Bitcoin has seen a significant price enhance over the past few days, rising from a low of $53,000 last week to above $66,000 in the early morning hours on Wednesday before falling to its current price of $64,433.

This bullish price performance was the downfall of about 50,436 traders in the cryptocurrency market today. Specifically, according to data According to Coinglass, this number of traders led to mass liquidations, totaling $145.58 million in liquidations.

Bitcoin traders felt the effects of this complete liquidation, losing around $46.22 million, which was equally split between brief and long positions, indicating a mixed price trajectory for the asset over the past day.

Bitcoin: Major Liquidations Are Coming

While recent trading has resulted in the liquidation of millions of dollars in assets, further data shows that this scenario could escalate dramatically, turning into billions of dollars, if Bitcoin continues its rally towards record highs, breaking through a significant level.

Especially as reported According to MartyParty, a prominent cryptocurrency enthusiast in the community, if the price of Bitcoin reached $72,400, the market would feel the effects of this and close to $19 billion in Bitcoin brief positions would be liquidated at that price.

Marty Party reported this on Elon Musk’s social media platform X, citing data from Coinglass. Concluding the disclosure, the crypto enthusiast noted, “Never bet against technology.”

How long will the liquidation take?

While $72,400 may seem far from the current market price, it may not take BTC long to reach that level given the current fundamentals. For example, the market may reach that level sooner because that is where the liquidity is, which is driving its current trend.

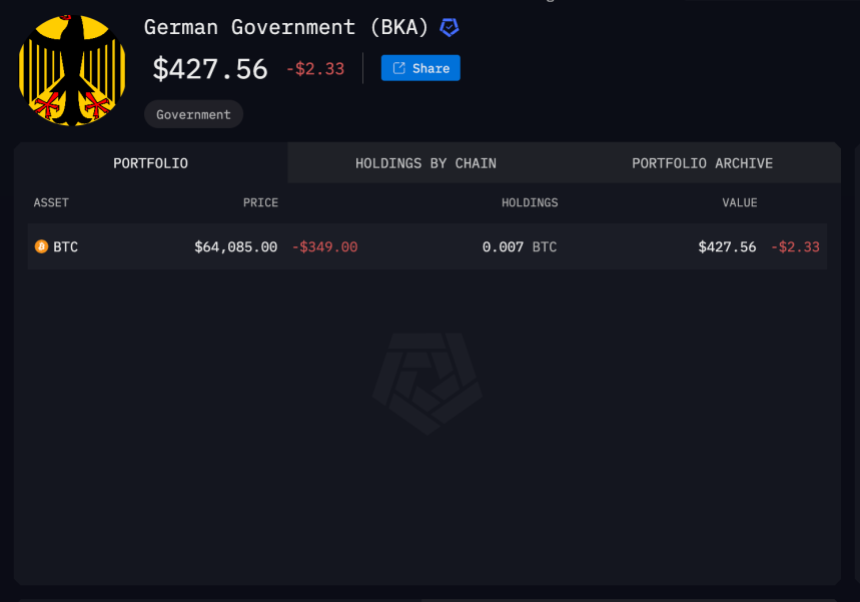

Apart from that, there are no bearish trends in sight that could snail-paced down the asset’s growth in the brief term. First of all, the German government sold all of its BTC holdings, amounting to around 49,858 BTC, with the current balance below $500, according to data from Arkham Intelligence.

It is worth noting that the current balance of around $427 in BTC is the cumulative sats (miniature units of BTC) transferred from different wallet addresses. Furthermore, according to the latest data from CryptoQuant, 36% of Mt. Gox BTC was distributed to creditors.

However, despite this distribution, the BTC price has yet to experience any noticeable correction, which suggests two things: that creditors are not selling, and even if they are, the Bitcoin market is absorbing it very quickly, as evidenced by the slight stabilization in the BTC price.

These major sell-offs by the German government and Mt. Gox, once considered major threats to the cryptocurrency market, now appear to have minimal impact, indicating that no significant bearish obstacles are preventing Bitcoin from surging to $72,400, triggering a brief squeeze.

Featured image created with DALL-E, chart from TradingView