This article is also available in Spanish.

The recent surge in attractiveness of Bitcoin Exchange spot funds in the United States has temporarily ceased.

On Tuesday, those funds reversed, as a result net outflows of $79.01 millionafter an extraordinary seven-day streak of positive inflows. The source of this data is Farside Investors, a company specializing in the analysis of ETF flows.

A tiny obstacle

The outflow of $79 million represents a significant change in sentiment among investors who previously showed great interest in investing Bitcoin ETFs. Last week, around $1 billion flowed into the market in two days, which means there is robust demand for these financial products.

The main cause of this negative change was 21Shared’s Ark and ARKB, which resulted in a significant outflow of $134.7 million.

BlackRock’s IBIT, the best-performing bitcoin ETF by net assets, attracted $43 million. Fidelity’s FBTC and VanEck’s HODL also helped, receiving $8.8 million and $3.8 million, respectively. There were no recent flows on the remaining eight funds during the day, including Grayscale’s GBTC.

Nevertheless, Bitcoin ETFs could bring in more than $21 billion to date. This number clearly represents the growing utilize of Bitcoin as a recent asset class and only means that more hedge funds will take larger positions.

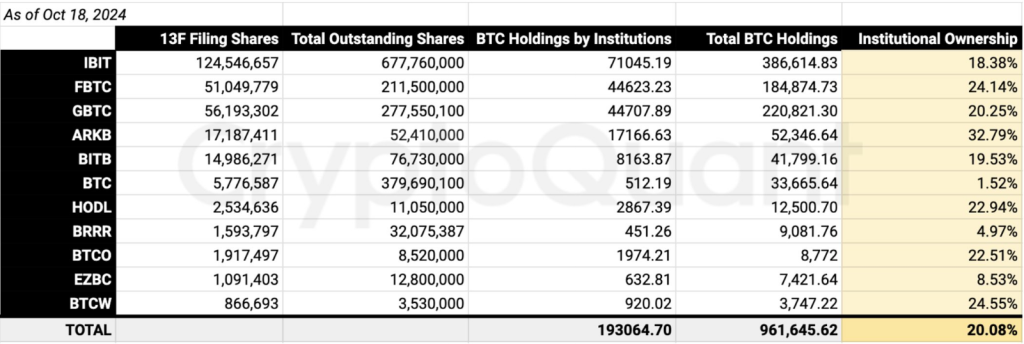

US-listed Bitcoin spot ETFs have also attracted great interest from institutional investors – as of October 22, they accounted for 20% of the market.

US Institutional Ownership #Bitcoin Spot ETFs account for approximately 20%, and asset managers hold 193,000. BTC (as reported on Form 13F). pic.twitter.com/9YTOEH3G5w

— Ki Young Ju (@ki_young_ju) October 22, 2024

Institutional demand remains robust

Regardless, while recent ETF flow fluctuations have been significant in their own right, they cannot distract from the continued push for institutional adoption of Bitcoin. Major companies that have made enormous investments in these funds include Goldman Sachs and Millennium Management.

The SEC’s approval of options trading on 11 Bitcoin ETFs will aid investors manage their exposure to Bitcoin, boosting interest.

By hedging positions more effectively, made possible by options trading, investors can aid stabilize the market and reduce volatility over time. Analysts say this would attract more institutional money to the industry, thus supporting Bitcoin’s reputation as a reliable investment tool.

Bitcoin ETF: Looking to the future

While outflows may be a concern, many analysts are positive about Bitcoin ETFs. The SEC’s approval of options trading is a turning point that could improve market efficiency and liquidity.

More institutional players entering this space will likely change the dynamics. The current interruption in inflows may only be a short-lived phenomenon; investors reposition their strategies due to changes in market conditions.

The outlook for Bitcoin cash ETFs, looking from a longer-term perspective, seems quite positive, given the current surge in adoption from the institutional space and Bitcoin trading at or near three-month highs.

Recent outflows from spot Bitcoin ETFs may indicate a short-lived setback; however, the prevailing trend of increased institutional interest and regulatory support indicates that this asset class is here to stay. Investors will be closely monitoring the rapid evolution of this market for recent developments.

Featured image from The Rio Times, chart from TradingView