This article is also available in Spanish.

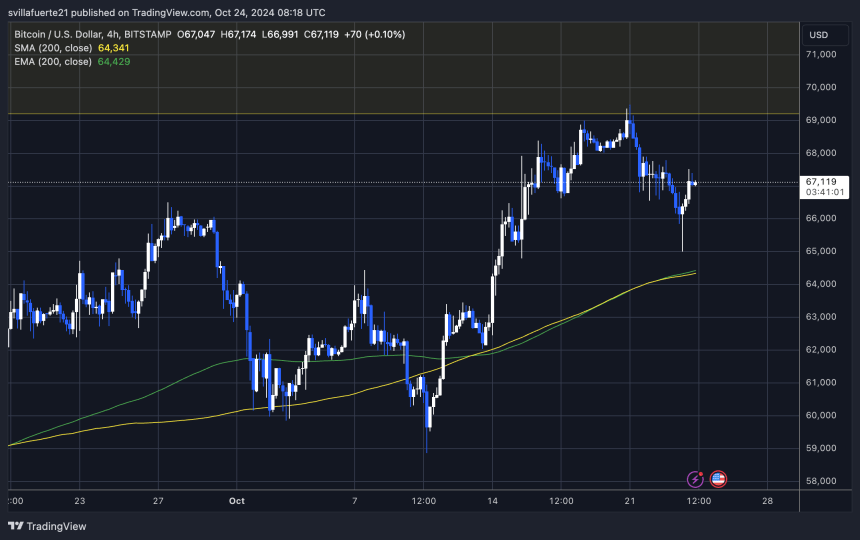

Bitcoin rebounded strongly from the $65,000 level after a 6% decline from Monday’s high of around $69,500. Despite the recent pullback, BTC remains in an uptrend that has continued since early September. This rebound shows resilience, helping to maintain the bullish market structure.

Key data from CryptoQuant shows that the average funding rate has been rising steadily since September, indicating that bullish sentiment is increasing as more traders become actively engaged in the market.

The next two weeks will be crucial for Bitcoin as it nears its March high. Investors and analysts are closely watching price movements as BTC gains momentum towards breaking key resistance levels.

If the uptrend continues, Bitcoin could be poised for another significant rally, with the potential to quickly set modern highs. However, failure to maintain current levels could result in renewed volatility.

Bitcoin shows strength

Despite the recent decline, Bitcoin remains robust above key demand levels, maintaining an overall bullish structure. Analysts and investors are closely monitoring the price action to confirm that the current phase is simply bullish consolidation before another rally.

CryptoQuant analyst Axel Adler shared data on Xhighlighting the BTC futures perpetual funding rate, which has shown steady growth since Bitcoin reached $60,000. This indicates an increasing number of bulls entering the market, and optimism increases as the price increases.

Adler suggested that the bullish momentum is likely to continue as long as the funding rate continues to rise, confirming that BTC is in a fit consolidation phase. However, this does not guarantee an immediate breakout. There is still a significant chance that Bitcoin could trade sideways in the next few days. Sideways price movements can be crucial to building liquidity, allowing the market to muster the strength to move more.

While market sentiment remains sanguine, especially as bullish activity continues to boost, investors should prepare for potential volatility. The next gigantic price action could go in either direction, but consistent support above key levels is a positive indicator for those betting on Bitcoin’s price continuing to rise.

BTC Holds Above Key Demand

Bitcoin remains firmly above the $66,000 level after finding support near $65,000. Currently trading at $67,100, it appears that the market is in a consolidation phase and it may take some time to break above the key $70,000 level.

For bulls to maintain momentum, it is crucial for the price to hold above $65,000 or find support around $64,300, where both the 4-hour exponential moving average (EMA) and moving average (MA) are converging.

If Bitcoin fails to maintain these support levels, a deeper correction can be expected, with the price potentially returning to lower demand zones around $60,000. On the other hand, if BTC manages to break and sustain above $70,000 in the coming days, it could trigger a robust rally towards challenging all-time highs.

As investors closely monitor key support and resistance levels, the next few days will be crucial in determining Bitcoin’s direction.

Featured image from Dall-E, chart from TradingView