Bitcoin apparently can’t leave the $60,000 price level as it continues to trade amid uncertainty. On Saturday, August 3, the cryptocurrency experienced another piercing decline, briefly dipping below the $60,000 level.

Even though the drop only lasted a few minutes, it was quite significant, especially considering the fact that the price of Bitcoin surpassed $62,000 that same day. These fluctuations had a particular impact on market participants, leading to the liquidation of many long positions.

At the time of writing, over $197 million worth of leveraged positions have been liquidated in the last 24 hours. It is worth noting that this number rose to up to $288 million at the peak of selling pressure.

Bitcoin and Market Liquidations

Bitcoin’s continued inability to sustain a stable position above $60,000 underscores the uncertainty and speculative nature of the cryptocurrency market. Traders and investors remain cautious, closely monitoring price movements.

This cautious approach has likely been reinforced by recent reports repayments initiated by bankrupt cryptocurrency lending company Genesis Global Capital, which flooded the market with additional digital assets, primarily Bitcoin and Ethereum.

Given the dominance of Bitcoin and Ethereum in the market, this cautious approach has inadvertently led to persistent bearish sentiment around other cryptocurrencies. While Bitcoin and Ethereum have seen the highest liquidations, the impact has spilled over to other digital assets.

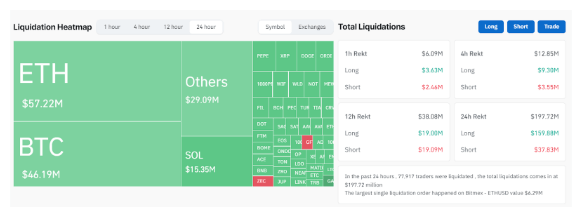

According to Coinglass data below, Ethereum led the market with $57.22 million in leveraged positions liquidated. Bitcoin was close behind with $46.19 million in liquidations, and Solana with $15.35 million.

The total liquidation amount reached $197.72 million, with the majority ($159.88 million) being long positions. The majority of these liquidations occurred on Binance, OKX, and Bybit, with $85.88 million, $65.83 million, and $16.47 million in liquidations respectively, each showing an 80% long liquidation rate.

Dominant bearishness

The cryptocurrency industry is no stranger sporadic liquidations such huge amounts. Given the prevailing short-term bearish sentiment, most of these liquidations were multiple long positions. On June 24, the market I witnessed almost Positions worth $300 million were liquidated in 24 hours. Similarly, positions worth over $360 million were liquidated on June 7, when the price of bitcoin fell from $71,000 to $68,000.

Recent market dynamics suggest the industry may not be out of trouble with such liquidations just yet. Bitcoin continues to struggle to stay above $60,000, and that trend could continue in the coming weeks. This is partly because the Spot Bitcoin ETFs, which have historically been a catalyst for Bitcoin price gains, ended last week in the red. To be precise, they ended Friday’s trading session with an outflow of funds amounting to USD 237.4 million, the highest daily runoff from May 1st.

Featured image from The Michigan Daily, chart from TradingView