Indeed, the price of Bitcoin has been on an upward trend in recent weeks, returning to its previous highs that most investors have become accustomed to. However, the past week has been fairly still for the leading cryptocurrency, as it has been for most of the digital asset market.

Interestingly, the latest blockchain news suggests that the cryptocurrency market, and Bitcoin in particular, may not remain dormant for much longer.

BTC price dynamics are changing to positive – impact on price?

In a recent post on Platform X, popular cryptocurrency expert Ali Martinez revealed that the capitulation of Bitcoin miners has apparently come to an end. This on-chain observation is based on the change in the Glassnode Hash Ribbon metric, which measures BTC’s hash rate.

Typically, Hash Ribbon has two moving averages, including a short-term (30-day) and long-term (60-day) hash rate. A short-term moving average crossing below the long-term moving average indicates miner capitulation, which is characterized by widespread miner sell-offs.

On the other hand, when the 60-day band is below the 30-day band, it indicates the end of a capitulation and the potential beginning of a recovery phase for the network. As shown in the chart below, this positive cross seems to be the current state of affairs for Bitcoin, signaling an hopeful future for the flagship cryptocurrency.

Ultimately, this means that Bitcoin miners are coming back online and resuming their operations as they become more profitable. Historically, the end of miner capitulations is a bullish sign, as it often precedes significant price jumps for the leading cryptocurrency. Martinez highlighted this in his post on X, saying that “this could present a good buying opportunity.”

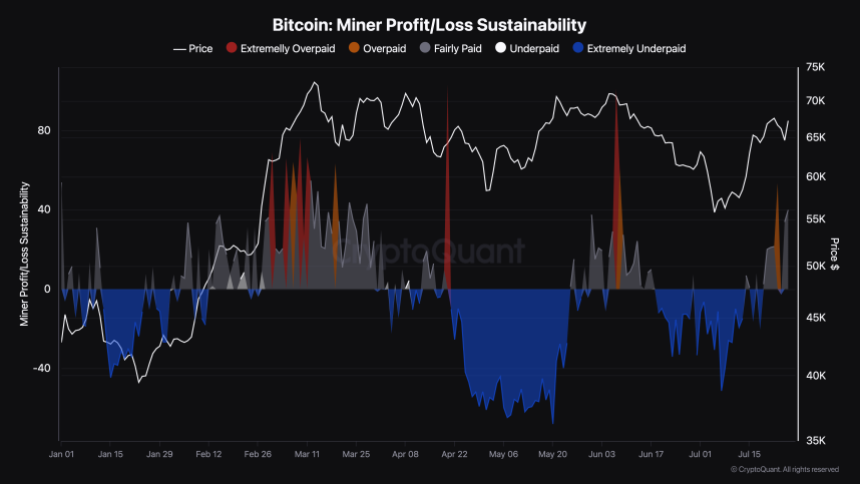

Another metric that confirms this on-chain finding is the Bitcoin Miner Profit/Loss Sustainability metric, which measures how fair miner revenues are. According to the latest data from CryptoQuantBTC miners have made some profits over the past few days, which puts them in the fair paying zone of the indicator.

Bitcoin price in brief

At the time of writing, Bitcoin is trading at around $68,230, up just 0.7% in the past 24 hours. As previously reported, the major cryptocurrency had a still week in terms of price action, hovering between the $64,000 and $68,000 range.

According to data from CoinGecko, BTC is up just 1% over the past week. Nevertheless, the cryptocurrency has maintained its position as the largest digital asset in the sector, with a market capitalization of over $1.33 trillion.

Featured image from iStock, chart from TradingView