quantum69

Fundstrat’s Tom Lee said the U.S. stock market could find further gains thanks to interest rate cuts by the Federal Reserve and Nvidia (NASDAQ: NVDA) financial update that highlights the solid fundamentals of AI investing.

Lee, head of research at Fundstrat Global Advisors, appeared on CNBC on Thursday, the day after Minutes from the Federal Reserve’s July meeting indicated that “several” policymakers were ready to start cutting interest rates in September. Investors also received downward revision to federal job growth estimates in the 12 months to March.

“The amendments that have just been published show that many jobs have disappeared. It is not as strong [jobs] market and I think that gives the Fed more ammunition to start a cycle of cuts,” Lee said. “That will boost the economy and [stock] market, especially cyclical and small-cap stocks,” he said.

Lee spoke Friday before Federal Reserve Chairman Jerome Powell, who was expected to signal in his speech at a symposium in Jackson Hole how far policymakers will begin to cut interest rates.

The U.S. economy does not appear to be entering a recession, and the likelihood of a pliable landing is increasing, Lee said. “So it should be a mild cycle of cuts — good for markets,” he said.

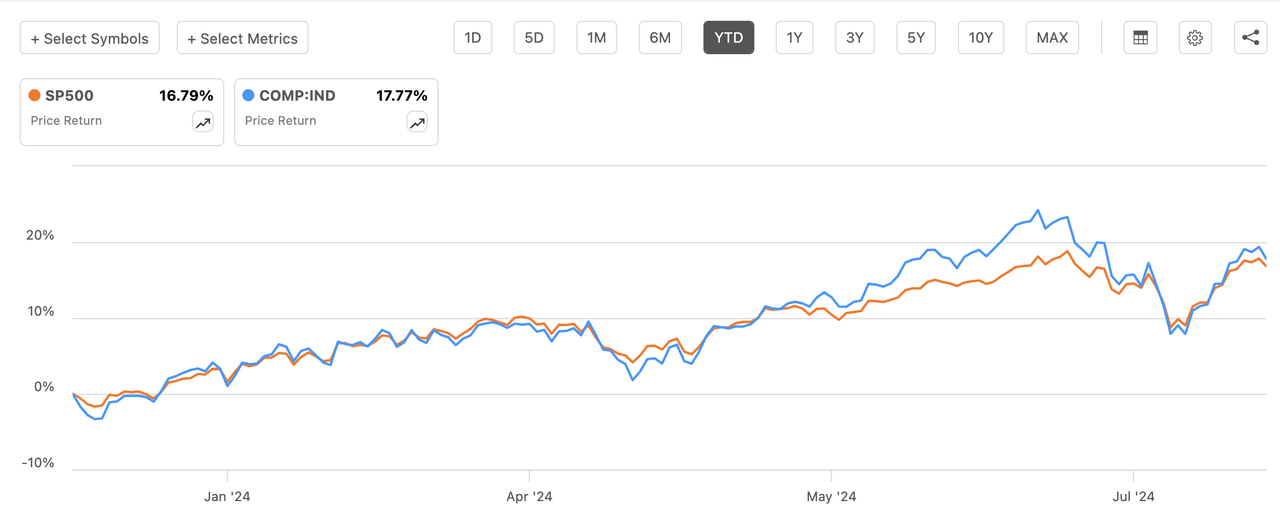

The stock market (SP500)(COMP:IND)(DJI) showed strength, rebounding sharply from a “splitting” slump earlier this month sparked by fears about U.S. economic growth, Lee said. A decline in tech stocks (XLK) dragged the Nasdaq Composite (COMP:IND) into a correction, but the average has since narrowed its losses and is 5.5% off its all-time high close.

“I think the technology is still in a good position with AI, and Nvidia (NVDA) should strengthen that,” Lee said ahead of the AI chipmaker’s Q2 results on Aug. 28. Lee said Nvidia’s (NVDA) multiple is not demanding.

“Nvidia is maybe 28 times forward earnings, which is not a high multiple for one of the most important companies in the world,” he said. “So if the technology is doing well and then you have the Fed cuts, I think that allows the whole market to expand.”

The S&P 500 (SP500)(SPY)(IVV) was 1.7% off its all-time high close of 5,667 on Thursday. It is up 16.8% this year. The Nasdaq Composite (COMP:IND) is up 17.8% YTD on Thursday.