XRP is one of the top-performing cryptocurrencies in the top 100 by market capitalization over the past 24 hours. With a 7% price enhance, the price of XRP shows significant bullish momentum that could continue to grow, according to various cryptocurrency analysts.

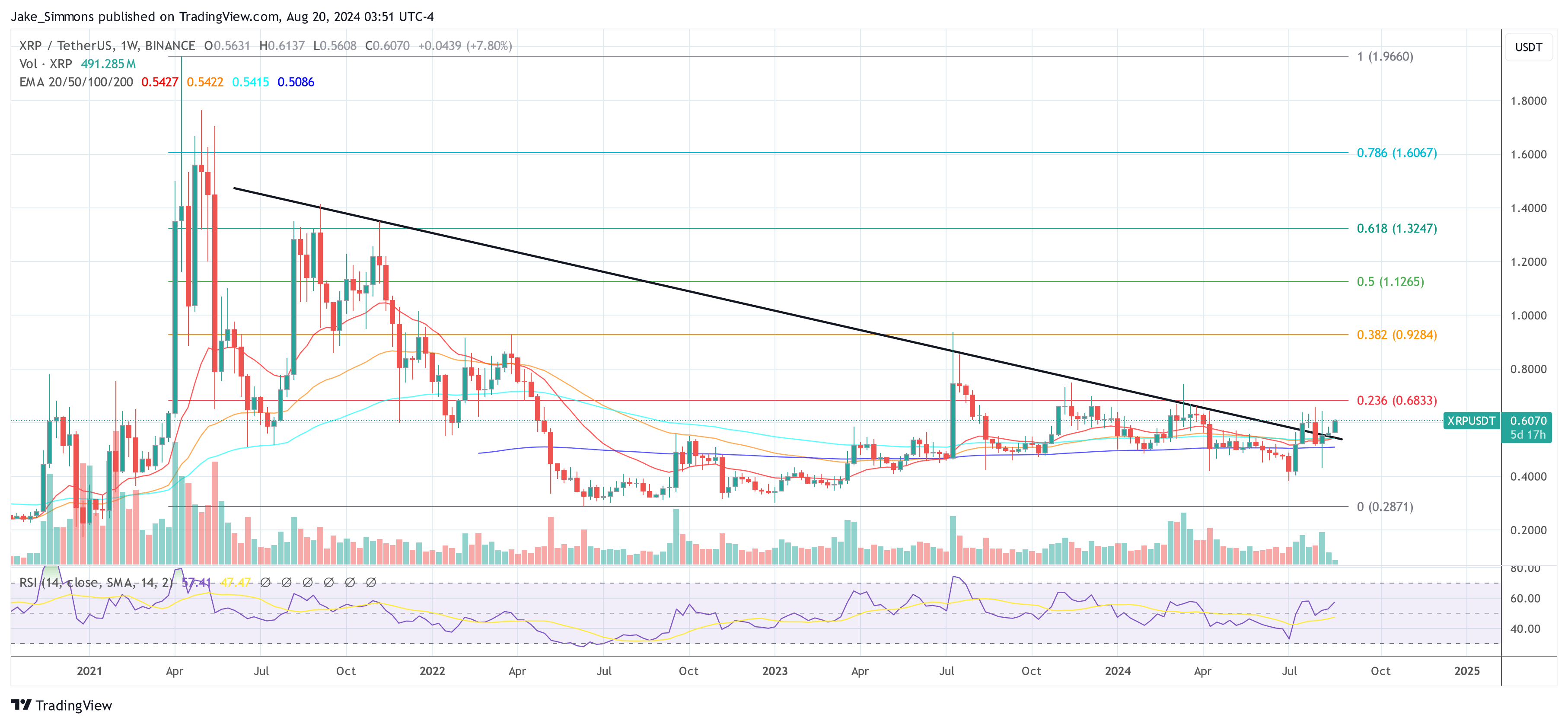

Dark Defender (@DefendDark) released modern technical analysis for the XRP/USD pair today, which shows a forceful uptrend. According to his latest post on X, “XRP has touched the 61.80% Fibonacci zone at $0.6044 and is trying to break through here. Heikin Ashi candles are bullish and green. RSI has a golden cross and is green. Ichimoku clouds are green. We expect to touch $0.6649 soon, followed by $0.9327!” This statement is full of technical insights and predictions.

#1 XRP about to break through key Fibonacci levels

Starting with Fibonacci retracement levels, a popular tool among traders to identify potential reversal levels, XRP price touching and trying to break the 61.80% retracement level at $0.6044 is significant. This level often acts as a major resistance or support level, depending on the direction of the approach.

For XRP, this level is crucial as the price has bounced off recent lows and is testing this key threshold that could confirm the continuation of the uptrend. If XRP closes above $0.6044 on the daily chart, $0.6649 (70.20%) and then $0.9327 (100%) could be the next targets, according to Dark Defender.

#2 Heikin Ashi Bull Candles

The mention of “Heikin Ashi candles are bullish & Green” indicates that the recent price action has been predominantly bullish, characterized by green Heikin Ashi candles. These candles are different from classic ones because they are derived from average price movements, thus helping traders identify trends more clearly and make decisions based on less boisterous data.

#3 RSI Golden Cross

Another crucial aspect that Dark Defender highlights is “RSI has a golden cross and green.” The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change in price movements on a scale of zero to 100. Typically, an RSI reading above 70 indicates a market in overbought conditions, while below 30 suggests oversold conditions.

