Ordinal numbers are a relatively novel innovation in the cryptocurrency space, but ORDI, a cryptocurrency named after ordinal numbers, is in bear territory.

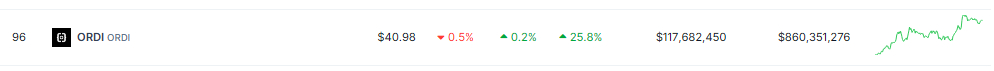

According to the latest market data provided by CoinCodex, the token is down almost 5% in the last 24 hours, even as Bitcoin has seen an 11% augment over the past week.

Up and down the rabbit hole

While the market seems bullish on Bitcoin and the market as a whole, Ordinals seem to be going against the grain. Analysts are hopeful that ORDI is on track for a potential bullish breakout, but that seems unlikely.

While BRC-20 standard tokens follow the general market trend, ORDI itself is dull, offering no other utility unlike others in the same category. But its utility in getting NFTs onto the Bitcoin blockchain could add some value to the mix.

The recent State of the Union address at Christie’s Art and Tech Summit demonstrated that NFT Market Relationships with the world of classic art is in a transition phase.

“We know that provenance verification is possible. We all know that, and we all know that the art world resists it because it suggests a transparency that we say we want but don’t really want,” Pace Gallery CEO Marc Glimcher said at the event.

If Bitcoin Ordinals continues to attract developers to its niche by further expanding its codebase on Github, there is a chance that the growth in open-source platform development will lead to wider adoption of the BRC-20 standard overall, which will boost investor confidence in the asset.

Is the ORDI 50 rate closer than expected?

Even though volatility is a double-edged sword in most cases, ORDI bulls are in a great position to leverage the token to its limits; At the time of writing, ORDI maintained solid growth of 26% on a weekly basis. And at $41.33, the price is offering little resistance to the overall positive market sentiment, which could lead to a bullish takeover in the next few days.

ORDI price up in the weekly frame. Source: Coingecko

Once this happens, ORDI has a better chance of hitting the $50 level in the next few weeks. However, the high volatility also means that this accumulation move will be a gamble for investors and traders as more and more analysts predict a bigger breakout in the longer term.

This scenario is highly dependent on the overall market rally, which may or may not occur over the next few weeks. Investors and traders should monitor the market and look for other opportunities before considering a return to ORDI.

Featured image from Pexels, chart from TradingView