Image Source: Getty Images

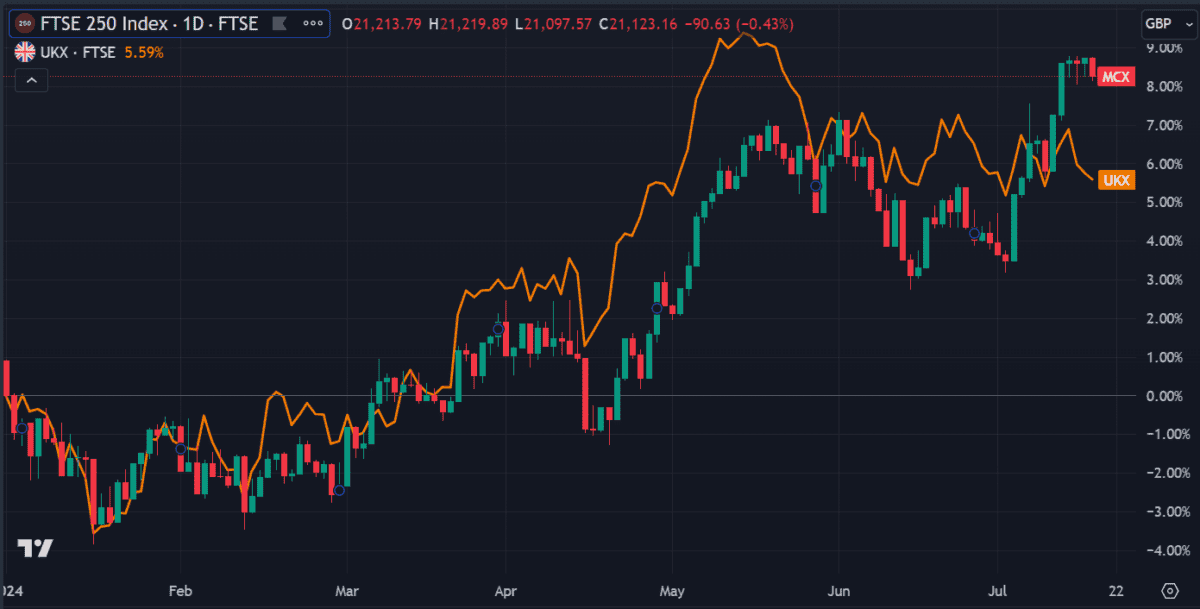

This FTSE 250 Index increased by 8.2% this year, which exceeded FTSE100 by almost 3%. It recently hit a two-year peak above 21,200 points, its highest level since April 2022.

It’s not uncommon for it to outperform its bigger brother. The smaller-cap stocks it lists often have more room to grow. That’s why digging into undervalued stocks at 250 is a great way to tap into additional growth potential.

Moreover, the average price-to-earnings (P/E) ratio of the index is 19.8, which is close to the lowest value in two years.

With that in mind, here’s one FTSE 250 share that shows growth potential as we head into the second half of 2024.

Predicted to be the winner

IntegraFin Holding (LSE: IHP) is a British investment firm and operator of the Transact trading platform. My attention was caught yesterday by Berenberg’s “buy” rating on the stock. I also see that Barclays gave the stock an “overweight” rating.

Brokers appear to be hopeful about the company’s future. But what prompted their recent interest?

The stock has done well this year. So well, in fact, that I’m kicking myself for not noticing it sooner. It’s up 34% since hitting a year-to-date (YTD) low of £2.67 in overdue February. Did I miss it?

Not exactly.

There is still plenty of room to grow on the five-year chart. Despite the recent rally, it is still 40% down from its all-time high of £5.99 in November 2021.

Value Game

The balance sheet is always a good starting point when evaluating a company. If it has potentially unmanageable debt levels, then it’s a no-go for me. IntegraFin looks good to me, with no debt, a high cash position, and assets exceeding liabilities.

Looking at the latest quarterly financial results released this week, things are looking good. Funds Under Direction (FUD) reached a record £62.42bn, up 14% on last year.

Net flows increased by 6.8% and the number of customers on the platform increased by 1.9%.

Given that the share price is below earnings over a three-year period, there is an argument that the stock is undervalued. If the company continues to attract positive attention from brokers, that could facilitate the price continue to rise.

Price pressure

However, not all indicators speak in its favor.

Analysts estimate that the stock is slightly overvalued using a discounted cash flow model. This is based on estimates of future cash flows that are unusually high for the company. This is most likely due to the enormous amount of capital inflows that usually occur on investment platforms of this type.

For this reason, the data may be distorted.

But that’s not the only metric that suggests it’s overvalued. It also has a slightly higher-than-average P/E of 23. Some analysts think a ratio of 15 would be more fair, but that would require a significant escalate in earnings — or a huge drop in the price.

In addition, persistent inflation and an uncertain economic outlook could dampen trading activity as consumers curb unnecessary spending. That adds another layer of risk to stocks.

Overall, I would say that robust financials work in the company’s favor, making it worth considering for its long-term growth potential.