The analyst explained that the worst may be behind bitcoin, and the fourth quarter could see a return to growth momentum if history is a good indicator.

The third quarter was historically the worst period for bitcoin investors

In the novel fasting in X, Capriole Investments founder Charles Edwards spoke about how investors are getting through the worst of times for Bitcoin. Below is a table cited by the analyst that shows the quarterly returns the cryptocurrency has seen throughout its history.

As you can see, the third quarter of the year was overall the worst period for Bitcoin on record, with average monthly returns of +5% and a median of -4%

By comparison, the second worst quarter is usually Q2, but its average and median returns of +27% and +7% respectively are still significantly better than Q3.

On the other side of the spectrum is Q4, the next quarter of this year. Bitcoin had its best periods this quarter, with average and median returns of +89% and +57%, respectively.

“If you’re still here, congratulations. You’ve made it through the worst of times for Bitcoin,” Edwards says in a post about BTC traders. “The best is yet to come.”

Last year, the cryptocurrency enjoyed growth of almost 57% during this period. With Q3 quickly coming to an end, the question remains how the BTC price will fare in Q4 this time around.

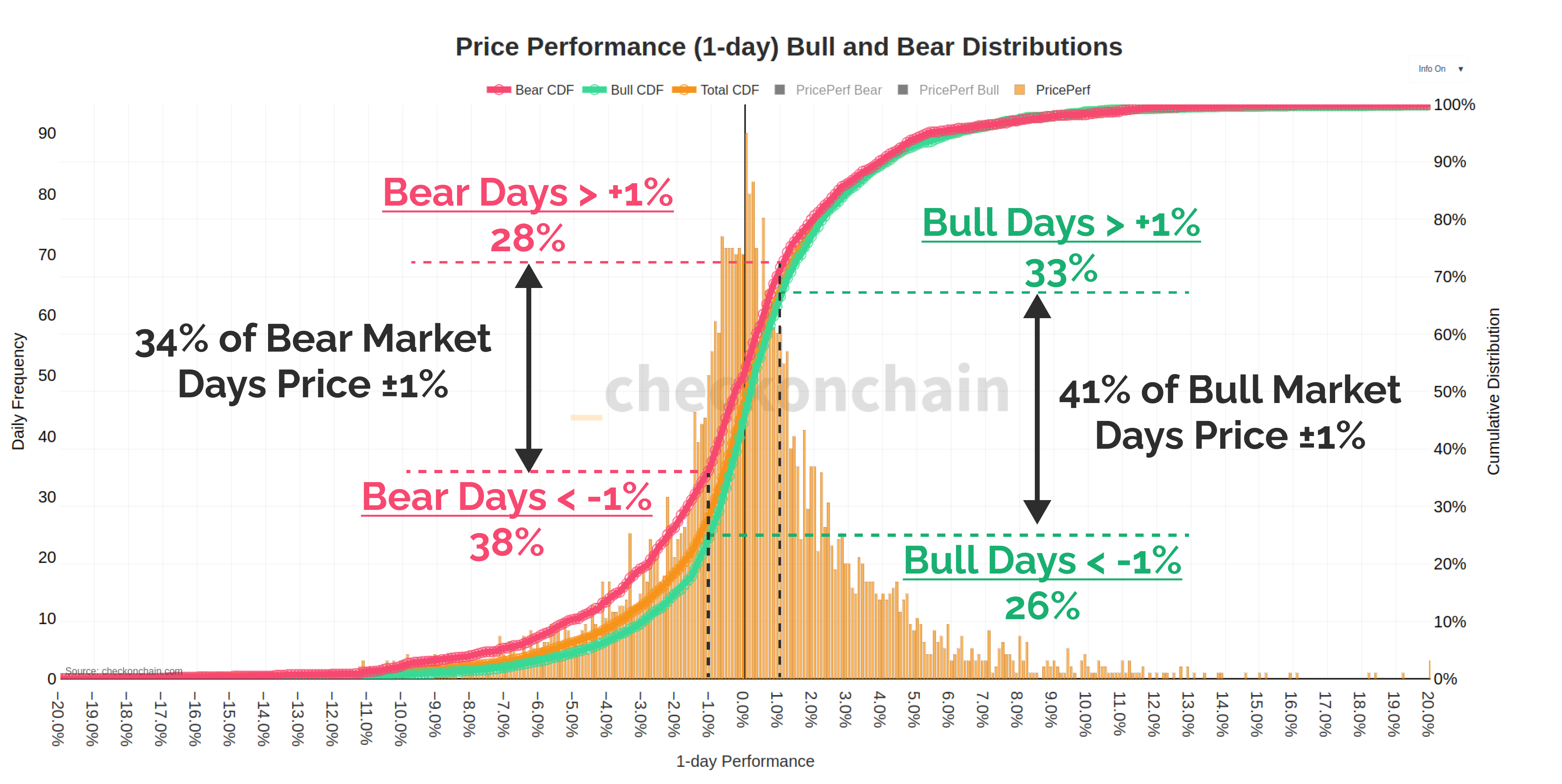

Speaking of historical patterns, on-chain analyst Checkmate discussed what the daily price distribution looked like in bull and bear markets in post X.

Here is a chart provided by the analyst:

As shown in the chart above, on about 28% of bear market days, the asset trended higher than +1%, while on about 38% of days, it fell by more than -1%. On the remaining 34% of days, the cryptocurrency stayed within a range of +1% to -1% from the previous day.

During periods of growth, Bitcoin was up more than +1% on 33% of days, while it was down more than -1% on 26% of days. The asset was in consolidation for the remaining 41%.

The symmetry between the three types of days is fascinating, but what is most striking is that the distributions are almost the same between bull and bear markets.

“Day traders are trying to beat a three-sided coin where one-third of the days are up, one-third are sold off, and one-third are doing nothing,” Checkmate notes.

BTC price

Bitcoin has shown a sudden bullish impulse in the last 24 hours, with its price rising by over 5% to reach $60,900.