Ethereum (ETH) recently it has fallen below critical levels and psychological support level 3000 dollarswhich raises concerns for ETH bulls. This development comes amidst a continued decline in revenue generated on Ethereum Network.

Ethereum falls below $3,000

Ethereum has fallen below $3,000, and this downtrend is likely due to several factors. One of them is the outflows that Spot ETFs Ethereum I have been experiencing it since he started trading July 23. Data These funds again saw net outflows of $54.3 million on August 2, according to data from Farside Investors.

These measures did not have the expected impact on the ETH price, and Ethereum has fallen by more than 10% since trading began. Data Soso Value data shows that since their launch, these funds have recorded a cumulative net outflow of $510.7 million. Grayscale’s Ethereum Trust (ETHE) was individually responsible for these outflows, which resulted in $2.12 billion being paid out since the fund was launched.

This put significant selling pressure on ETH, leading to its recent downtrend. ETH price also fell below $3,000 thanks to a decline in the broader cryptocurrency market, led by Bitcoin. Ethereum had to suffer a significant drop following Bitcoin’s decline, as data from the market intelligence platform To the Block shows that currently both assets have a powerful price correlation.

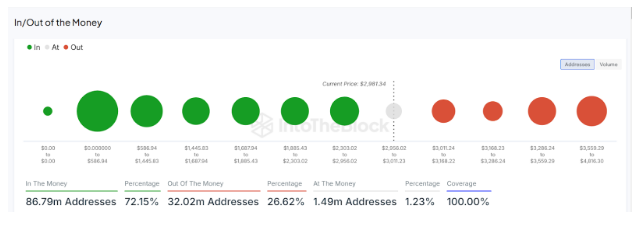

Ethereum’s drop below $3,000 is undoubtedly worrisome for investors, given how much lower it could fall. However, ETH has quickly regained the $3,000 level over the past three months, whenever it has fallen below this key support zone. This time may be no different, especially given data from IntoTheBlock indicating powerful demand for Ethereum at this price level.

If Ethereum fails to maintain this range, the second-largest crypto token risks falling to from just $2,700which is a more significant support zone for ETH, considering that 11.11 million addresses purchased the token at an average price of $2,647.

Ethereum Revenues Fall to New Lows

Data from Token terminal shows that Ethereum revenues have fallen to up-to-date lows, falling 40.4% over the past 30 days and 44.8% year-on-year. Fees earned on the network were also not impressive. Over the past 30 days, Ethereum users have paid $92.97 million in feesi.e. a decrease of 32.8% and 38.3% year-on-year.

This fall Ethereum Revenues and fees can be attributed to a drop in the number of daily vigorous users on the network. Further data from Token Terminal shows a drop of 9.8% Monthly Active Ethereum UsersThe same applies weekly and daily vigorous userswith a decrease of 20.1% and 15.3%, respectively.

At the time of writing, Ethereum is trading at around $2,979, down more than 5% in the past 24 hours, according to data data from CoinMarketCap.

Featured image from Pexels, chart from TradingVIew