Despite the recent decline, Bitcoin is seeing an intriguing change in investor behavior, with analysts like Crypto Tony betting on a possible bullish momentum in the near future. While the market is still highly unpredictable, there is slowly a trend of consolidation and profit holding.

Crypto Tony recently commented that a break above could show the start of a up-to-date uptrend, citing $58,300 as a key resistance level. Latest data from Glassnode is making a move in this direction, indicating that while the price of Bitcoin remains highly volatile, key players may be preparing for a up-to-date accumulation phase.

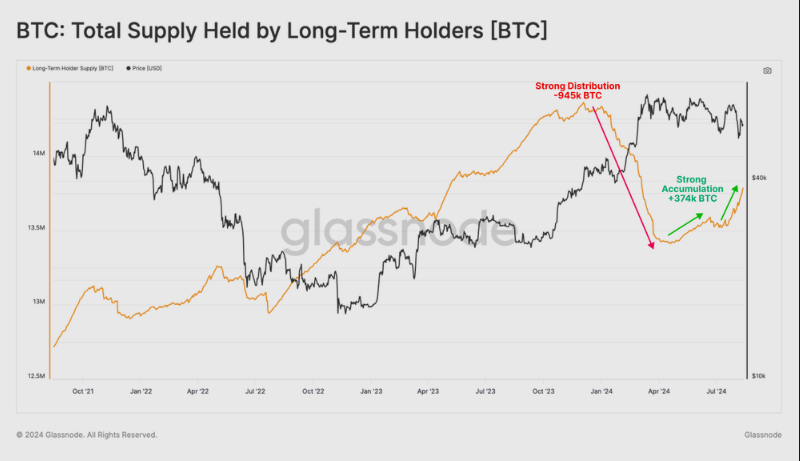

This comes after a period of distribution that lasted for several periods to portfolios of varying sizes. After bitcoin reached record highs in March, investors sold their holdings for an extended period. However, this trend now appears to be reversing, and for larger portfolios, often linked to ETFs, it appears that enormous entities are once again starting to accumulate bitcoin en masse — a potentially confident sign for the future of cryptocurrencies.

Long-term Bitcoin owners are changing rates

The behavior of long-term holders is also changing. LTHs are showing a renewed willingness to hold on to their assets after selling during the ATH growth period. In the last three months alone, more than 374,000 BTC obtained LTH status. This means that a enormous proportion of investors are opting to hold onto their assets rather than sell them, a development that could serve to support the price of bitcoin in the coming months.

Bitcoin accumulation is currently at 1.0 Accumulation Trend Score (ATS), which measures the globally weighted balance sheet, thanks to sturdy buying in the past month, particularly from long-term holders. These holders were previously in a so-called “phased distribution”; this appears to have changed. Their newfound interest in bitcoin holdings could mean that confidence in the market is growing.

The spot price is still above the critical level

Another positive aspect is that the current price of Bitcoin is still holding above the Active Investor Cost Basis (AICB). This measure of vigorous coins indicates the average cost of purchase. On a spot basis, staying above this level seems to be a sturdy market indicator, even considering the aggressive distribution from April to July. It looks like investors are taking advantage of the quick momentum that may soon follow and are preparing for an uptrend.

Weekly above $58,300 is the main target for bulls this week. This could provide a good base if we get it pic.twitter.com/CeSUHqDmSa

— Crypto Tony (@CryptoTony__) August 13, 2024

Key Long-Term Resistance Level to Watch

From a macro perspective, Bitcoin is approaching a make or break level. Analysts have identified $58,300 as a key level to watch. Crypto Tony commented that if Bitcoin were to close above this resistance, it would be the start of something more intriguing. In other words, this resistance level would present itself as a major hurdle to overcome, and if it does, a huge amount of buying pressure would likely follow.

It is also vital to keep an eye on whale activity in the market. After all, mass trading by these larger investors can easily trigger enormous market movements. As Bitcoin approaches $58,300, the actions of these whales could prove to be very vital in determining the next trend.

Featured image from Pexels, chart from TradingView