This article is also available in Spanish.

The latest weekly digital asset fund flow report of CoinShares revealed that crypto asset investment products saw net inflows of around $2.2 billion globally last week, marking the largest inflow since July.

This raise in inflows follows a gradual recovery in major crypto assets over the past week, with most of them now rebounding from major highs and posting near double-digit gains over the past 7 days.

Who led the charge?

Bitcoin-based products were the main beneficiaries of last week’s inflows. US Bitcoin spot funds (ETFs) added $2.1 billion, with BlackRock’s IBIT ETF alone generating over $1.1 billion.

The cumulative impact for these Bitcoin ETFs, which began trading in January, is now $21 billion. These funds have grown to manage a record $66 billion in assets, underscoring their significant role in the market.

It is worth noting that the renewed confidence in Bitcoin products reflects the positive sentiment from earlier this year. Last week’s inflow was the largest since March, when U.S. Bitcoin spot ETFs surged to $2.6 billion and Bitcoin hit its all-time high above a price of $73,000.

This sturdy demand suggests that investors remain positive about Bitcoin’s long-term prospects, despite recent market volatility. While Bitcoin took center stage, other cryptocurrencies also saw inflows last week, although much smaller than BTC.

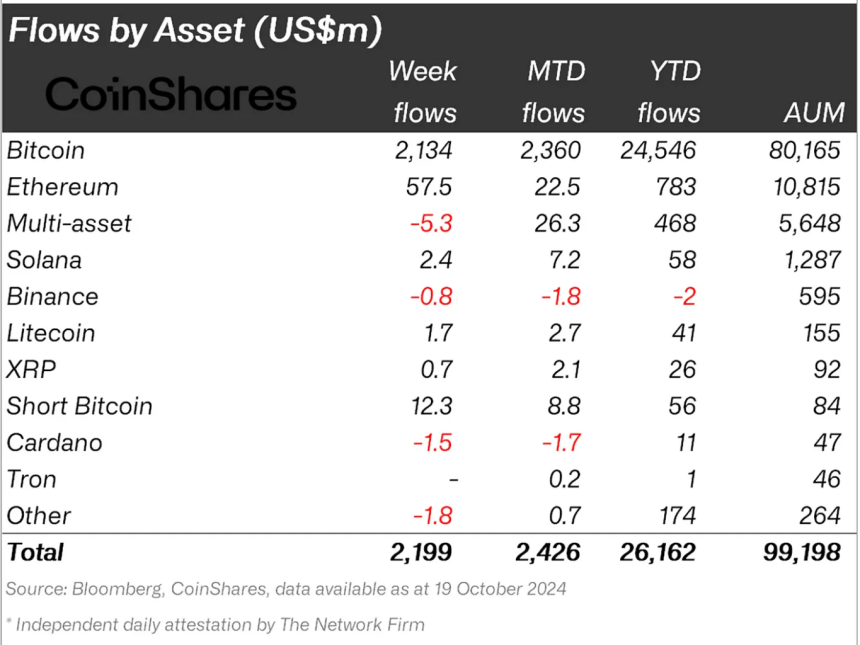

Ethereum-based products attracted net inflows of $58 million, while Solana, Litecoin and XRP funds saw smaller inflows of $2.4 million, $1.7 million and $700,000, respectively.

However, multi-asset investment products did not perform well, recording a net outflow of $5.3 million, ending a 17-week streak of consecutive inflows.

What caused the rapid inflow of cryptocurrencies?

According to CoinShares, this raise in inflows is linked to growing optimism about the upcoming US elections, with a potential Republican victory improving investor sentiment.

Many believe that a Republican administration would support the digital asset market more favorably, which would lead to increased investor confidence and positive price dynamics. James Butterfill, Director of Research at CoinShares, specifically noted:

We believe this renewed optimism is due to rising expectations for Republican victory in the upcoming US elections as they are generally seen as more supportive of digital assets.

Notably, Butterfill reiterated this view, adding that trading volume in these investment products increased by 30% last week. The total assets under management (AUM) of cryptocurrency funds are now approaching $100 billion globally, underscoring the sturdy interest in digital assets.

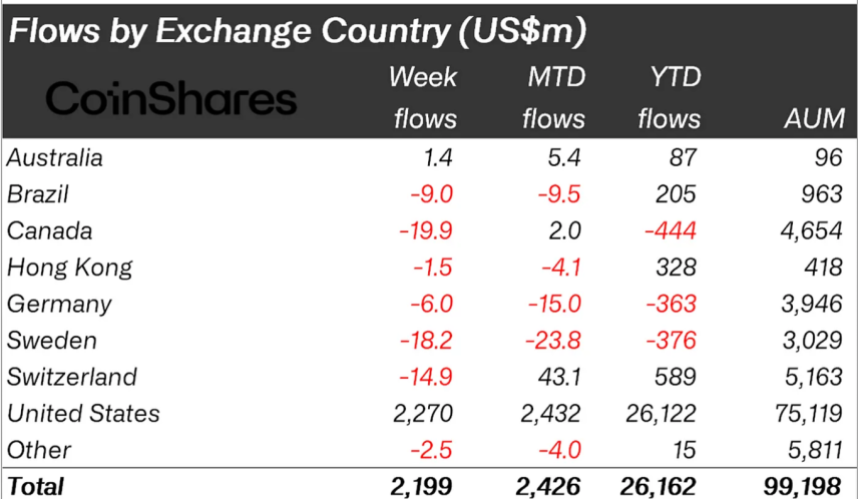

However, while U.S.-based funds have thrived, investment products in other countries such as Canada, Sweden and Switzerland have experienced net outflows, pointing to a more polarized global market.

Featured image created with DALL-E, chart from TradingView