This article is also available in Spanish.

Like Bitcoin, Ethereum and other top altcoins, Solana remains under enormous selling pressure. As bulls struggle for momentum, $160 is emerging as a local resistance level that investors should watch out for.

Despite the growth dynamics in September, Solana buyers did not raise prices above this line. At press time, there is a local double top, even according to one of X’s analysts notes that Solana has outperformed other platforms with a surge in net inflows.

Solana received more than $800 million in net inflows in three months

Unlike Ethereum, Solana is a state-of-the-art blockchain with relatively high scalability. The platform can process thousands of transactions per second, which translates into low fees, which is why more and more projects decide to run online so that it does not affect the user experience. The events of the last three months related to the inflow of capital to Solana consolidate this position.

By comparison, Solana reported net flows of more than $800 million. This capital injection is more than twice the size of OP Mainnet, Ethereum-2 layer, received and much more than what Sui, another scalable blockchain, has published in the last three months. This is also more than what Base and Starknet – two popular Ethereum layer 2s – posted, and exceeds what Avalanche and BNB Chain received.

Interestingly, during this period Arbitrum, layer 2 of Ethereum and the largest of them all, Linea, Blast and Bitcoin, saw outflows. Despite being the largest shrewd contract platform, Ethereum has seen massive outflows of almost $800 million.

Time will tell what could have triggered the outflow in Ethereum while encouraging capital for Solana. While on-chain fee differences may matter, the continued ETH airdrop in Q3 2024 could have resulted in an outflow. At spot rates, ETH is down 35% from Q3 2024 highs, while Solana is down just 25% from July highs, when it rose to around $192 before falling.

Will SOL break $160?

Even as Solana attracts capital, the coin remains under intense selling pressure. For the upward trend observed in the second half of 2023 to continue, the local line at $160 should be broken. Continued gains will push Solana all the way to $190 and likely break out of its current range.

However, there may be headwinds. If Bitcoin fails to recover, it could drag down altcoin markets, including Solana. At the same time, there are concerns that the upcoming FTX token distribution will have a negative impact on SOL prices.

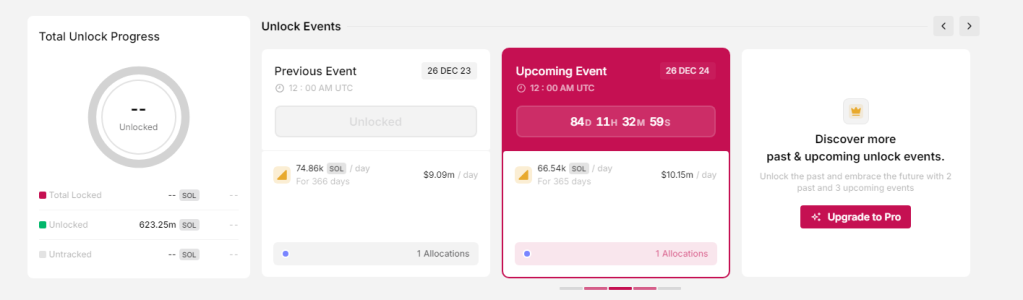

Moreover, according to The token unlocksthe team plans to release tokens on December 26, 2024. Over 66,000 SOL will be released daily for a year.

Feature image from DALLE, chart from TradingView