This article is also available in Spanish.

Several indicators point to renewed altcoin strength, suggesting a potential altcoin season on the horizon. However, to confirm, Bitcoin’s (BTC) dominance has yet to decline.

Altcoin market cap is above the 200-day EMA

Cryptocurrency analysts closely monitor various indicators that track the performance of altcoins, with one of the key indicators being the 200-day exponential moving average (EMA).

According to the chart below, the OTHERS Index – an index tracking cryptocurrency market capitalization excluding the top 10 digital assets by market capitalization – has exceeded both the 100-day and 200-day EMAs.

For the uninitiated, the 200-day EMA is a commonly used technical indicator that shows the average price of an asset over the last 200 days, with more weight given to recent prices. It is used to identify long-term trends – when the price is above the 200-day EMA, it suggests that the asset may be in an uptrend, while being below it signals a potential downtrend.

Currently, the OTHERS index is at $227.5 billion, while the 200-day EMA and 100-day EMA are at $221.8 billion and $212.9 billion, respectively. According to for cryptocurrency analyst Caleb Franzen, the last time this happened was in July 2023. At that time, altcoins established forceful support on these EMAs to reach higher highs.

Another cryptocurrency analyst, Ali Martinez, alluded to to altcoin market capitalization – excluding BTC and Ethereum (ETH) – breaking what appears to be a long downward trend. Though Martinez isn’t entirely convinced about the full-fledged one altcoins season, calls this breakout “a good start.”

Bitcoin’s dominance must collapse before the alt season

While altcoin market capitalization snapped out of a sustained downtrend raises hopes for the upcoming alt season, BTC’s (BTC.D) dominance is set to decline significantly from current levels.

Currently, Bitcoin’s dominance is 57.5%. From the chart below, it is clear that BTC.D has been on a sustained upward trajectory since at least November 2022. According to for cryptocurrency analyst Yoddha, BTC.D looks on the verge of a mid-40s crash, potentially paving the way for full-blown economic growth alternative season.

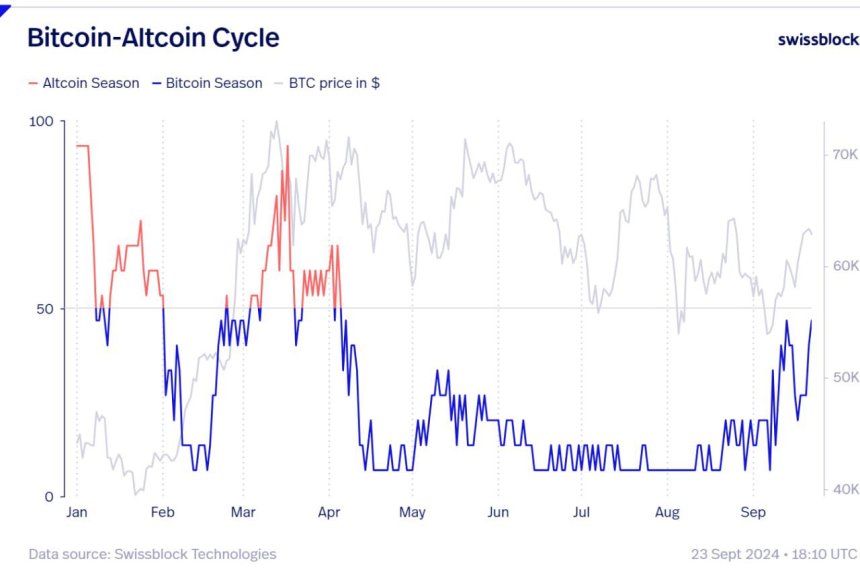

Negentropic, co-founder of on-chain data platform Glassnode, he noticed that the market seems to be on the cusp of altcoin season. Referring to the Bitcoin-Altcoin cycle chart from Swissblock, Negentropic notes that once BTC breaks through its all-time high (ATH) and enters price discovery mode, the altcoin should follow suit.

The Bitcoin-Altcoin cycle chart shows the inverse relationship between BTC and altcoin price changes throughout the year. Any reading above 50 indicates that the market has entered an altcoin-dominated phase, while a reading below 50 signals a BTC-led market.

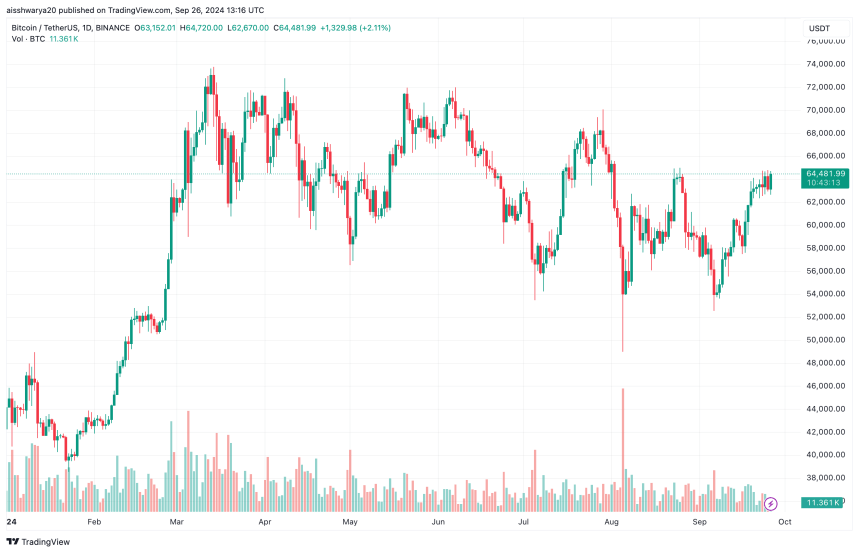

Despite these promising indicators, it is vital for the leading altcoin, ETH, to rebound against BTC before capital flows into mid- and small-cap altcoins. As previously reported, the ETH/BTC trading pair is currently trading at its level lowest as of April 2021. At press time, BTC is trading at $64,481, up 1.5% in the last 24 hours.

Featured image from Unsplash, charts from Swissblock Technologies and Tradingview.com