After a uninteresting week that saw Bitcoin, Ethereum, and Solana prices fall or trend sideways, there was a mighty rally at the end of last week.

Notably, losses in Ethereum were halted as prices regained strength, rising from around $3,000. At the same time, Bitcoin and Solana surged higher, closing at $70,000 and $200, respectively.

Interest in Bitcoin, Ethereum and Solana is growing rapidly

According to Santiment dataDespite weakness across the board, there were signs of strength towards the end of last week. It’s worth noting the renewed interest, with Solana, Bitcoin, and Ethereum all seeing significant increases in trading volume.

When trading volume spikes, it often suggests that market participants are curious and eager to get involved, especially if prices are rising. As these top coins have been mighty, shedding losses, especially since Friday July 26th, buyers have been in the equation, looking to take advantage.

As analysts at Santiment have noted, how Bitcoin, Ethereum, and Solana perform tend to affect the overall market. If Ethereum rebounds, for example, the broader Layer 2 and Layer 3 ecosystems would benefit. This would further boost activity in meme coins and even decentralized finance (DeFi).

There are many factors behind this interest. In the case of Bitcoin, the changing regulatory perspective on the world’s most valuable coin and growing support from politicians, especially in the United States, may explain why more people are interested in learning more about the coin.

Trump Impact, Spot Ethereum ETF and SOL Flipping BNB

Over the weekend, Donald Trump, former president and presidential candidate in the upcoming November election, gave the opening speech at the recently concluded Bitcoin conference in Nashville. Trump expressed his support for Bitcoin, saying he would make America the home of cryptocurrencies.

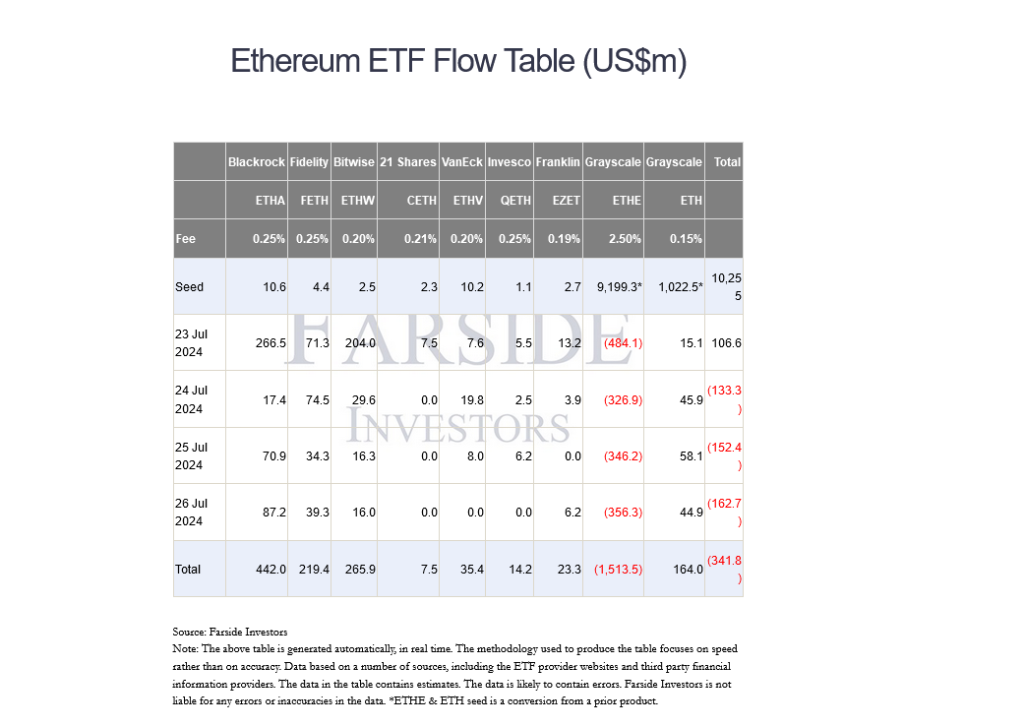

Meanwhile, eyes have been on Ethereum following the approval of a spot ETF by the U.S. Securities and Exchange Commission (SEC). Although the derivative product has begun trading on leading exchanges, including the NYSE and Cboe, inflows remain low.

If anything, the data Farside he showed that through Friday, spot Ethereum ETFs had seen outflows for three consecutive days. The main driver was outflows from Grayscale’s ETHE. Even amidst this unexpected development, BlackRock’s spot Ethereum ETF saw over $87 million inflows on July 26.

Traders have also been keeping an eye on Solana after the coin overtook BNB as the third most valuable cryptocurrency, excluding stablecoins. As of July 29, SOL’s market capitalization was $88.5 billion, while BNB’s was $86.5 billion, according to CoinMarketCap. data.

SOL has been on a slight uptick in the last few weeks. In terms of numbers, SOL is up 56% from July lows. It will likely see modern highs in Q3 2024 if buyers push above $200.

Featured image from DALLE, chart from TradingView