The data shows that the cryptocurrency derivatives market saw significant liquidations after Bitcoin surged above $63,000.

Bitcoin’s Rise Led to Short Liquidations in Derivatives Market

According to data from Coin glassrecent volatility in the cryptocurrency market has led to immense liquidations on the derivatives side. “Liquidation” here naturally refers to the process that any open contract goes through, where its platform forcibly closes it after accumulating losses to a certain extent.

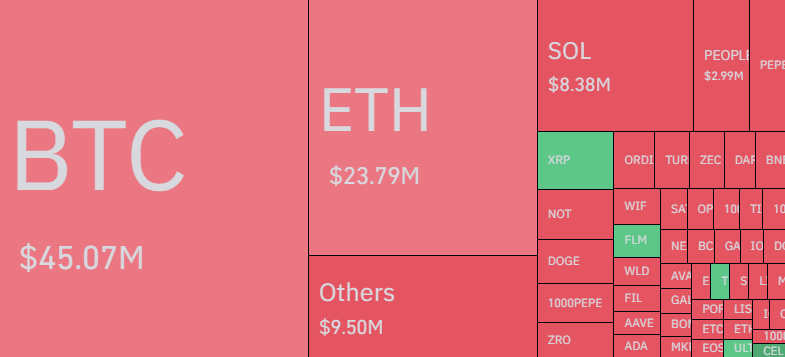

The table below shows the liquidation of derivatives over the last 24 hours:

The crypto derivatives market appears to have seen a total liquidation of $126 million over the past day. Of that, nearly $101 million in contracts were tiny.

That figure represents more than 80% of the total, meaning bearish investors have been hit the hardest by recent volatility. That makes sense, of course, as assets across the sector have posted green returns during this window, led by Bitcoin’s rally.

Mass liquidations like this last one are popularly called a “squeeze”, and since the tiny players were the party that caused the majority of those liquidations, the squeeze is also called a “short squeeze”.

During a squeeze, liquidations end up further fueling the price movement that caused them, thus unleashing a cascade of further liquidations. Thus, the previous day’s keen price rally would have been partially fueled by a tiny squeeze.

When it comes to analyzing the latest crisis involving various symbols, it looks like Bitcoin, as usual, came out on top, with sales of around $45 million.

Ethereum (ETH) and Solana (SOL) made up the rest of the top three with $24 million and $8 million in liquidations, respectively. Interestingly, while most of the sector saw a dominance of tiny liquidations, XRP (XRP) in fourth place saw a decline in long positions. This could be due to the fact that the coin generally moved only sideways, while the rest saw an raise.

BTC managed to regain the support level of USD 62,000

Thanks to the recent wave of growth, Bitcoin managed to rebound significantly, and its price briefly exceeded the level of $63,000 at the beginning of the day.

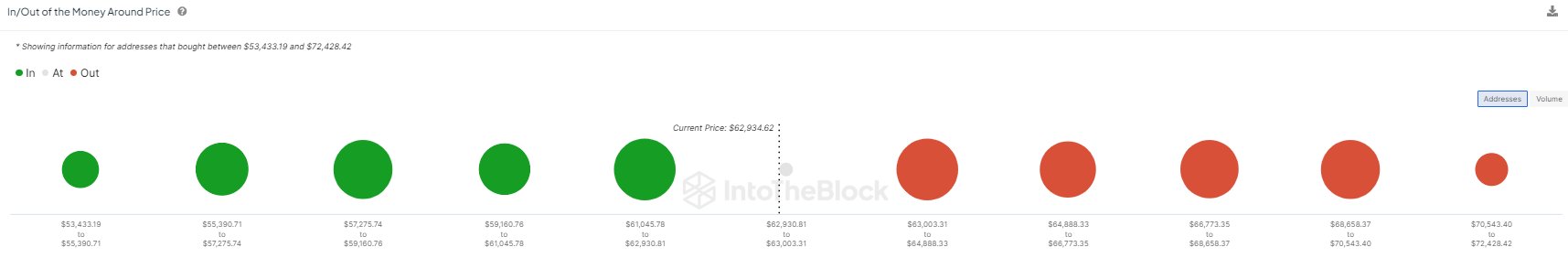

The chart below shows how the coin’s value increased:

According to data from the market analysis platform To the BlockBitcoin is currently hovering above a significant on-chain support level at $62,000. “While resistance is strong above, sufficient bullish momentum could prevent selling pressure,” the analytics firm notes.