The RSI line has crossed above the moving average, forming a so-called “golden cross.” This is typically a bullish signal, suggesting that momentum is shifting to the buyer. The RSI is currently trending higher, remaining within neutral territory, indicating that there is room to move higher before the asset becomes technically “overbought.”

#4 XRP Transactions Over Ichimoku Cloud

In addition, the analyst points out that the “Ichimoku Clouds are green.” This is another popular technical analysis tool that provides insight into future price action. A green cloud typically indicates a bullish future price move and acts as a support area for the price. This is consistent with other indicators suggesting forceful bullish momentum.

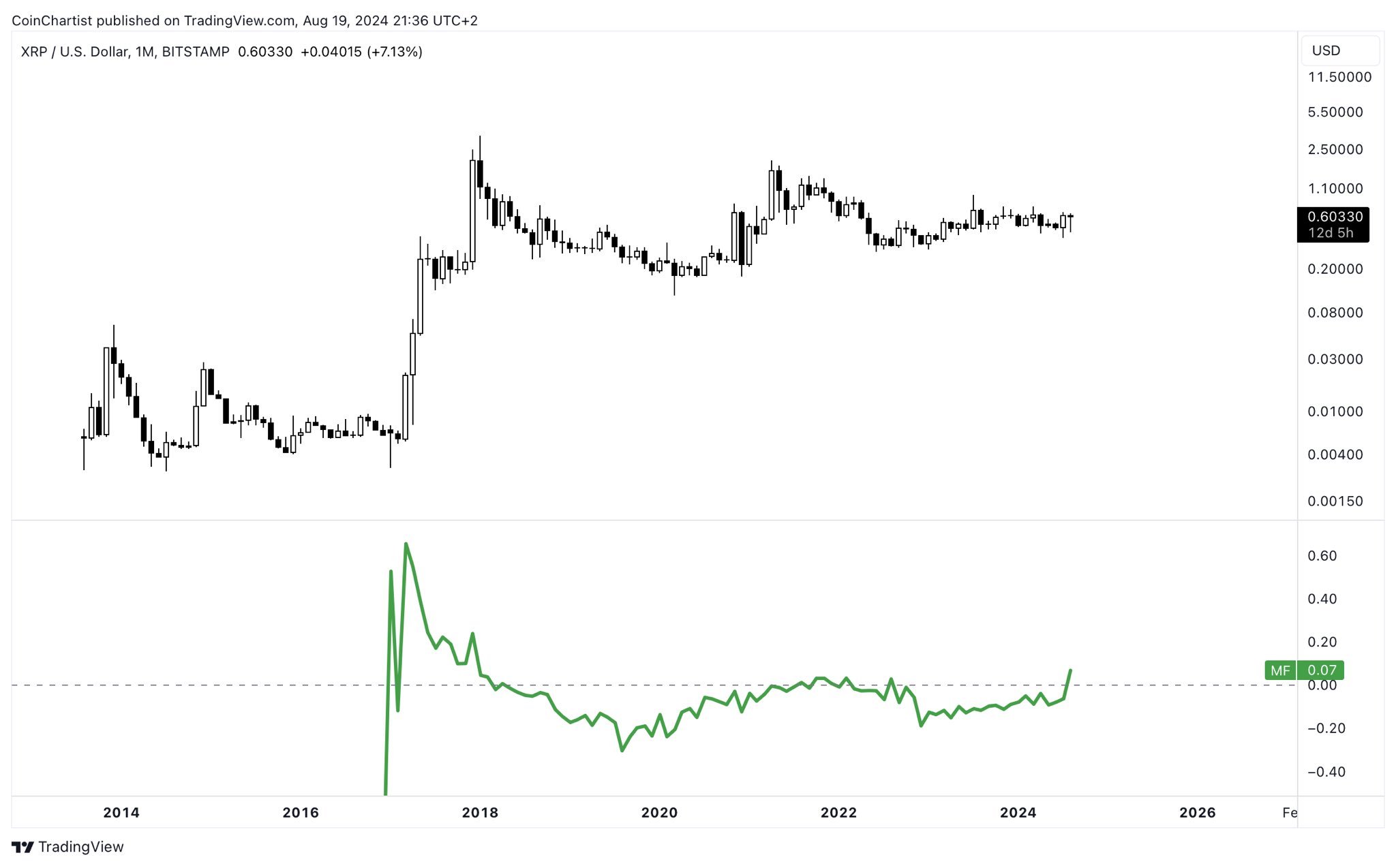

#5 Chaikin Money Flow Hits New Record

The fifth bullish reason comes from NewsBTC research chief Tony “The Bull” Severino. Via X, he he noticed:”Chaikin’s monthly money flow for XRP looks promising, with a higher high.”

The Chaikin Money Flow (CMF) indicator plays a key role in underlining bullish sentiment. Severino’s recent observation that CMF has formed a higher high indicates a significant enhance in buying pressure.

The CMF, measuring volume-weighted transaction accumulation over the past month, shows more traders buying XRP near the closing prices of trading sessions, a pattern generally associated with increased market confidence. A shift in the CMF into positive territory is a change that suggests forceful money flows into XRP, contrasting with periods when the CMF has been at or below zero, reflecting balanced or dominant selling pressure.

At the time of going to press, XRP was priced at $0.6070.