but it could easily jump 6x to over $462,000 in the coming sessions. To confirm this outlook, the analyst stated that the coin is breaking above key resistance levels and the Fibonacci extension levels are reflecting this trend change after the decline in Q3 2024.

Based on analyst assessment, historical price action shows that BTC is peaking between the Fibonacci extension levels of 1.618 and 2.272. Technical analysts exploit this tool to predict how quickly prices will rise or fall based on a given range.

If historical guides and Fibonacci extension levels remain current, applying the same pattern to the current cycle could easily push Bitcoin upwards to between $174,000 and $462,000. These two levels mark the lower and upper limits of the expansion levels that define the peak zone of previous cycles.

No matter how hopeful this forecast is, it is essential to know that the anchoring range of any Fibonacci extension is subjective. Because of this, it will vary from analyst to analyst, meaning the potential highs will shift accordingly.

Regardless, the consensus is that Bitcoin could break out and hit recent all-time highs in Q4 2024. Moving on to X, another analyst stated that Bitcoin is already in a bullish breakout pattern, easing above a descending channel or bull flag . At the same time, prices are breaking through the resistance of the “cup and handle” formation.

Institutions are buying as BTC recovers

If the bulls take control, sending prices higher, the evolution will confirm the gains of Q1 2024. This would then mean a resumption of bullish trends, which would be an encouraging development after a 30% drop from March highs.

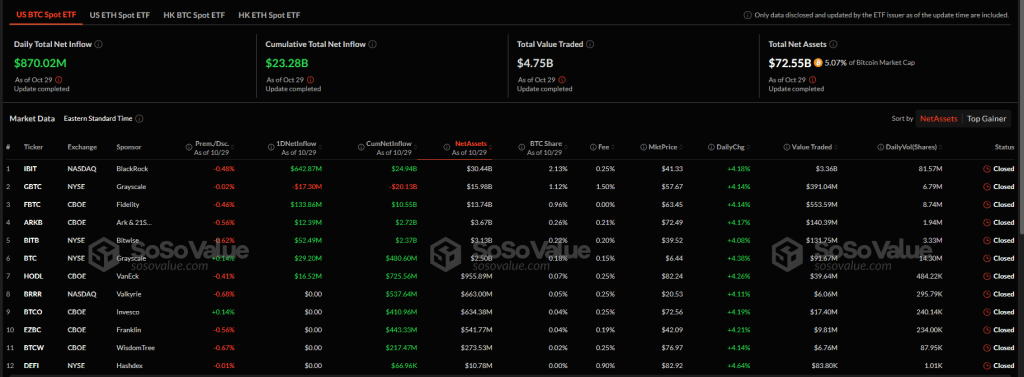

Amid this wave of optimism, institutions are also pouring in, gaining exposure through spot Bitcoin ETFs. According to Soso valuethe inflow of funds is huge as institutions buy more shares on behalf of their clients.

On October 29, issuers of spot Bitcoin ETFs in the United States purchased $870 million worth of BTC-backed shares for their clients. IBIT BlackRock received $642 million, increasing its BTC under management to over $24.9 billion.