The data shows that the cryptocurrency sector as a whole has seen a high number of liquidations due to the volatility that Bitcoin and other cryptocurrencies have been going through.

Bitcoin regains above $63,000

Following reports of the US Federal Reserve cutting interest rates, Bitcoin responded positively and its price exceeded the $63,000 level.

The chart below shows how the asset has performed recently.

The chart shows that after a 5 percent gain in the last 24 hours, the cryptocurrency is already close to reaching its highest level seen in August.

As is usually the case, the rest of the digital asset sector has also seen growth as Bitcoin’s recent rally has taken hold. Some altcoins like Solana (SOL) and Avalanche (AVAX) have even managed to significantly outperform the number one coin.

The consequence of high market volatility was chaos on the derivatives market.

Crypto derivatives market sees $201 million in liquidations today

According to data from Coin glassthe crypto derivatives market has seen a enormous number of liquidations in the last 24 hours. “Liquidation” here refers to the forced closure that any open contract is subject to after accumulating a certain percentage of loss.

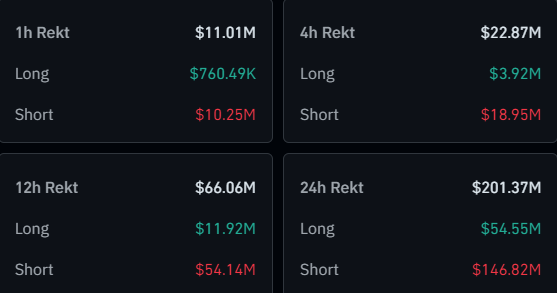

Below is a table showing liquidation data for the sector over the past day:

As shown above, the cryptocurrency market as a whole saw over $201 million in liquidations in the last 24 hours. Of that, around $147 million in fluctuations were in miniature contracts.

This means that short-term investors were responsible for almost three-quarters of the total liquidations. This is natural, as Bitcoin and other assets have seen significant growth during this period.

A mass liquidation event like today’s is popularly known as a “squeeze.” Since the recent squeeze was mostly miniature positions, it is called a miniature squeeze.

Events like these are not particularly uncommon in cryptocurrencies, as most coins can be volatile and speculation is usually quite lively. Compounded by the fact that many speculators are not afraid to touch leverage, enormous liquidations can easily occur.

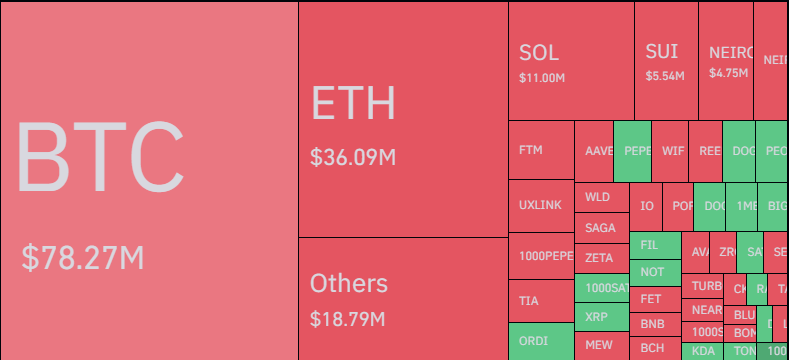

As for what the recent decline in the share of individual symbols looked like, the heat map below shows it.

As is the norm, Bitcoin topped the charts with $78 million in liquidations, more than double the $36 million of Ethereum in second place. Solana saw the most liquidations of the others, at $11 million.